Does The Dollar Rally Destroy Developing Markets?

The past two years have been dominated by talks of viruses, how they spread around the world and how they crippled economies. It's the same thing with economics, since we are in a globalized world, any economic issues that occur will eventually affect everyone as the contagion spreads.

I think it's safe to say it's getting harder to earn a relative income to sustain yourself in many parts of the world both developed and developing. The average Joe, who goes out to work for a living and earn a salary or through his small or her small business is getting screwed.

Jobs and businesses have been destroyed and in some countries like the US and around Europe people are refusing to work due to low wages. It doesn't make sense for them to work if what they earn cannot sustain them.

Dollar distribution channels

If American's aren't working they're less likely to spend, so governments have been trying to inject cash into the system through various programs. This could be through QE or through additional welfare, as the US markets are flooded with liquidity the theory is as follows.

Businesses that now have liquidity will hire, and spend on operations and imports. Consumers who have cash will spend, encouraging more job creation, importing, and travel.

American businesses and consumers are the primary methods of redistributing the dollar around the world. If there is a lack of dollars circulating around the world, it makes it harder for other countries to service their dollar-based debt.

So they are forced to devalue their currency to attract off-shore dollars or bulk up their reserves by buying dollars on the open market and driving down their currency in the process.

An example here at home

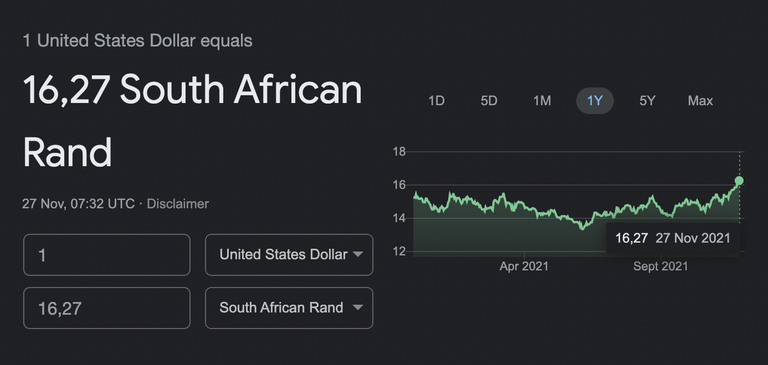

As the news of the new covid variant surfaces in South Africa, travel bans to and from the country have been swift. Markets have reacted too as the Rand weakens against the US Dollar. It's now trading at its lowest rate against the USD for the year.

1 USD would net you around R16.27 today, the Rand has always been a shitcoin, but it's evident it's basically a rug pull at this point. Citizens are the bag holders and they cannot see the scam at play.

A scam where they are going to be footing the bill for others' decisions.

Since there will be a lack of travel to the country, it means fewer dollars are coming in, through tourism and business. Sure the lower currency value makes it attractive to try and purchase goods and import them from South Africa, but with supply channels so stuffed up, it means the opportunity isn't as lucrative for businesses.

In addition, higher dollar prices don't only mean higher debt costs, it means higher import costs to South Africa. Energy and commodities are priced in dollars and for us to acquire offshore commodities like petrol means spending more per barrel because of the conversion to dollars.

The higher the cost to acquire, the more costly transport, food, and everything become in the country, since all business activity is dependant on energy.

Remote work has held as South African's with in-demand skills can work here and bring dollars into the country but this is only a small part of the population and not enough to offset the damage from other sectors.

The relative strength of the dollar

If we take a look at DXY we can see the US dollar's relative strength is at all-time highs. It took around 8 months to get back to these levels as emerging markets continue to struggle. If the dollar continues to appreciate in what many call a dollar milkshake theory it continues to put pressure on foreign markets.

The world is in desperate need of the US to continue to devalue their dollar to service demand for dollars and paper over the cracks. If the S allows the dollar to run, it could cause widespread global issues such as currency collapse, immigration problems, and even civil and regional wars.

Sure it's not the US's fault if another countries currency is obliterated, there are always several factors involved, but to try and maintain global order for as long as possible, dollar debasement seems like the only tool.

The demand for dollars continues

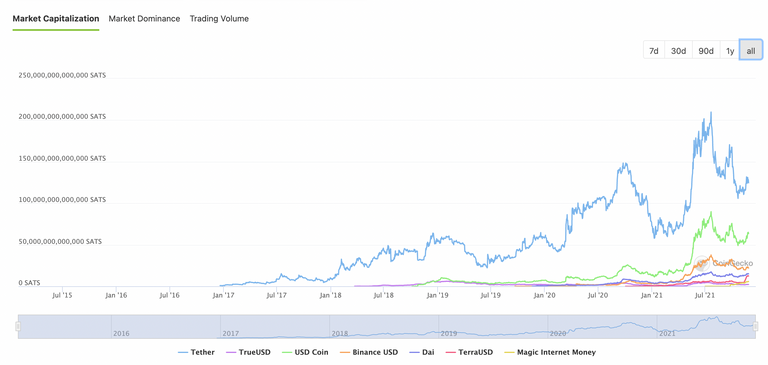

The current dollar distribution channels and Eurodollar market don't seem to be enough to reach the people and countries that need it most. We can see this by the growth in the stable coin market. Since stable coins are permissionless, we're seeing more demand for them from citizens and even institutions in non-dollar-based countries.

