Bullmarket isn't over. Here's why.

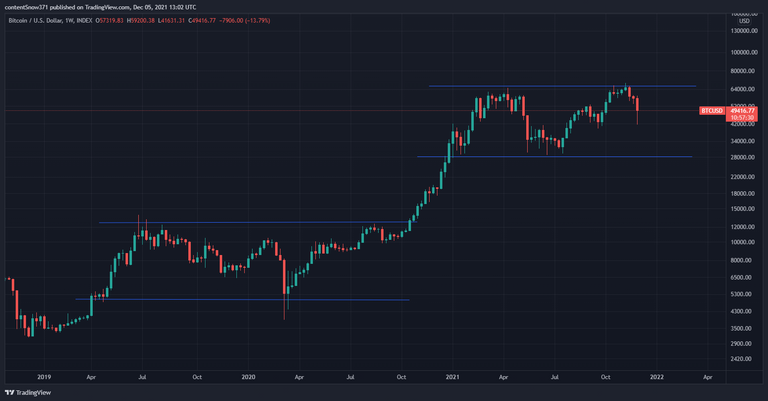

So Bitcoin crashed 20 or so percent yesterday and people are freaking. Some are even calling for a bear market. First of all, I would say: lengthening cycles. There's no reason there should be an EOY market top, because there's no 4 year cycle to begin with. Not a popular opinion, but lengthening cycles is the most coherent theory to explain Bitcoin's price action when you look at the data as a whole. It's not guaranteed, but in my mind it's the most likely outcome to play out.

Now this isn't another preach on lengthening cycles, because there's something else that indicates that the bullmarket is still on.

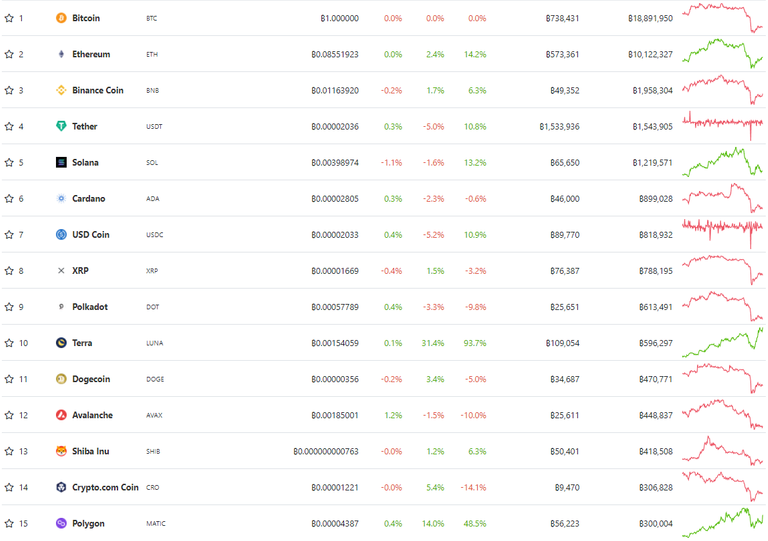

The chart above describes altcoin dominance in percentage terms, which is basically Bitcoin dominance inverted (100-BTC.D in Tradingview). Why I'm looking at altcoin dominance, is that during bull markets altcoins gain bigger chunk of the cryptocurrency market, whereas in bear market Bitcoin gains a bigger part. Usually when there's a big correction with Bitcoin, alts drop even more when people shift back into Bitcoin because it's the least risky asset.

With yesterday's crash, the opposite happened: There was a bullback, yet altcoin dominance went up big time as you can see on the chart.

If you go to Coingecko or Coinmarketcap and change crypto prices to show in BTC, you'll see lots of green in the percentage change tabs.

So just relax. The crash was probably just whales shaking out weak hands and over-leveraged traders who fell for the EOY parabolic run trap. They know how to play the game.

One more thing that I think is interesting and good to understand.

The nature of this bullmarket has been much different from the previous cycles. We've basically went sideways the whole time except in late 2020 when we went from the sideways channel to another sideways channel that we've been in the whole 2021. Much different from 2017 that was a steady ascending parabolic rally to ATH. There's actually an argument to be made that this a stretched out version of 2013 which had a local top before reaching the final one later.

Anyway, I wouldn't freak out if we retested 42k or even 30k support once more before starting the final leg of the bullrun and breaking up from the sideways channel. There's no reason to expect 2017 to happen again especially when the current bullmarket has been completely different animal compared to it.

Lots of traders got rekt now by taking too much leverage with the belief that we're just going up, because it's December, but it doesn't take a genius to zoom out a little and realize that there's a good chance it won't happen this time. We could get a small Christmas rally, but I think it's almost certain that 100k at the end of year is not gonna happen.

agreed totally. Don't know how it will play out but this is so reasonable and exactly what I've been thinking.

Let's see if the market agrees to my reasoning :D

Who knows?

I'm buying more BTC.

But I'm skimming off other bits and pieces too!

I would buy if I had any fiat available. For the next bear market I will (hopefully) have plenty of available when I cash out this cycle's gains :D

I'm thinking now that if I don't take out a certain amount now and there's another 4 year bear cycle, I'll feel pretty stoopid.

Thankfully the passive gains from Splinterlands over the next sixth months should give me a decent amount to live off, not that I even need that, but I'm feeling like it's time to skim, but that's just me!

Starting to skim now is definitely a reasonable thing to do. I'm willing to take a bit more risk myself, because the more I research, the more likely it seems to me that the bullmarket will continue for a while.

I'm converting rental income to credits to buy more CL packs. Hopefully SPS would increase in price, so I would get a good rate to purchase more credits – I have spent way too much HIVE already, want to save my precious HIVE's for the January 6th airdrop!

I think you can't go wrong with CL packs - I'm now selling most of my DEC to save for packs.

I'll probably also spend some Hive on them.

I'm not that tempted by the 3SPEAK drop - isn't desktop P2P storage a bit 1998?

I think that might sell off HARD.

Or maybe things are coming full circle I dunno, whatever I'll probably hold onto all my drop and just stake it like the mug i am!

Will see, but there's also Dan's NFT game, Ragnarok's, snapshot on the same day. In his words it's going to be a highly strategic game and an HBD sink.

Well I'm not inclined to sell HIVE ATM, but if it goes to $4-5 this wouldn't be enough to stop me selling a few thousand!

That's about my view of it!

Subscribe to that. Glad to see there are more alike, seeing the lengthening of the cycle and the decoupling of this market from previous patterns. We're on different territory with different metrics now. As I wrote in a post today, I believe to, that BTC could test $30,000 and still not enter a bear market. I personally believe in corrections, but don't believe in bear markets like what we had so far.

Posted Using LeoFinance Beta

Hey mate, sorry to jump in off-topic.

Do you mind reviewing and supporting the Hive Authentication Services proposal? That would be much appreciated.

Your feedback about the project is welcome too.

Thank you.