Whee, SPLAT! (This affects more than FTX)

Centralised exchanges... hate them, but can't live without them. So, let me get this out of the way for the "not your keys..." crowd. Yes yes, you SHOULD hold your own crypto in your own non-custodial wallets... but let's be serious, that is a pretty crappy sort of user interface for most of the world's population. Sure, a Ledger or Trezor is pretty damn handy and a good deal less crap than most other non-custodial wallet interfaces, but it is still BEYOND what most people can or want to do. After all, just consider the problem with password reuse and just trying to get people to use 2FA that ISN'T your publicly available phone/email! And then dealing with people who invariably lock themselves out of their accounts...

... yes, we will need centralised infrastructure or custodial wallets into the short to medium term... and perhaps a good deal longer. The truth is that people in general are unwilling or unable to handle their own digital assets, and to deny that is to deny reality. That said, even those who DO manage their own digital assets can quite easily fall prey to losing it without any additional help as well!

So... onto the issue at hand. Wow, that was spectacular and somewhat unexpected... FTX/Alameda collapsing in a big way. Centralised exchanges playing funny business with customer deposits and ending up with a huge huge black hole in their balance sheets. It really wasn't the sort of thing that was expected from an exchange like FTX... sure there were always questions about the closeness between Alameda and FTX, but FTX was supposed to be one of the good ones... the ones who played by the rules, and was abiding and helping to write regulations!

Booom... FTX really unraveled in such a fast and spectacular way. It appears that there was some funny business happening between the FTX and Alameda sister companies, the sort of thing that is borderline (if not actually...) criminal!

Binance has stepped away, but was never going to bail out Alameda... and it appears that they were already pissed about SBF going to lobby the US government with regulations that would target other exchanges and DeFi whilst benefiting FTX. Boom, Binance headshot!

So... there are many who are saying that they have no exposure to FTX. And that might be true that you might not have anything directly locked/lost on FTX... but the wave of token dumping is incoming. Alameda and FTX are busy dumping to hopefully reduce the hole... and their portfolio is holding quite a lot of tokens that are going to be rocked when they are dumped. In addition, there appear to be a number of teams (and even retirement funds?) that held their treasuries on FTX as it was deemed to be one of the safe harbours in the crypto-ecosystem.

So, keep your head in... this isn't really money making times here, more like unpredictable tsunamis that could taken anyone down. Things can and possibly will get worse, as unbelievable as that seems! Personally, I have to make sure of only one thing on Synthetix... I have no leverage anywhere else, but it is quite likely that even lending pools might be a little dicey.