Stable coin market growth - Via @coingecko

A strengthened dollar means lower demand for risk assets.

When people can find shelter in the dollar as it appreciates against other currencies, it can also cause a compounding effect if not quelled as soon as possible. If the dollar is allowed to continue to appreciate in value, it offers a risk-free rate for cash holders. They can park their money in dollars.

That means they can sell risk assets, assets in emerging markets, assets in speculative markets all searching for yield to take on that risk fee appreciation.

In addition, as the dollar increases in value, it becomes harder to acquire, making debts in the US harder to service and in turn, we would see massive defaults.

If defaults are allowed to happen, it causes further deflation and the dollar will appreciate in value even more. The dollar is battling an insane amount of deflationary pressures and we can see that by the sheer amount of currency they need to print to maintain some sort of order in global markets.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

A great take on the USD breakout!

Thanks, glad you found it insightful

Our currency and run up of debt is staggering at some point people will have to realize nothing in life is free!

Dollar has been affected when reading people who live in the country, they have been on the precipice a couple of times, printing money is not the answer.

With new omicron virus things will become worse in the next week across all markets trying to leverage once again.

!BEER

Money printing is not the answer, but allowing the whole thing to deflate will be far more painful. The US Fed is simply doing what creates the least amount of pain. there is no real solution, they are trying to keep it going until I would say Bitcoin is ready to take over something I don't think is going to be a reality for some time

So we need these systems in the mean time, despite its horrible flaws

At this point in time the wheels are falling off of many old structured systems, concur it will take much longer than many are hoping for.

World is sitting in a strange position with finance, good balance between the two may avoid some of the disaster.

Familiar may have to stay for a lot longer with few ready at this point in time, most countries are adding zeros to the numbers rising in debt, how we get out of this hole eventually is anyone's guess.

View or trade

BEER.Hey @chekohler, here is a little bit of

BEERfrom @joanstewart for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.decentralization and true open markets is the way, in an ideal world, countries would have their own currencies possibly, but the world is f'ed up with dirty tricks and dollar dominance,, , decentralization thru crypto and blockchains presents healthy models, and people can have mobile wallets with dozens of coins and tokens and stop thinking in terms of currency on most days

peace

I still see many of those "dirty" tricks in other "decentralised" finance products too, but I do agree, i think that the transition to this new way of operating and accounting for value is long overdue

Contrary to what people think, there is a shortages of dollars, especially in the Eurodollar market. This has been the case since 2007-2008. The recent stimulus where Congress decided to helicopter money caused them to sell a ton of bonds. This pulled in even more USD from around the world.

Now it is locked in the US banking and financial system, where it helps very few.

Posted Using LeoFinance Beta

Exactly when imports are secured they dollars are used to purchase bonds so countries that export to the US can have dollar reserves

A lot of the worlds dollars are secured in credit and liquid dollars is what people and businesses need!

Since 2014 many countries have been converting their bonds. The media (at least in the West) like to jump on the bandwagon that they are dumping. That isnt the case. The reality is they need USD and that is how they get it.

China is in that position because their economy is basically dollarized anyway since the Yuan floats only when they want it to.

Sadly, it doesnt seem like it is a situation that is going to get any better. What we do know is this will keep causing a slowdown in global growth.

Posted Using LeoFinance Beta

I agree that the dollar going up is bad for the global markets. However I think QE locks up dollars in the Fed so it doesn't inject money into the system. The only one capable of printing money are the commercial banks and they aren't loaning money. After all its way to risky for them to loan and have their collateral at the Fed seized when people can't pay.

Besides that point, I agree with the rest.

Posted Using LeoFinance Beta

I agree that QE locks up dollars but it frees prime brokers from liabilities, sure they still have to lend and drive credit creation which seems to be squarely focused on corporate and real estate debt now which is why they probably have to give more money to welfare programs or debt relief programs so they can free up capital.

No it doesn't free them up. At least they need to have enough treasuries depending on how much they want to loan. The problem is that the banks don't want to lend and if they want to lend, its to the wealthy or big companies. This means there isn't enough money moving around on the bottom layer (normal citizens). This is why the people need to ask for the government for help since they are hollowing out the middle and lower class.

Posted Using LeoFinance Beta

"I am a Jessie." Nap time for me.

Posted Using LeoFinance Beta

Lol hope I wasn’t the one that put you to sleep with my ranting

I thought I was here for the football commentary first before economics.

LOL its mostly football with a little bit of ranting in between, I have a lot of feelings

This is a very thought provoking write up. I enjoyed reading it and reading all of the responses. I did not see a proposal in your write up regarding the actions that any of the users reading it could take.

I am hoping a wider acceptance of crypto currencies and Hive to be specific will help people around the world earn additional income to help offset the impact this covid has caused to all of the economies. I believe the more widespread crypto becomes the more it will help all the citzens of the world. I am hoping this will create a new world economy however we will still need people to produce food and other needed products which are currently based on the countries currencies in which it is produced. Until everyone can use crypto as a form of payment for those items the world will not progress very far.