Fed Rate Inbound What To Expect

.jpg)

Fed Rate Inbound What To Expect

These fed increases are like clockwork these days and we have seen many of them play out in the last few months. With that history we can kind of expect what is coming and what's next for not only the stock market but also crypto.

Crypto And Stocks

You see as of two years ago the stock market has become a increasing factor into the crypto markets. This is due to businesses like Coinbase and other mining warehouse firms that mine bitcoin having exposure into the stock market. While it's not the general huge overall market it's still a increasing exposure to the markets for each.

What's nice about crypto is we can see into the future of the stock markets at bit. This is due to crypto being traded 24/7 while the stock market has a very limited trading window.

As a recent example we saw a hard sell off in the crypto markets last night (Sunday night) and this morning the stock market then sold off. This is most likely a result of what people are expecting to be yet another rate hike. This rate hike is going to really start to dampen the buying rates but I honestly feel the fed is trying to increase rates for the wrong thing. I don't feel there is a increase demand and instead it's actully just the reset of world events from being shut down for nearly two years a now global war. All of this adds up to what we are seeing now and I don't see the feds increase rates having any effect on inflation and instead just constantly depressing the markets even more when in a time they need to actully be rallying as we come out of a two year lockdown from covid.

More Rate Hikes

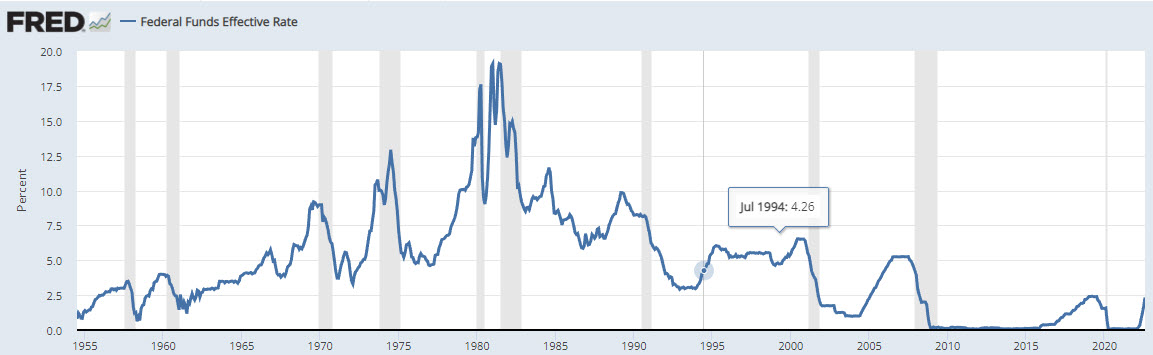

It's expected there will be another rate hike yet again and that rate hike is coming in at 75 points again or 0.75%. Here's the thing though many need to realize. This rate increase is the SAME we would be at before the covid lock downs. It's why I don't feel the stock markets etc have been hammered as hard as many thought they would be.

*Image pulled from FRED

However that being said what's going to really matter is if they increase rates after this one. I don't feel we will feel this one as hard still but the next could very well start to paint a picture of real recession kicking people in the teeth.

This rate hike if they played their cards right should start to see inflation dip towards 5% next month IF it's actully having a factor at decreasing the demand while supply is increasing. However I'm still betting on supply is the real issue and not the demand pressure. This combined presser could have disaster effects on the economy.

What are you thoughts on the rate hike inbound this week and how it will effect the economy and crypto?

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @bitcoinflood.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

https://twitter.com/bitcoinflood/status/1571934227930951680

The rewards earned on this comment will go directly to the people( @bitcoinflood ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

There is no need for 100 points atm, inflation is stable and recession is coming. Fed wants to be hawkish but not be blamed for the recession

Posted Using LeoFinance Beta

Nice write up, the rate bound could be a better place with time

Posted Using LeoFinance Beta