[Metals] [Silver] Is Silver world's most undervalued asset ?

As y'all may know that I am a very big fan and a firm believer of stacking physical gold and silver because that is real money without man made inflation that is used for more than 5000 years by humans.

Today's post will be dedicated to silver and it's price action. Hold tight it could become a long one but I promise I will make it worth your time.

Silver

Recently, Silver touched it's high of $26 and then has been falling since. It fell so much that currently it is trading at $22 per ounce. Let's look at the chart.

That green line is our current downtrend.

But it is not even the real manipulation. Let's zoom out the chart.

Can you even see the green line ?? That's my point. Silver hit it's all time high above $45 per ounce in 2011 and been falling heavily since.

Manipulation.

I am not a conspiracy theorist l. I only believe something when I see some source or facts behind it. I have enough reason to believe that the current silver price is highly manipulated. Let me list you the reasons.

1. Demand vs Supply

It is simple. Every market price should be determined by it's demand versus if it has the supply to meet that demand.

As for silver, it is not only used for collection and investment but also for industrial purposes. Silver's industrial demand has kept steadily increasing over the decades whereas it is becoming more and more difficult to keep up with the supply.

Look at this article for example which points out the production and mining issues world will face due to growing demand. It has an interesting chart from silverinstitute.org which gives us a clear picture that silver is the backbone of so many industries. They tried to replace it with others metals but failed. There is simply no exact substitute for silver ...!!

Let me post the chart here for those who are lazy. It is in the same article above.

If you are thinking that this article is old from 2016 and things have changed since then.

Look at this one from 2019 written by Dominic Frisby.

You can go through the whole article. It is a gold mine (Pun intended)

Let me quote you one paragraph from it so that I can move on my next point.

A geologist will tell you that ratio should be closer to 15: there is only 15 times as much silver in the earth's crust as there is gold. Indeed, 15 is the historical monetary ratio between the two.

He argues that since the natural physical ratio for silver to gold is 15:1. The price should be accordingly or atleast near it.

You'll be surprised to look at the current gold/silver ratio according to their price.

It is unreal.

2. Artificial supply

This one is the most neglected one when we talk silver price. The silver that we see now also takes into account the trading of paper silver which is silver etfs,bonds etc. These securities have a significant impact on price but they are just paper silver meaning no physical silver is traded here.

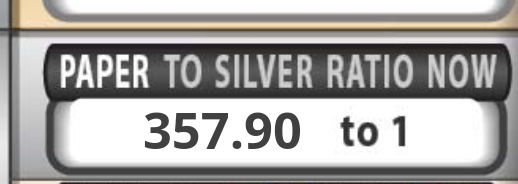

In fact, we don't even have physical silver to back the paper silver supply on the market. Confusing ? Look below.

This is the current paper to silver ratio which above 350+ which essentially means that for every physical silver ounce in existence there is atleast 350+ more ounces trading on the market. This is a clear case of artificial supply creation used by banks , financial institutions to keep the price suppressed.

Again, you may again accuse of being a conspiracy theorist. I mean why would banks do that right ? Why do they care so much about metal's price.

Number one : Free money

With the invention of these etfs they can sell 350x more for a single ounce of silver they hold which is free money for them that they can use in other investments for a way better return and pocket the profit. Evil huh ? Burn the bankers you say ? I'd be happy if they just leave the price to free markets that's all.

Number two : Trust in fiat.

Silver and Gold prices soaring while raging inflation in fiat will cause distrust in fiat and investors would together shift to metals for inflation hedge. So the money that investors put in mutual funds, etfs , stocks for wealth creation and safety against inflation would into metals. Trillions in losses. If I were a bank , I'd lose millions shorting silver instead trillions in investor withdrawal should there be an steady increase in metals for decades so the price affects all.

3. Naked shorts

Last but not the least, naked shorts.

These are clear, documented and effective technique or con should I say that banks do manipulate silver. They basically place a sell order in the market by millions without first buying. It is called as a naked short. While us common traders sell something to buy it back at a lower price but for banks the motive is to just have those gigantic sell orders there to artificially suppress the price.

But what happens if someone buys the silver order they created out of thin air ?? Congratulations you created an artificial supply of silver. Just increase that paper to silver ratio by 1 and enjoy. :)

There is one big bank named JPMorgan which has even been caught and charged in silver manipulation . The fine which they paid meaning they accepted it else they would have taken it court but they wanted to close the case by paying fines.

Watch this brilliant video by capital.com on the subject.

Conclusion.

The reasons given above aren't the only ones I think are the reason for silver price manipulation . There are numerous. May be a different post for it.

In an ideal world. These bankers should be behind jail for such a circus show but we are far away from there.

Let me know what do you think of my analysis.

Upvote and comment on this post to support my blog. It means a lot. Any suggestions or tips are welcomed as well.

Take care. Peace out.

I really think it is so undervalued…

Let’s keep stacking some more silver 😉

Have a great weekend!

Posted Using LeoFinance Beta

Yes let's stack some. You have a great weekend as well. :)

Thank you kindly @cassillas5553 😊

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @cassillas5553.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Hi @cassillas5553, you just received an upvote from @gotgame on behalf of https://hypeturf.io.

Hypeturf is HIVE frontend built by @gotgame where you can earn rewards on Hive by creating engaging content and commenting on posts.

Thank you.

Silver is so undervalued. The ratio to gold is 77:1. It so difficult to comprehend. If only just physical metal exists, then I'm certain the ratio is much closer. Let's keep on stacking silver !

I was just commenting on this.

Silver is so awesome..

I wish mene sold it.

Posted Using LeoFinance Beta

True. The current GS ratio is totally artificial.

I grew up in California very close to the border and have been collecting Mexican Silver since I was a kid.

It used to be CHEAP to buy rings cause they were "just silver."

Then, when I was in college I learned that silver is actually more rare than gold - and I've been a silver lover ever since.

I hope that the rarity of silver makes it worth for me to have been collecting it all this time in time for me to enjoy the fruits of my collection.

Posted Using LeoFinance Beta

True.Keep stacking the real money.

I agree silver is a good long term investment, but instead of thinking the recent decline of silver is manipulation, have you considered the fact that silver is an industrial metal? and its demanded as an industrial metal also, which means when economic expectations decline, like recently because of market declines, prices of silver react more to economic activity than gold does in my opinion.

!PIZZA

!LUV

!LOLZ

!PGM

BUY AND STAKE THE PGM TO SEND TOKENS!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@forsakensushi(1/4) gave you LUV. H-E tools | discord | community | <>< daily

H-E tools | discord | community | <>< daily

lolztoken.com

Periodically.

Credit: reddit

@cassillas5553, I sent you an $LOLZ on behalf of @forsakensushi

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/6)

It could be but if you looked at the data at silver institute supply and demand. You'll find that even in economy declined the demands for silver doesn't decline a lot. Fundamentally it results in at max 5% more output than demand. This is okay and normal for a market but silver's price already includes an artificial paper silver supply of 300+ ounces for every physical silver so technically this shouldn't affect the price which is why I called it as manipulation. Manipulation can be done with money or with propaganda to steal dumb money who sell based on economic slowdow both are same in my eyes.

PIZZA Holders sent $PIZZA tips in this post's comments:

@forsakensushi(1/10) tipped @cassillas5553 (x1)

You can now send $PIZZA tips in Discord via tip.cc!