Comment Activity: How is Inflation Affecting You in Your Country?

Hello again. We have announced in previous posts that we will organize events and competitions to increase mobility in the community. Our goal is to grow the Cent Community. It's been almost a year since the token, prize pool and community launch. As a community, we have made noticeable progress. Now is the time to step up. Events are one of the main ways to achieve this. This event is one of them. You can share your comments about the topics we mentioned below this article. You can have data about the economic situation in the world by reading the comments made by other users. You can learn the applied methods.

Our Event Topic; How does the inflation in your country affect you, what precautions do you take against inflation? Or what kind of tools do you use to be less affected by inflation?

Awards: Every comment you make will be judged and voted on by the curators. In addition, users with the most votes will receive the following rewards;

The one with the most votes

1st user 1 CentG reward,

2nd user 0.75 CentG reward,

3rd user 0.5 CentG reward.

Edit:

- @creativehive https://peakd.com/hive-173575/@creativehive/re-centtoken-rg98ek

- @faquan https://peakd.com/hive-173575/@faquan/re-centtoken-rg9bdf

- @mypathtofire https://peakd.com/hive-173575/@mypathtofire/re-centtoken-202287t193557688z

Our event will continue for a week. We will continue to organize new events and competitions. Please stay tuned.

Well, personally, it affected me a lot. Losing 12% of your savings due to inflation is no small thing. The main problem is that it is mainly affecting food and basic services, which makes it much harder.

How do I protect myself? little can be done. I have part of my savings in dollars and by improving the change I have not lost anything. I also have investments besides Crypto that are helping me.

The question is how long can we last? What if things start to get violent?

Posted Using LeoFinance Beta

In the United States, our inflation woes are pretty bad. Inflation has been affecting the poorest among us and the newly arrived immigrants that want to experience American life. Of course, being in a 'wealthy' country, we have living standards that are different than countries that are not as affluent as we are; In comparison, we are not suffering even if we are pushing 7-14% inflation - real-world inflation.

Yet, that doesn't mean we should not be concerned. Generally, the federal reserve targets a 2% interest rate or less; We've gone beyond that. My family has been focusing on interfamily transactions and interfamily credit. We have also begun acquiring investment assets to protect against inflation, such as physical and digital assets.

The physical assets we're obtaining to push back against inflation are acquiring copper, silver, and (if it's cheaply available) gold. We are looking to purchase more property within the next year or two. We've also obtained stocks in companies (as individuals) and have begun expanding our holdings of physical currency, including old coins for our collection. Digital assets, like cryptocurrency, have helped us diversify our portfolios since we cannot effectively rely on keeping our wealth in fiat.

Our priorities are diversity in wealth.

That's true @esecholo, you guys in the US are in a safe haven. This is simply because your economic system is working and your leaders are accountable to you guys. In Nigeria, the case is different, our leaders embezzle funds meant for developmental purposes for their selfish gains. When inflation arises like they're right now, we tend to suffer more than others in high income countries.

Thanks for sharing your thoughts on inflation.

Hi @esecholo

I take note of the actions that you and your family are undertaking to shovel and prepare against inflation. Some could apply them in some way with crypto assets.

I think Nigeria should be called inflation. Why I said this is because, nothing that goes up due to inflation that comes down after the inflation. This simply means that once the prices of commodities skyrockets it'll take months or probably years before you can see slight chance in the prices of commodities.

Inflation have made most families in Nigeria to feed less than 3 times a day, leading to severe hunger and death of citizens caused by high cost of goods and services within the country.

My believe is that I should earn more rewards from the hive blockchain and other crypto holdings that I have. This is very important because the exchange rate from hive and other Blockchains favor Nigerians on the blockchain.

I also try to buy and stock should m some goods when they're cheap in the market against when the prices skyrockets. For instance, between February and March, the price of palm oil is cheap when compared to September to December and I sell them when the prices skyrockets.

Thanks @centtoken for this idea.

Hi @creativehive

I know about the situation your country and other African countries are going through. A pity lack of governments that attack effectively in favor of their voters.

It pleases me to know that you had an exit with cryptocurrencies.

