Escaping back onchain...

Bah... early in the year, Binance esentially nerfed their exchange for Australian users... there was still a huge drawcard in the form of their Launchpads and Launchpools for BNB holders. But due to "compliance" with Australian laws (still not really sure what that is...), Binance removed the ability of Australians to take part in those... and that meant that I really had very little reason to keep assets on exchange, especially with the Earn products also being restricted, so you couldn't even earn interest on idle assets that were waiting around to be traded.

... and yesterday evening, OkX put out a message saying that their Grow products and Jumpstart programs were now being restricted due to compliance with Australian laws. A whole heap of other things as well, derivatives and leveraged trading... I don't care about those, but I do care about the "safer" interest bearing ones... but the yield from those products were due to loans to the margin traders, and I guess that if one was out, then the other part would be too... especially if the entities were being seperated out (Australian and global...)... honestly, I wish all this protection stayed in the United States... I'm really getting sick of the way that we blindly follow the United States in all things... cultural, social, and financial...

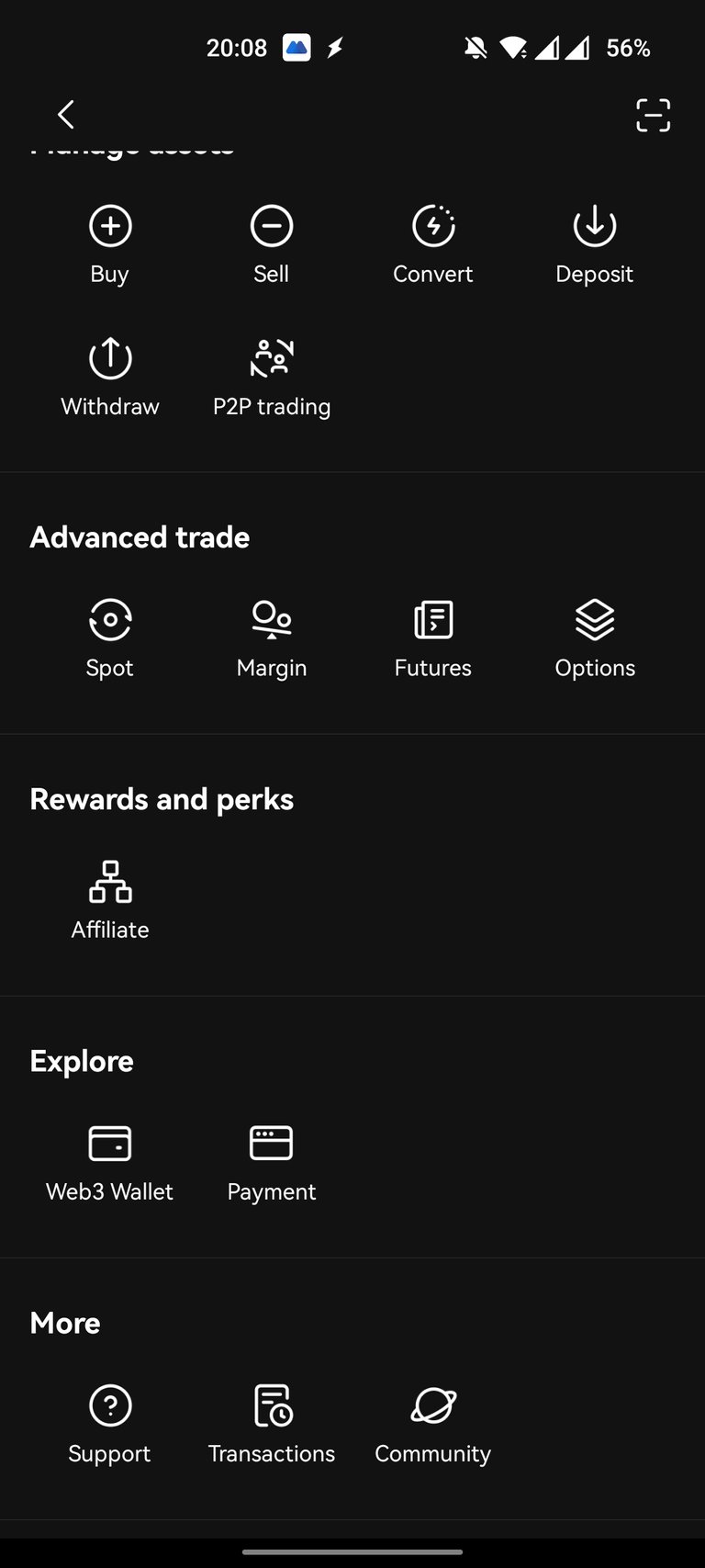

So, what is left on the completely nerfed OkX homescreen? You can deposit and withdraw, and trade a few thing... Margin and Futures are for wholesale traders, and that is pretty much it! Unbelievable, I would be happy to loan assets to the wholesale traders...

... and OkX did have nice hourly rates on stablecoins as well... starting at 10 percent and in recent weeks spiking up to 40-60 percent! Making it a pretty decent place to park stablecoins temporarily. I guess that will have to be for other parts of the world then...

