Russias Current Account Surplus Is The Envy Of The World

I've always been a bit of a stats nerd and being the data geek I am, I have been looking at the data we get out of the Russian economy. I wanted to know what the world's most extensive financial sanction package would do to a country.

We've seen what sanctions have done to countries like Venezuela, Cuba, and Iran, as the west loves to weaponise the dollar and the swift system when they don't get their way by forcing regime change in countries.

The EU and US were hell-bent on creaming the Russian economy but by what significant metric have they done so? American and US companies have pulled out sure, they stole foreign reserves sure.

They're cutting off trade in certain industries sure, but what effect has that really had?

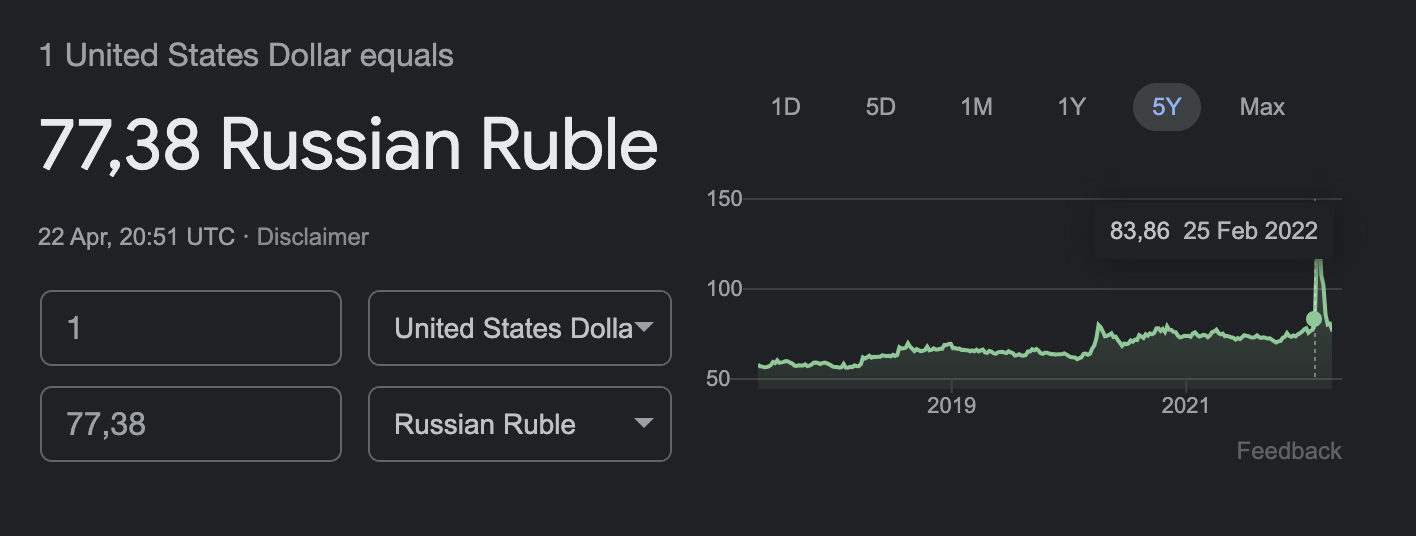

Ruble to rubble? I think not?

The ruble fell to an all-time low of 124 Rubles to the US dollar last month and the West thought they had them beat, yet today the ruble sits at 77 recovering to pre-war levels, and looks like it will continue to strengthen and consolidate.

The Russian central bank raised interest rates to %20, using reserves to back that interest payment and stabilize retail investors' panic, and reduce the chances of a bank run. That alone is a miracle in itself and shows how strong this economy is, don't believe me?

Try taking the US or any EU country's interest rates to 20% it would collapse under its debt obligations in a matter of days.

In addition, the government is pushing rubles for exports stance, which means their exports would fully back their currency.

I could see the ruble trading in the low 70s to even the high 60s which would be an issue for the Russian economy. The stronger the ruble becomes, the more expensive their exports, the more expensive their exports the fewer buyers they will have, so there is an incentive to reduce the value of the ruble.