For my part, I support many of your country in Steemit with votes and curate.

Thank you so much for your concern about my country. Hive and other platforms are keeping most of us going.

They say inflation is around 10% here in Germany but this does not reflect the reality that fuel prices are nearly doubled in the space of a year, food prices are between 50-100% more expensive and similar for electric/gas prices.

We also see manufacturers playing games with pack sizes. Before we bought a 100g pack of chocolate and now the price is up 50% plus it's now smaller 85g bar.

Hi @mypathofire

If to what you describe we add the medium-term effects of the conflict between Russia and Ukraine, the outlook looks unfavorable not only for your country but for all of Europe and the rest of the world.

These games by the controllers are annoying for sure. The best way to avoid any negative effects is to not give the news or mainstream media your attention.

Greetings everyone, I appreciate this effort and an idea to create traffic on the community. Kuddos to @centtoken and @anadolu.

My thoughts on inflation will be precised and I'll look at the cost of imported used cars from Europe and America between two different administrations in Nigeria. Toyota corolla 2008 model was about #1,800,000 to #2 million as at two years ago, but to today it's about 3 million naira.

The painful things about the inflation in Nigeria is that the income of workers still remains the same, which is making life unbearable for citizens in the country.

Let truth be told, Nigerians living in Nigeria are suffering from hardship and leadership.

Inflation here is close to 80 per cent. It is becoming difficult to buy the same product at the same price a few weeks apart. Although salaries such as minimum wage, pensioners and civil servants have received good increases, it is becoming increasingly difficult to maintain purchasing power.

There are also those who take advantage of high inflation. These both increase their products and reduce the weight or number of the product. In a way, they make a double raise thanks to the hidden raise.

The expectation was that prices would fall in the summer months, but nothing changed and inflation continues to climb upwards. I can't even think about the winter months, I hope it won't be worse than this.

My personal method of fighting inflation is simple. I try not to buy anything other than vital needs. I postpone my activities in non-priority areas such as clothes and travelling or try not to allocate additional budget as much as possible.

Hi @lindo-cactus

Reading the colleagues, I observe a lot of similarity in how they describe the effects of inflation in daily life. From your participation, I identify with how I have limited my expenses and consumption.

Hi,

inflation and the problems it creates are common, and I can predict that the solutions will be similar.

I'm from the US but last year I moved to Mexico. Our main interactions are with groceries and the electric bill which have gone up substantially but we are fortunate enough to be able to afford it with our savings. Many others aren't so lucky.

What we've found to be very interesting is that while the price of goods are going up, whenever we need to hire someone for some type of labor like a plumber or a taxi, prices aren't moving up. We've spoken to a few people about it and the answer we get from the locals is that they don't feel comfortable raising their prices so they just find ways to cope.

Since we are barely affording groceries at this point and they already barely were, it seems that coping is just not having.

Posted Using LeoFinance Beta

that is very nice event for the community, lets keep the engagement going.

ok I am not going to talk like I know well about the topic, as my economic knowledge is not that good. But according to Bank Central Bank data the inflation on July 2022 is around 4% which already on the rise since a few year ago according to that data.

But there are many cases that some commodities are skyrocketing because of the crooks and bad distribution makes the stock less thus driving the price up.

One good thing in short term is that the government still subsidies the gas/oil price, keeping the other prices affordable but in long term that will makes the national debt higher, which will be pretty bad in the future.

Hi there, this contest is a great idea, I saw it on ecency. A platform like Hive lives from exchange, so I like to participate here.

