Bitcoin hash rate crash

For the second time in a week, the price of bitcoin (BTC) corrected significantly, which on April 23 produced "red" numbers in the cryptocurrency market. The price of the cryptoactive was below $50,000, a price not seen in almost two months.

The collapse in the processing power of the network or hash rate has increasingly evident consequences in the market. The high commissions to validate a transaction, the delays in the mining of the blocks and the lack of a readjustment in the difficulty of mining, are negatively affecting the commercialization of the first cryptocurrency.

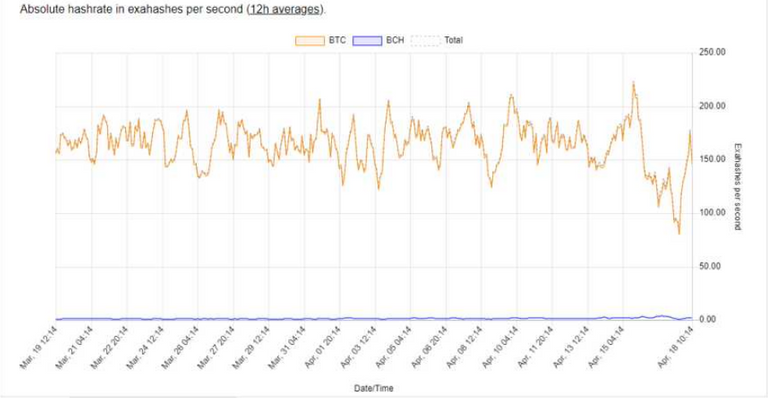

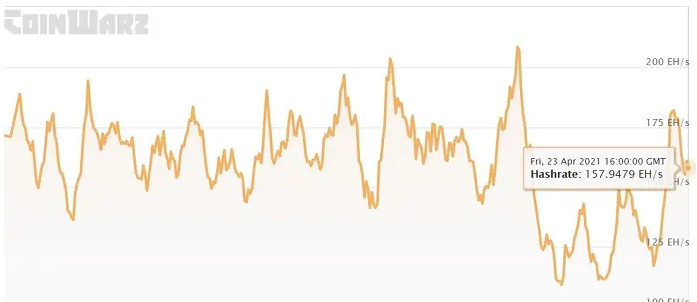

The departure of Chinese miners in Xinjiang province, due to power outages, is taking its toll. According to Coinwarz figures, on Thursday, April 15, the network's hash rate was 208 EH/s, a record high. However, two days later the collective computing power plummeted more than 40% to 109 EH/s.

On that occasion, the price of bitcoin went from more than $63,000 to about $51,000. Now the downturn bottomed out at $47,700, representing a 20% drop over the past seven days, according to CoinMarketCap records. As for the hash rate for the second stumble, the figure went from about 181 EH/s to 155 EH/s.

A blocked network that takes days to process a transaction, due to the loss of its computational muscle, would not be attractive. Rather, users could lose interest in trading BTC and migrate to altcoins. That is, it would not be logical for someone who operates with bitcoin to send a transaction of 30 dollars, for example, if he has to pay in commissions 20 dollars.

The problem is magnified as there is no certainty of how many days the slow processing of transactions could take. In addition, those who wish to exchange their BTC for altcoins must also carry out an operation to acquire an equivalent of another currency. That is, you have to transfer to an exchange which translates into more commission payments.

Impact of losing the chinese miners is significant. Reduction in hash rates and increased transaction costs have probably affected the prices of bitcoins collectively. Even the euphoria of tesla buying bitcoin is getting over now

I tell you that after everything that is happening, the btc is going to rise, although countries and banks are not interested, it will continue to rise