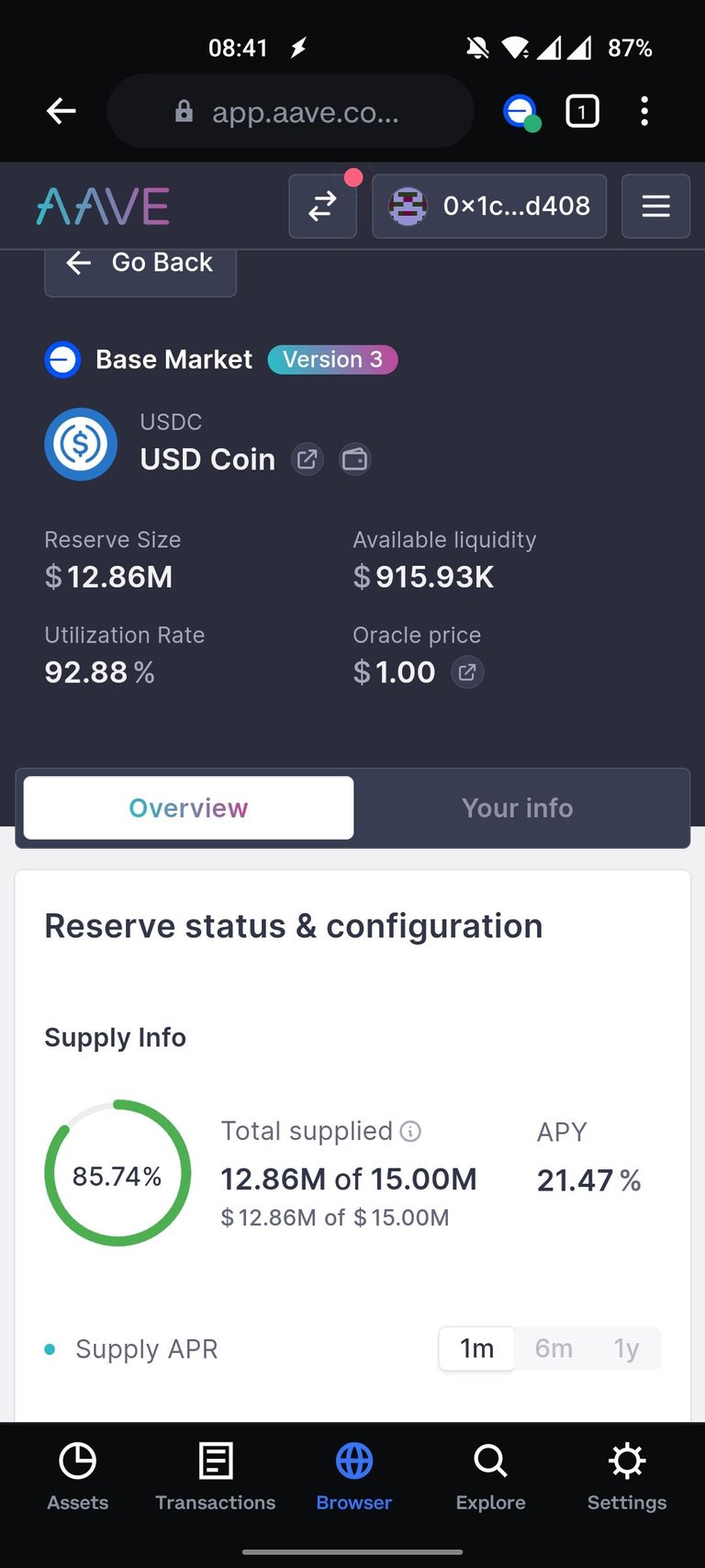

... and so, with more and more avenues closing up on CEXs with decent interest rates, it is time to jump back onchain with the stablecoins. And it appears that Coinbase BASE Ethereum Layer 2 is just the spot to go, with a pretty nice 20 percent APY on USDC via Aave.

And it only costs a few cents to move things around to execute smart contracts thanks to the Dencun fork last week which incorporated dank-sharding and blobspace! Ethereum mainnet is still expensive, but the Layer 2s are fiendishly cheap now... to the point of being much cheaper than the monolithic L1 Eth-killers! So, Ethereum keeps evolving whilst preserving the central tenets of decentralisation...

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Coinbase Wallet: Multi chain wallet with lots of opportunities to Learn and Earn!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

WooX: The centralised version of WooFi. Stake WOO for fee-free trades and free withdrawals! This link also gives you back 25% of the commission.

GMX.io: Decentralised perpetual futures trading on Arbitrum!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

KuCoin: I still use this exchange to take part in the Spotlight and Burning Drop launches.

MEXC: Accepts HIVE, and trades in most poopcoins! Join the casino!

ByBit: Leverage and spot trading, next Binance?

OkX: Again, another Binance contender?

Account banner by jimramones

Posted Using InLeo Alpha