Curve finance project and it's features

The Curve finance is similar to the uniswap, it is a Decentralized exchange that is used for trading cryptocurrency assets in the market. The important features of Curve Finance include the liquidity pools and its interface, which is used for trading which includes lending and exchanging of cryptocurrency assets.

We can know about the features by going to its official website at Curve Finance

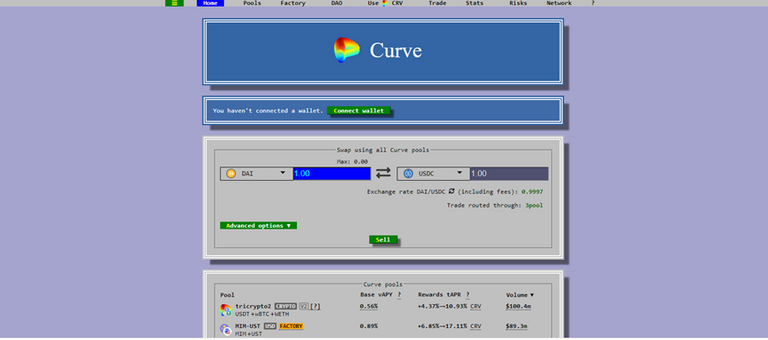

This is the interface of the Curve Finance stablecoin. The interface is made up of many features such as the CRV, Trade, Factory, pools Stats, Risks, Network, and some other. The trading platform can be seen below and its features

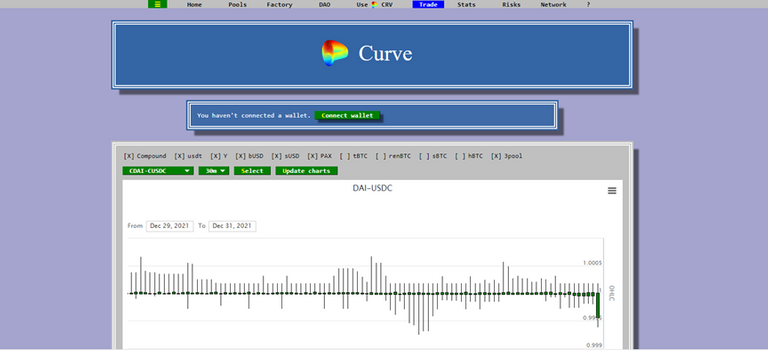

The trading platform on the Curve Finance is used for trading which includes buying and selling cryptocurrency assets, it is made up of different cryptocurrency pairs and even time frames, which you can adjust to suit you.. it is like the other trading platform with some difference. It has this graphical appearance, you can look from the chart above.

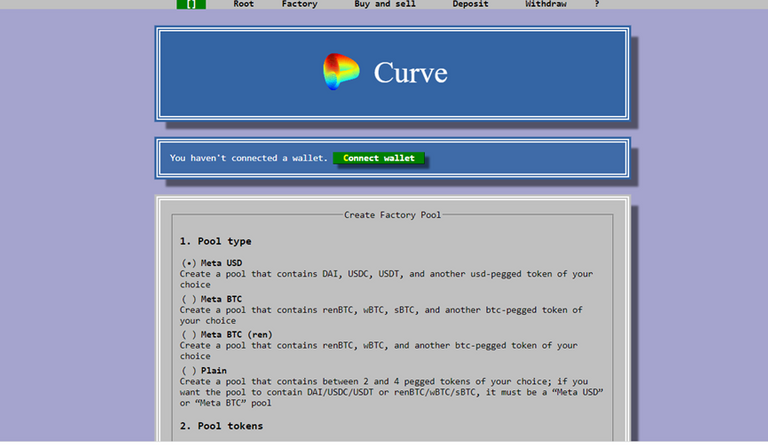

Another Feature I earlier mentioned is the Factory feature, it is a very important feature in the Curve Finance platform.

