BTC Mining Continues To Explode

The price of bitcoin $BTC continues to struggle a bit bouncing off of its recent highs of 30k per bitcoin. However it's nearly doubled since it's all time lows earlier this year of just 16k. I think that's one thing many people lose sight of is the longer road.

When you start to combine this price data you can see that bitcoin is doing rather well and almost just sitting in range waiting for a major event to happen. Either a new trend like NFTs that takes off or Bitcoins spot ETF.

Soon bitcoin will be going through yet another halving event. However in past history we have seen that the price action on BTC halving is well priced in upwards of a year before it even happens.

Which we can see above has already happened and most likely could have been the jump we saw off of the 16k mark. That means I wouldn't really count on the halving event sparking any more price increase in itself but only if something else takes foot shortly before and they fuel each other.

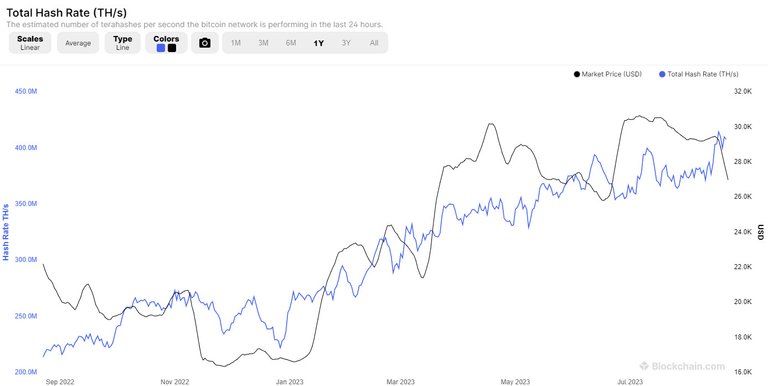

What we are seeing is a massive accumulation of BTC as miners continue to pump hard to claim the last bit of BTC remaining.

There are a total of just 21 million BTC that can be mined. Currently 6.25 btc is being mined per block as inflation. In April of 2024 when the halving is expected to take place this will drastically drop to just 3.125 bitcoin per mined block added to the inflation. Of that 21 million already 19.4 million bitcoin has been mined with roughly 1.5 million left to be mined. That's a rather small bucket in a very compressed time of space. I'm also sure that many bitcoins have been lost over the years especially from the start when it held little to no value at all and had the highest of emissions rates.

This clearly shows that many people and companies are willing to bet on higher prices now to stack bitcoin as fast as possible for what the future may hold. What it shows is a high confidence that bitcoin will soon enough be priced high enough that these high expenses at the moment are worth it and that competition for them is greatly heating up.

While other people might use charts and graphs it's something I've always avoided. Mainly that's because markets now move on emotion more than real facts. There was once a time when stocks where traded by few and ended up that how a company actully performed did mean your stock rose or fell. Those days ended when everyone had full control to invest in whatever they wanted. Now it's more on who wants what and why and that spills over greatly into the crypto space.

Produce enough hype, demand and buzz around a crypto and you could see that thing shoot off 100%+ this still holds true for bitcoin as we see news release of possible spot ETFs and bitcoin go from 26k to 30k. Then news the ETF is postponed until 2024 and we see prices take a while but end up returning to that 26k level.

You can almost get a really good sense of how markets will perform based on if bad news or good news comes out but you need to be quick on it. Overall however it feels like bitcoin is in this steady accumulation phase just waiting for that prime time bull run again which seems like it might be at least held off until 2024.

Time will tell and news will tell but for me constant stacking of bitcoin feels like a smart move.

*This article is for entertainment purposes only and is not financial advice.

Posted Using LeoFinance Alpha

I agree with you, BITCOIN is my savings account

https://leofinance.io/threads/bitcoinflood/re-bitcoinflood-2yocguegn

The rewards earned on this comment will go directly to the people ( bitcoinflood ) sharing the post on LeoThreads,LikeTu,dBuzz.

After the next halving, we may see a massive pump.