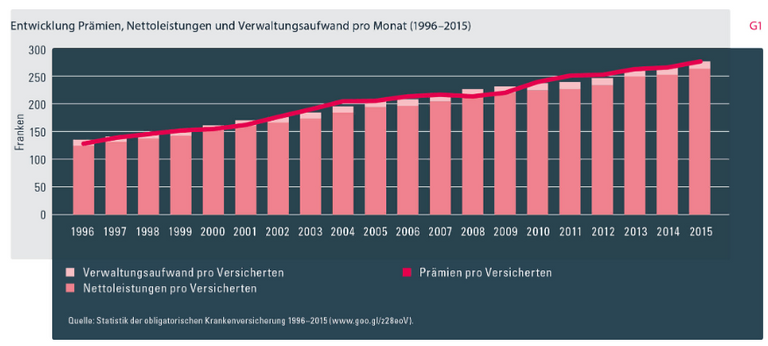

In Switzerland, inflation is currently at 3.4%, which is very low compared to many other countries, but very high by our standards. This becomes clear if you look at the inflation values for the last 10 - 15 years:

You have to go back to 2008 to find a similarly high rate, and even to the 1990s for a higher one.

We have a very high standard of living, low unemployment and a high salary level. But just as high is the price level, do not get me wrong I like living here very much and do not want to complain.

Of course, low-income groups are also more affected by inflation here. A big burden here is housing and health care costs. These are increasingly putting a strain on the budgets of the middle classes as well. In Switzerland, health insurance is mandatory, and on the one hand, that's very good. Nobody dies in our country because he cannot afford a treatment, on the other hand the expenses for this compulsory basic insurance are increasing more and more. nicely to see in the following graph, where the red line represents the premium per person:

These constantly rising costs are often not taken into account in inflation and they are an increasing load.

But all this is still complaining on a high level, when I see how it looks in other countries. That's why we also try to donate a small amount every year.

For me personally, inflation is rather not a problem, I get an annual salary increase, which min. corresponds to the inflation value, at least so far it was so :D.

In addition, I am invested in the stock market and cryptos, in both cases I hope for long-term gains. And of course I try to grow my account here on Hive.

Translated with www.DeepL.com/Translator (free version)

Question 1: How does the inflation in your country affect you?

Answer:

The typical narrative about inflation is inaccurate and misleading. In addition to the usual excuses such as labor unions, greedy businessmen, rising prices of oil, and the consumers, our President shifts the blame to international forces. He calls the national inflation rate inaccurate and points his finger at “imported inflation” and describes the country’s higher inflation as an outcome of a global problem that has affected imported goods. And so, for the President, inflationary forces are out of their control. He disagrees with a 6.1% inflation rate in the month of June and a 6.4% last July. For him, these numbers are misleading. The country’s target is 4% or less.

An independent news portal reported otherwise. The last time the country suffered the high inflation that we are experiencing right now was in November 2018. The numbers look even more alarming on a per-region basis. The inflation rate outside of the National Capital Region is 6.3% and in some regions is as high as 7.5%. One statistician said that the purchasing power of the Philippine peso has declined and that the value of 1.00 Php in 2018 was worth just 0.87 Php in June 2022.

As for the impact of inflation on our family, it affects us not only financially, but also psychologically and our relationships as well. Due to rising prices of goods and services, our usual income is no longer sufficient to provide for our needs. It makes us worried about the future of our kids wondering where we can find the extra fund we need for their education.

Reference

Question 2: What precautions do you take against inflation? Or what kind of tools do you use to be less affected by inflation?

Answer:

A person that does not have much capital can do little to protect himself against this inflationary attack. In my small way, all I can do is think long-term and use my monthly savings for micro-investing in digital currencies.

The inflation in my country seems to be increasing day by day. Instead of getting better, there have been a consistent increase of goods and services price, the Naira keep loosing it's value making the country hard for the poor, only those investing outside the country are benefitting. The poor has been left behind and the average is also been affected, the government is not helping the matter at all.

I will advice investors in Nigeria to try investing in foreign businesses for now in order to be on the safer side.

Among other problems of my country, one of the most important problems is inflation. The prices are increasing one after another. The prices of almost all the daily essentials are increasing uncontrollably. No one cares about anyone. He is increasing the price of things as much as he can.

If the price of rice is high today, the price of wheat will be high tomorrow. Today the price of oil is high and tomorrow the price of curry is high. As such, the price of almost everything is going up unimaginably. Those who are extremely poor or middle class are not having confidence to buy essential goods.

There is a class of people who are involved in these activities by making syndicates. They remain untouchable. Their character is such that they catch fish without touching the water or they are very deep water fish. They never come in front of society they always attack from behind.