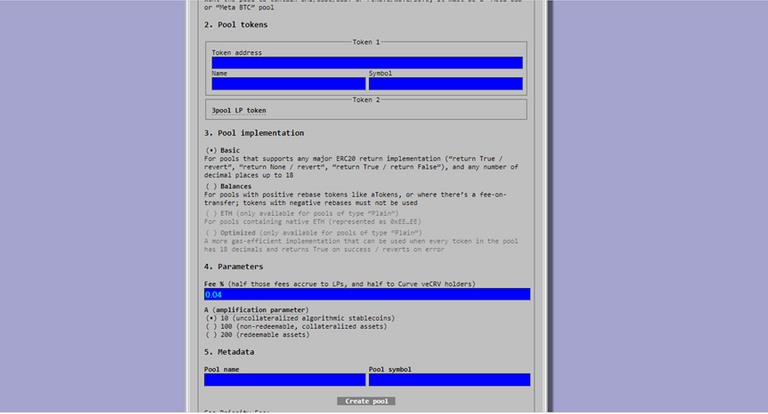

The factory feature is made up of pools and how to create and start your own liquidity pool. It has different sections like the pool type, pool token, pool implementation, parameter, and metadata.

The types of pools include

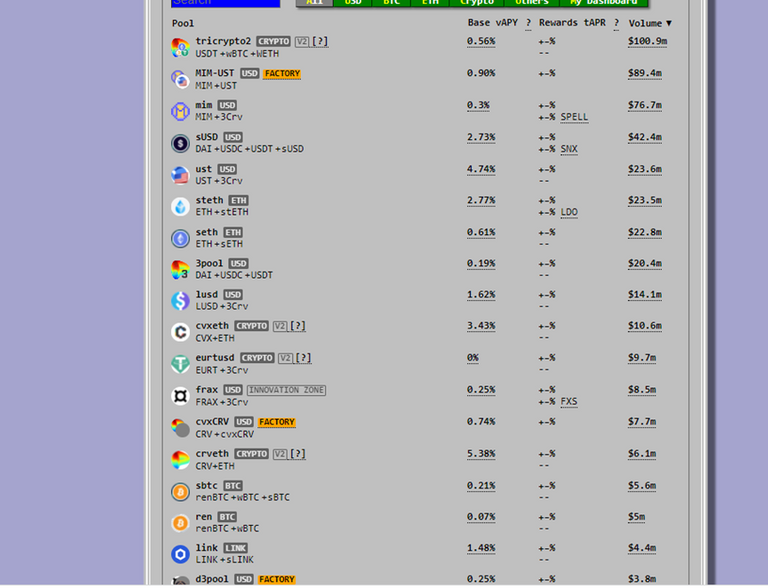

Tricrypto2, ren, 1usd, sbtc, CRVETH, 3POOL, STETH, UST, EURTUSD,LINK, FRAX etc

The pools are being categorized in the platform and these are some categories below

- TriPool: The Tripool is mainly known for its main stablecoins which are the USDT, DAI, and the USDC. The Tripool is also known as Plain Pools and it is the largest curve pool because of the list of stablecoin it has.

- Bitcoin Pools: This pool is mainly used to tokenize the Bitcoin and some pools on it include the wBTC, renBTC, sBTC, and hBTC.

- Lending Pools: These pools are used for lending and there is interest that is added for lending your crypto. Some of the lending pools include PAX, Y, BUSD, and compound

What are the major DeFi protocols Curve is integrated with?

Some major DeFi protocols that are integrated with curve include AAVE, Compound Yearn Finance, and Synthetix, and they are done in a way that if liquidity is being deposited, it can supply more liquidity to the liquid provider.

The pools are interconnected to others and this is possible due to the help of the Wrapped token pools. But if a problem happens in one it will affect others.

How does Curve Finance improve the second layer utility of a token of a different protocol?

This is done by the way the curve is being integrated with other major external DeFi protocols and transactions can be done across the different Dei Protocol which makes the Curve to be a single point DeFi that is used by the users.

This further gives you the opportunity to work with more than one platform. For instance, you can use the Compound platform for your lending and you can be given a DAI token which is not the native token of the compound platform. And there are many ways the curves have improved the second layer token. It all the platform to become one, and they all work in harmony.

This is @benie111

I would like to hear from you. Do you have contribution or comment? Do well to drop them in the comment section.

Posted Using LeoFinance Beta