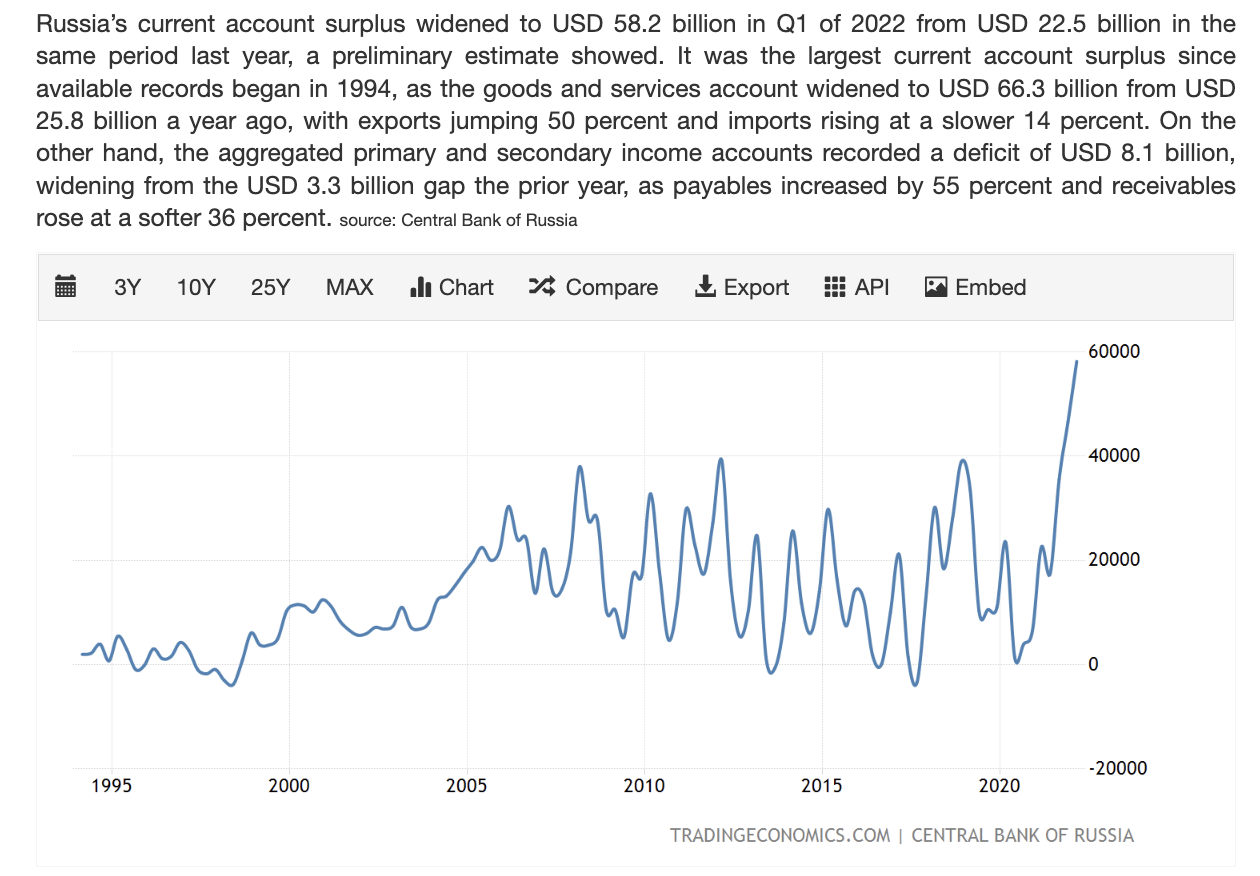

Current account going parabolic

The actions of a 20% interest rate and converting foreign currency to buy rubles to purchase goods and services from Russia have seen their current account explode, in fact, it has tripled in the last year.

Russia would have previously used their income to hold foreign reserves in USD and EUROs for imports or purchased bonds with that capital. Since they have no need for dollars and Euros, the capital is piling up and they need to figure out what to do with it.

Sure they can continue to purchase bitcoin and gold to stack up reserves and backstop their currency but that's not going to solve the issue of increasing the value of the ruble.

What the Russian central bank needs to figure out is how they are going to flood the market with new credit creation to put downward pressure on their currency.

What I predict would obviously be spending on infrastructure and military, because that's all governments know when they need to spend. However, there will also probably be funds made available for supplemental industry.

A silly example would be Russia imports a lot of buttons from Europe for garments, now that it's no longer feasible, there is a local market meaning governments are likely to fund businesses who would manufacture this locally and subsidize them to meet demand as fast as possible.

