Who Actually "Charts The Course for BTC"...

BTC is about to have its first weekly close above $60,000 at the end of today, weeks after plenty of analysts were calling for a bear market. There are voices on CT saying that we're far from entering bear territory and my gut feeling tells me they're right. We haven't had a proper mania phase yet.

Altcoins are not doing too good lately, as most have lost value on their BTC pairings. It is probably clear by now for most of you who's buying Bitcoin lately and why. If not, I give you one hint: it's not retail.

It is supposed that the first Bitcoin futures ETF approved in the US will start trading as of tomorrow and that's what pushed Bitcoin, and holding it, at $60,000 levels. Retail is still in a coma unfortunately...

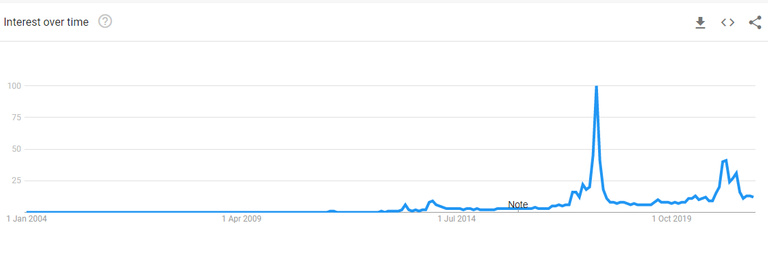

Just checked the google trends search term for "buy Bitcoin" and it is resting at 12 points out of 100 maximum(corresponding to the peak of 2017).

Now that says two things, considering that usually retail money is searching for "buy Bitcoin" on google: individuals are either not yet interested in buying Bitcoin atm or they already know how to do that and don't search on google anymore.

Bitcoin is gradually becoming the asset of the rich, although it was designed to be empowering the individuals across the world, truth is though that the so called whales are always outsmarting minnows when it comes to investing and Bitcoin is no exception in that regard.

I helped a friend of mine to buy some BTC the other day and although he only bought some worth $70 in the initial phase, he then asked me to help him buy more, now owning $180 worth of crypto. That's a sign that we're heading towards the mania phase of the bull market.

It also says a lot about "the state of Bitcoin". It kind of already belongs to the Michael Saylors and other big names affording to buy a lot at these prices. Now that we will have a BTC futures ETF trading as of tomorrow in the US, the demand coming from institutional players will increase...

We had our chances though, no doubt about that, the thing is that the significant buyers atm are definitely not retail, like it was back in the 2013 and 2017 bull market, thus we might have a "different cycle" this time when patterns will simply fail.

Thanks for attention,

Adrian

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Thanks for encouraging more people get into the future of money. Hopefully little skin in the game will increase his curiosity about crypto and it’s positive impact

Posted Using LeoFinance Beta

He's more interested in the price now, but so was I at the beginning.

Posted Using LeoFinance Beta

I was more interested in the price at the beginning.

Posted Using LeoFinance Beta

I'm afraid one of the aspects as to why average joes are not piling in on btc anymore is its price, people don't understand the divisibility of btc, and they think it's not worth aping into an asset as it costs over 60k to own one piece, I suppose its the same reason why average people don't buy Berkshire stock

True. Buying "whole coins" seems more appealing.

Posted Using LeoFinance Beta

Yes. Try explaining them that there are more US$ millionaires in the world than single Bitcoins in circulation.

Posted Using LeoFinance Beta

Lol asset for the rich it’s the national currency of a country so everyone can use it! It’s infinitely divisbale so you can acquire any amount you can spare in free cash flow

Bitcoins value comes from the fact that you have to expend resources linking the real world thermodynamics to a digital asset

All your Cryptos are going to zero against bitcoin

Jinxed it! Hopefully it will sneak back over for the weekly close!

Unfortunately yeah... :D

Posted Using LeoFinance Beta

We all talk about a bull market, but what I am thinking is if we will have a bear market or if it will be anything compared to 2017. With so much capital poured in I think that we cannot go down much, as for sure there will be investors ready to get into the action and buy the DIP.

Posted Using LeoFinance Beta

Everything's changed. I believe that most of what we've created as patterns when it comes to bull and bear markets is changed... There are whole different metrics right now and the market participants are totally different than what we had four years ago. The industry has evolved, thus the cycles can't stay the same either.

Posted Using LeoFinance Beta

Absolutely. Expecting this market cycle to repeat 2013 or 2017 pattern is the same as someone in August 1939 expecting WW2 to happen exactly like WW1.

Posted Using LeoFinance Beta

That Google trends chart shows perfectly how we're nowhere near peak retail mania.

This BTC rip to 60K is still largely a move driven by smart money.

Let that sink in and then consider how much higher this thing has to rip.

It's reckless to not be exposed to crypto right now.

Posted Using LeoFinance Beta

True. We're not even near the mania phase.

Posted Using LeoFinance Beta