Are REITs A Good Investment In These Times?

In these odd times many are struggling to find a way to make money or at least retain the value of their money. With inflation, war, super powers trying to out move each other and yes even crypto in the mix as a 3rd worldwide currency it can be hard to figure that out.

In a previous article of mine I wrote about Is The Stock Market / Dividend Stocks A Good Investment Still? in which I went over some classic ETF dividend style stocks that can be invested in.

In this article I want to focus on what’s normally a popular investment for many who are looking to live off of the dividends and that’s REITS or real estate investment trust.

A REIT is a way to allow individuals to invest in large scale income producing real estate projects. It’s mainly a single company that owns many real estate and other related assets such as mortgages, rentals, malls etc.

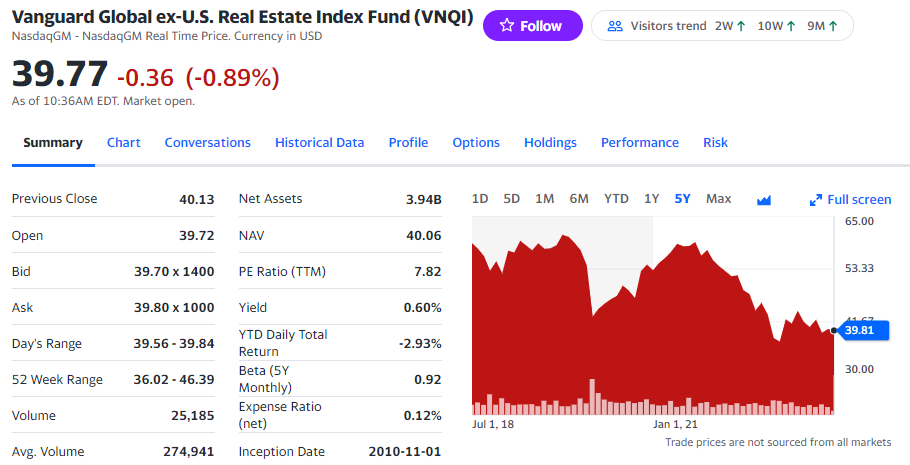

#1 VNQI Vanguard Global Ex-U.S. Real Estate ETF

*Screenshot from Yahoo Finance

If we look over a 5 year span of time on this ETF we can see that the stock price hasn't done well nor has the dividend yield. Normally stocks such as this will have a high dividend yield with a lower value in the stock price as REITs must pay out 90% of the profits to share holders. Overall this stock doesn't look great so let's next take a look into some higher dividend yield stocks.

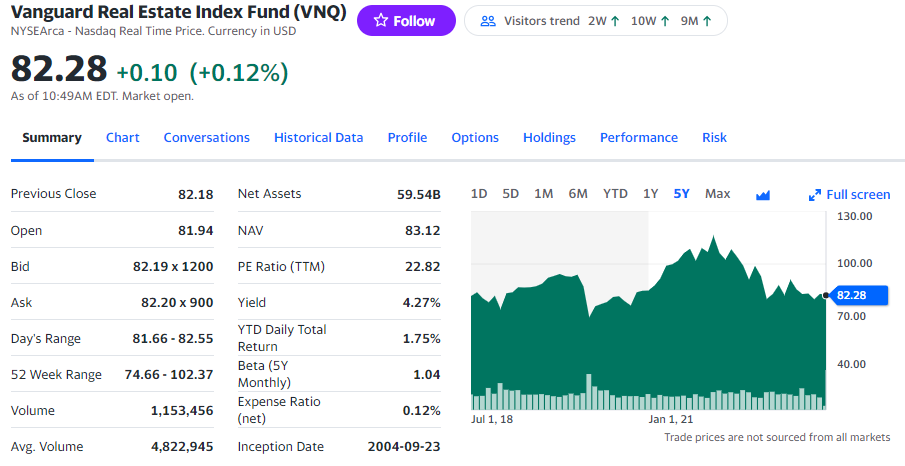

#2 VNQ Vanguard Real Estate Index Fund

*Screenshot from Yahoo Finance

This stock seems to hold pretty good in terms of price over the last 5 years. While there's no real growth of the fund itself it does pay out an over 4% yield which is pretty good during times on normal inflation and more normal times. However right now you can simply put money into a bank account and earn this same rate if not a little better. Perhaps a good value when thing return back to normal in another few years. You'll also have to watch out what mix some of these REITs have. Some will be malls etc which have continued to under perform and it's also going to depend a lot on the housing sector and rates of mortages.