Due to rising commodity prices, the country is in a miserable state today. Due to the increase in oil prices, the prices of various items have increased. The issue is like where to give pain medicine in all parts. We look at the sectors where prices have increased and there is no sector that has not seen an increase in prices of commodities or other goods.

This is such a wonderful Topic, thank you CENT TRIBE for giving us the opportunity to participate in this discourse

a) As a consumer who falls within the middle class:

In Mali where I live, the rate of inflation is growing by the day and it is something to really worry about at this point. Last week, a kilo of sugar that we previously bought for $1/kilo sells for $1.8/kilo this week, the same applies for other food, services and general consumer items in the country. With such a situation, livelihood is at stake, as a family person, this has really affected my finance a bit. I had to cut down on several expenses and projects that demanded huge sums of money in order to keep up with daily living expenses which have tripled. I can understand how difficult it is for the common man who cannot afford two square meals a day.

b) As a business owner/producer:

A lot of people believe that inflation favours business owners and producers the most, well that might be true to an extent. It is worth noting that a company or business, regardless of its level of operation can only benefit from inflation in the short term. Based on my experience as a micro-bakery owner, here are facts; For the past nine months, the Mali baking industry has experienced continuous increase in the price of bread flour and other basic ingredients. Initially, we tried to coped with the increase without making any changes to the price we offer our customers.

After the outbreak of the Russo -Ukrainian War, the price of flour skyrocketed up to 20% again. Many bakers demanded for a 30% increase in bread price. I believe with the new price, few bakery owners were smiling to the bank then. A month later, international financial and economic sanctions hit Mali and we all know the after-effect of such action. This time the price of flour increased by 35%. Bakers of course had no choice but to adjust. Presently, the price of one loaf of bread is 30% higher. In the light of these changes, the demand for bread has drastically decreased, some bakeries have laid off staff while some are out of business.

I am not sure anyone would wait until they experience inflation before taking precautions. We live in a world of uncertainty, and as we wish for long life and sound health, it is imperative to set up a viable financial plan for the future, especially if we are getting some extra funds.

The preventive measure I take Against Inflation Or rising cost of living

Before I go further, I would like to emphasize an important point: No one can completely have control over the rising cost of living. Although the poor are most vulnerable, the rich also have a great price to pay.

First of all, I maintain spending discipline by trying to work with the budget set aside and not spending on things outside the list unless for a pressing need. With such discipline, I have been able to save a lot over time. Secondly, I invest part of my earnings in local company stocks, life assurance contracts, properties and cryptocurrency. Hive is one of my new long-term investments anyway, still learning the curves and testing the system.

Congratulations @centtoken! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 15000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Inflation in America is not insane yet but it's not helping people from stopping going insane. We're at best months from an outright civil riot on a scale the world has never seen before. You think I'm kidding? Keep watching. They're using every pretext right now to arrest as many people as possible before things pop off.

Put it another way: About 150 million Americans with guns, lots of 'em, and LOTS of collective power and money are pretty fed up. You think that will just go away with another series of faked/manipulated/staged events?

We're running on empty.

The present inflation rate in Nigeria is 18.6% which iS the highest we have seen so far since January 2017.

And this has greatly affected almost all the prices of commodities in the market so also, the prices of goods and services.

The scary part is we can't sight any solution in sight. With all this the Government is still hell-bent on increasing the tax rate of the communication sector.

What am I doing to stay ahead of inflation?

There is little I can do for now as I'm a low-income earner. But I have cut down a lot on my expense, I only buy what are the essentials this day.

I try to invest as possible as I can in the digital currency and keeping as much stakes as I can on hive as well for the long term.

The inflation in Nigeria is making things very hard for ordinary citizens. Everything is now expensive from foodstuff to transportation to diesel to gadgets. Yet the most painful part is that no salary increase. Without salary increase and spending twice more than before makes life a living hell.

Thanks @centtoken, I'm so glad to part of this comment challenge and to win it is very massive for me. I'll love to thank everyone that supported my comment with upvotes, I really appreciate.