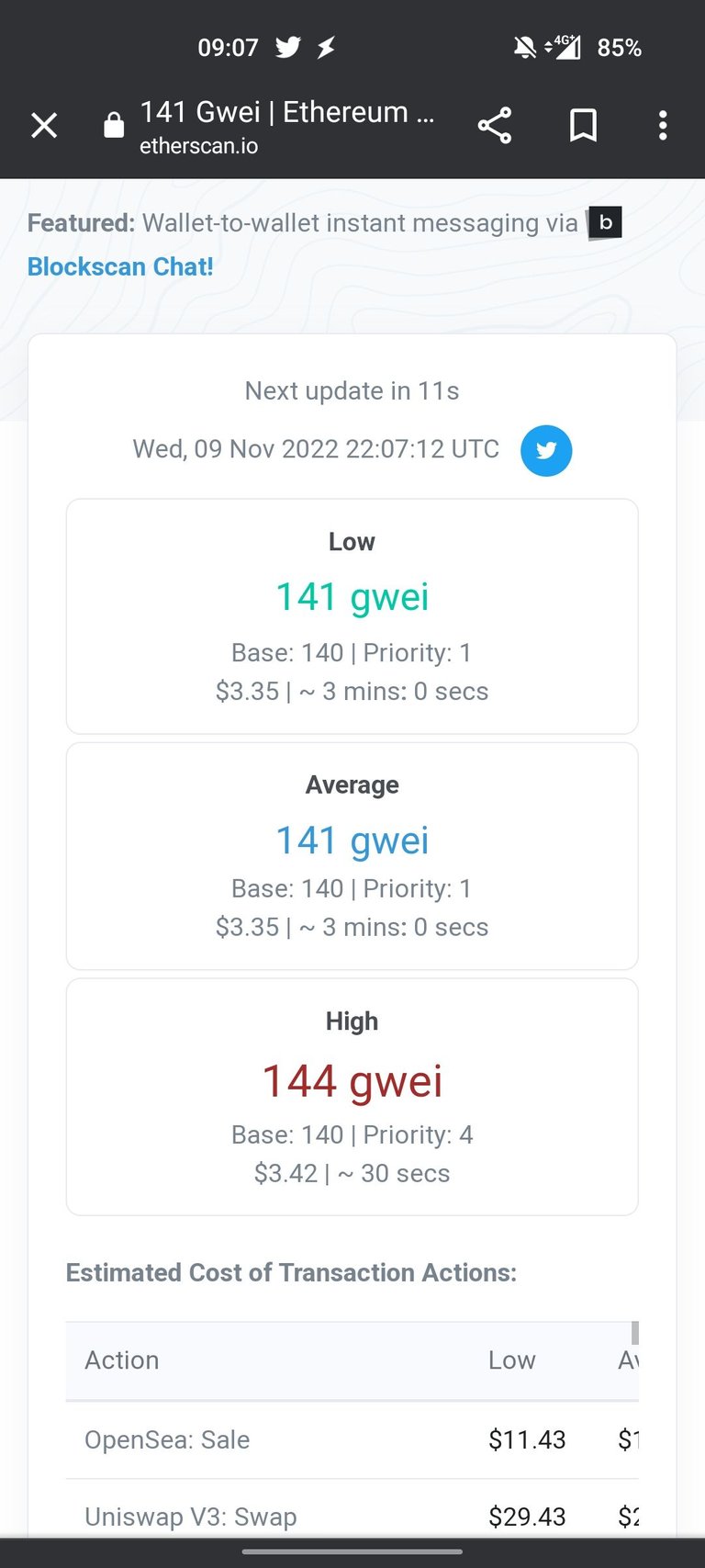

You can see that there is a huge rush to pull in positions and run for cover... Ethereum gas fees are really quite high as people make sure that their transactions are included as fast as possible, and MEV bots are doing their things as well.

I've heard rumours about Crypto dot com... and I wouldn't be surprised if there were more dominos falling in the coming months as the forced dumping reveals more dodgy dealings and cooked books. Perhaps it is a good time to start reconsidering what is on exchange, and what is a non-custodial wallet... I've started reviewing everything again, I was lucky to have most things get off of FTX before it imploded, and the bulk of what was left was just FTT anyway. However, I do now have an uncomfortable amount sitting on Binance and it will be high time to start reassessing that... of course, if Binance goes down, then we are all in for a larger world of hurt... but 2022 has proven that there are no sure things anymore!

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

GMX.io: Decentralised perpetual futures trading on Arbitrum!

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

MXC: Listings of lots of interesting tokens that are usually only available on DEXs. Avoid high gas prices!

Huobi: One of the largest exchanges in the world, some very interesting listings and early access sales through Primelist.

Gate.io: If you are after some of the weirdest and strangest tokens, this is one of the easiest off-chain places to get them!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Poloniex: One of the older regulated exchanges that has come into new ownership. I used to use it quite a lot, but have since stopped.

Bitfinex: Ahhh... another oldie, but a goodie exchange. Most noted for the close affiliation with USDT and the Basic "no-KYC" tier!

Account banner by jimramones

Posted Using LeoFinance Beta

Do you believe Crypto.com will have the same faith?

At the moment, there is so much tangled up that it is anyone's guess who will be next! Genesis now seems to be in trouble, and that is a trusted loan/counterparty that underpins quite a lot in the crypto ecosystem!