What is APR vs APY?

.png)

What is APR vs APY?

This is a common thing we see in the DeFi world but also just in our general lives but many people don't understand what the difference is between APR and APY and how much of a drastic effect it can have.

What APR and SPY stand ofr

APR - Annual percentage RATE

APY - Annual percentage YIELD

As we can see above there are two big words Rate and Yield both of which mean very different things. Your APY takes into account compounded interest while APR does not. This might seem like a little thing but it's not and here's why.

Compounding Interest

Compounding interest mean taking the interest you earned and earing interest on top of it. This can go one of two ways for you. Very well or VERY bad and the very bad is stacked against you.

The Bad

You know that pesky credit card you might be using with that high 15% interest rate if you don't pay it off each month? Well that 15% interest also compounds and gets interest added on top of it.

The Good

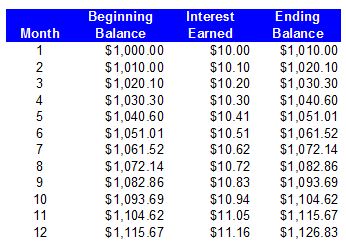

Invest $1,000 and earn 10% on it would look something like this all in your favor.

How It Applies To DeFi

In the world of DeFi we see APR and APY thrown around a lot and it's why it's important to know how each works. Let's take a look at some examples in CubDeFi

The world of DeFi is a beautiful thing! No longer will you get 1% interest from your savings instead we are talking 10%+ and in some cases upwards of nearly 100%!

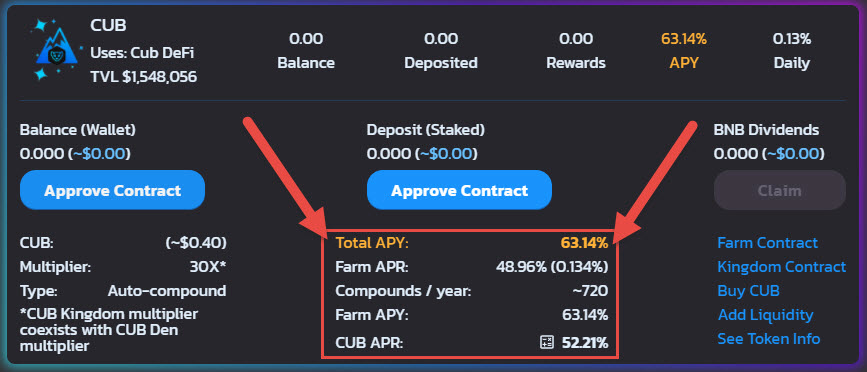

In the screenshot above we can see our Total APY is 63.14% and the APR is 48.96%

Broken down what this means is that we are earning 48.96% at the moment on our cub however because we are auto compounding in the kingdom 720 times a year this means the CUB interest gets restaked and earns as well changing us to a 63.14% APY.

This is the power of compounding as clear as day. If we just put CUB into a Den and let it sit there all year we would earn 48.96% however because of the compounding nature we get an extra 14.18% on our CUB. Not bad!

*It's important to note that DeFi changes rapidly and the values shown above are subject to change.

So now that you know the difference are you going to start compounding your interest and crypto?

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

This is a good one to point out, it took me a while to notice the difference and figure it out.

Nice and helpful post.

"good post" sir! lol

Posted Using LeoFinance Beta

I was today searching the exact thing in Google! lol... Found a similar answer as you did + that APR is usually used when we are taking loans, and it shows fees that we have to pay (sometimes with added fixed fees, etc)... And APY is usually used for what you explained... When we borrow money, and to find how much interest will earn... (with compounding effect...)

Thanks for this simple clarification! Very useful!

Good insight. I have never needed the English language much to do technical analysis, so if you are looking at these words before knowing buy and sell signals in the candles, you are probably way ahead of yourself.

Oh wise sage, bestow upon us plebs your arcane wisdoms of divining the candles.

Posted Using LeoFinance Beta

Selling hive to buy it back Q1 2022

https://twitter.com/bitinvest_news/status/1445074292463517710

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

So the APY takes into account compound interest, I see, very interesting, I always knew they weren’t the same thing but I also thought they were similar, now I see they aren’t similar at all. I guess a lot of people can use this piece of knowledge. I hope I remember the distinctions when it comes up.

Posted Using LeoFinance Beta

Never really knew the difference between both of them. Thanks for clearing it out

Awesome analysis here buddy. One of the challenges with auto compounding defi staking is the fact that withdrawing them is not instant unless you want to pay some percentage fee. One normally wait for some days interval to see the coins reflect back in the wallet.

I never really knew the difference, thanks for the clearifications.

I've certainly been guilty of using the terms APR and APY interchangeably when I should know better.

I've added a few sections of this post to my Obsidian and will no longer stay ignorant!

Cheers :)

Posted Using LeoFinance Beta

You're not alone on this one :)

Posted Using LeoFinance Beta

This is perfect thank you!

Also here is an extremely solid early project with a ton of potential specializing in pools and farms.

One of my closest friends is part of the team, I would never suggest to invest in anything unless I was 100% certain it was safe and profitable.

https://unitedfarmers.finance/pools

https://uff-frontend.s3.filebase.com/UFFToken.pdf

https://deeplock.io/lock/0xf0a5Ed7774Acaff7FAbF5867D78bc62b6AA58412

And ROI is also something different?

Posted Using LeoFinance Beta

People are falling into many places being confused between APR AND APY. simple words but we should know the behind meaning.

Posted Using LeoFinance Beta

Excellent points.

First...

I think this can't be emphasized enough.

Compound interest working for you is great, but against you it will suck up your hard earned income like a sponge sucks up water in the desert.

Second..

I run a shared pool on Cubfinance, and we are making a incredible rate there on the farms of over 100%, but once a day I harvest the yields and deposit them into Cub Kingdom for additional yield. I pay out earnings once a week to pool investors. When I first started doing this I didn't think it would make a big difference, but I was wrong. As Cub price has slipped recently I doubted the conversion to Leo would net the same earnings each week. After I started practice of depositing Farm Harvests into Cub Kingdoms each week I noticed that the Leo earnings were climbing each week instead of declining. I attribute this to the compounding in Cub Kingdom.

Some of it could be due to lower Leo price too.But it's complicated when Cub price falls, Leo price falls and yield increases.

Lastly,

By the way...I am absolutely holding my breath to see what the earnings will do if Cub price climbs after this next IDO!

Posted Using LeoFinance Beta

Not gonna lie, I barely gave attention to that, hehe.

You may wanna correct this section :)

Posted Using LeoFinance Beta

It is very clear, that one must be very careful when buying and selling too.thanks for clearing out our minds and sharing