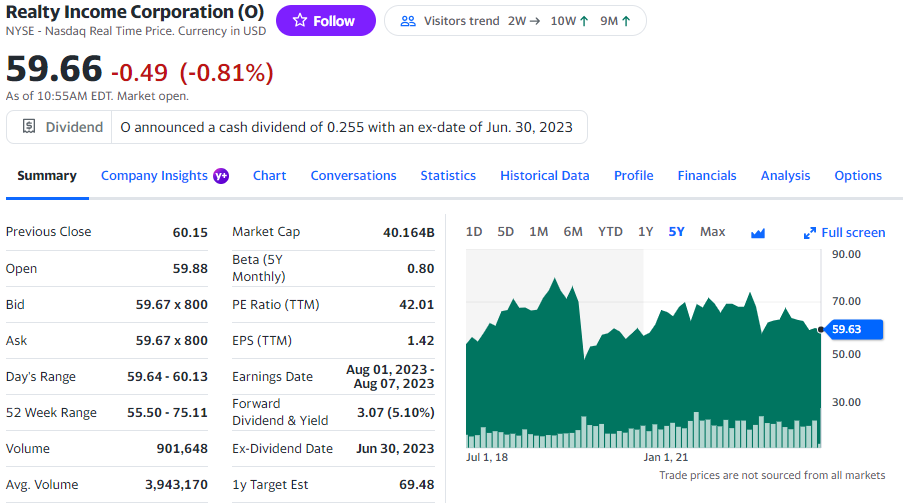

#3 O Realty Income Corpotration

*Screenshot from Yahoo Finance

O has been around for a while and is normally the first stock thought about when wanting to get into REIT investing. The price has held rather steady over the last 5 years and the dividend rate pays at roughly 5% so a little higher. The big thing with this stock is that it pays a monthly dividend and not a quarterly which is another big plus for those starting to invest.

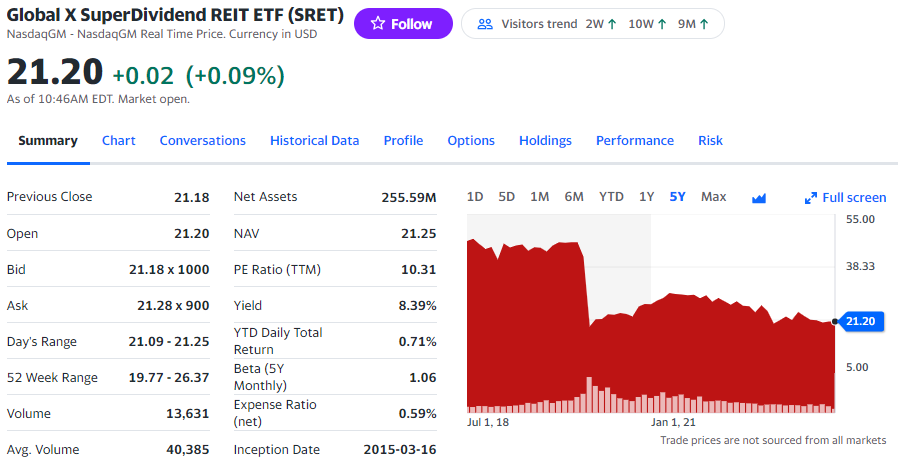

#4 SRET Global X Super Dividend REIT ETF

*Screenshot from Yahoo Finance

This stock took a major hit during the covid lockdowns and hasn't recovered since. However it's held ever since. If we look even further back we will see this stock normally simply holds its value while paying out a massive 8% dividend yield. This is the target price many investors tell you to make in order to really start to see your money grow. This could be a good option however there is the possibility for it to fall further or rebound to previous covid levels deepening on the FED rate hikes etc. I personally see this one slowly sliding further for the rest of this year so in another 2-3 years it might become a good dividend holder again.

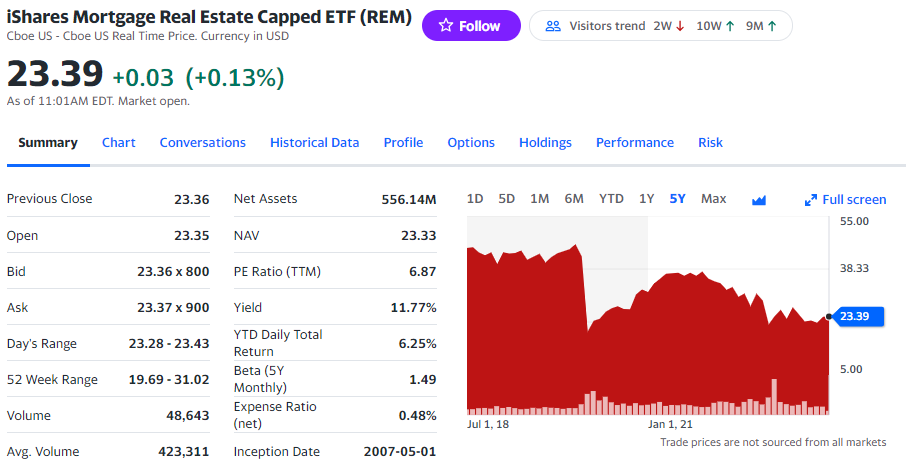

#5 REM iShares Mortgage Real Estate Capped ETF

*Screenshot from Yahoo Finance

Maybe the crown jewel of the REIT world this stock mimics many others with its decline during covid lockdowns but has held steady for the most part ever since. This ETF pays out a massive 11% yield which would take you over the top in terms of building real passive income. The only issue is once you start looking at these higher dividend yields you almost always sacrifice the stock price.

Overall REITs can still be a solid investment for good dividend returns. However you always run the risk at much higher yields of the stock price being crushed. They are often rather risky investments but ETFs can help spread out that risk over many companies instead of a single company.

*This article is for entertainment purposes only and is not financial advice.

Posted Using LeoFinance Alpha

https://leofinance.io/threads/bitcoinflood/re-bitcoinflood-2mv1erwn3

The rewards earned on this comment will go directly to the people ( bitcoinflood ) sharing the post on LeoThreads,LikeTu,dBuzz.

I'm a fan of REITs.

O has been in my portafolio for a long time. While I think real estate will definitely go through a tough period coming up, owning property is still one of the best ways to store wealth in the US.