Data source: - tradingeconomics.com

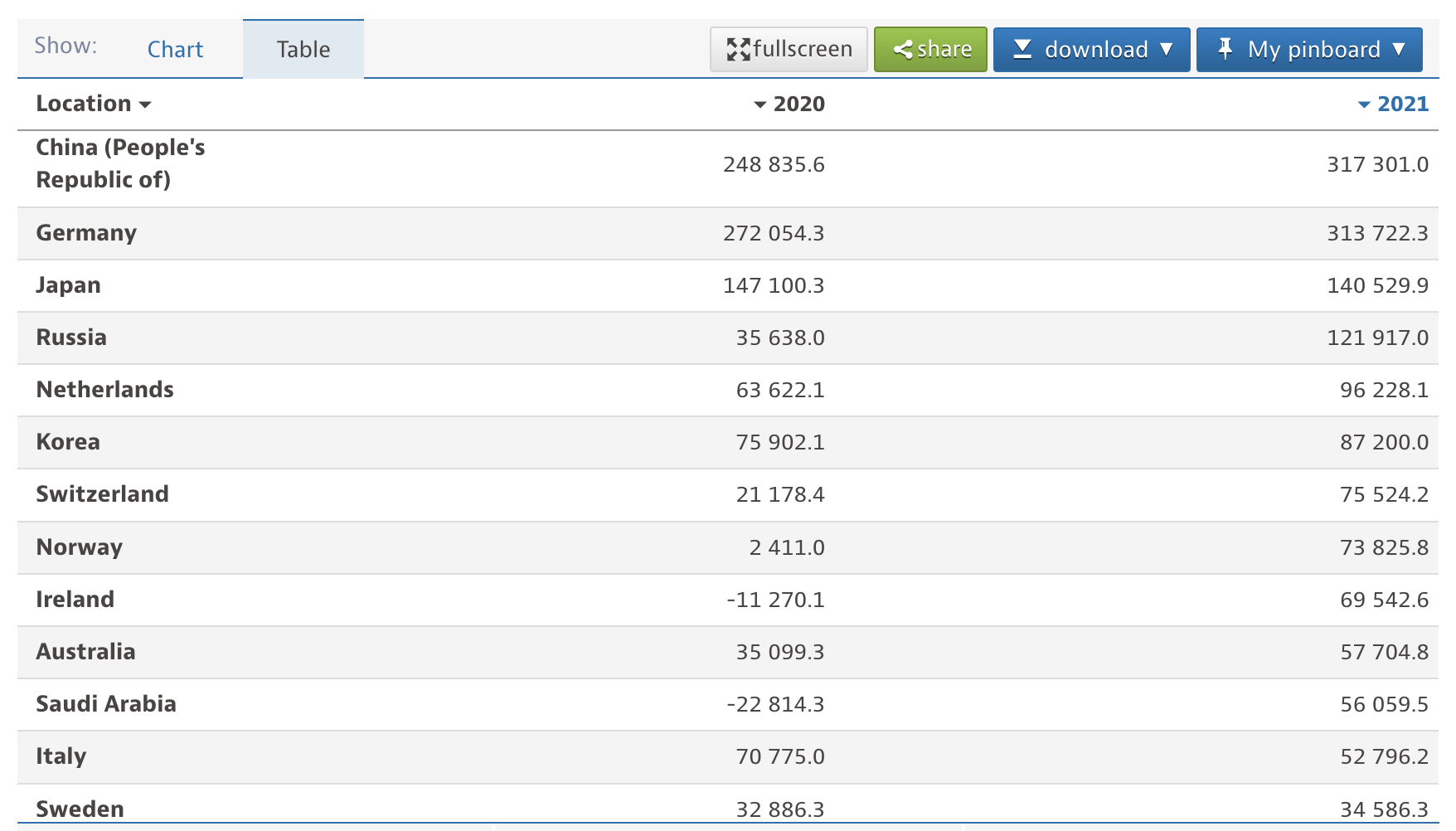

How does the Russian bank account stack up

If we look at last year's data comparing various countries, you can see very few countries were running a bigger surplus than Russia. Only China, Germany, and Japan, and with all that's happened, I would imagine Russia would leapfrog Japan and Germany in the coming months.

Daa source: - data.oecd.org

Having this much capital to deploy and a growing budget surplus attracts more investment to ride the waves of liquidity pumped in by the government.

I would expect foreign investment to pick up once again and we could see even more capital flowing into the country to grow their industries as well as relationships with commodity producers.

The previous battle between the US and Russia was communism versus capitalism, and capitalism won. This time around, it's a battle between debt, versus equity. The Russians are well capitalised while the US is highly indebted.

Who will win this battle of economies?

My money is literally on Russia, so forgive my biases.

Yes, I am breaking one of Warren Buffets' rules, never bet against America, lol well I am Warren, what are you going to do about it.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

"never bet against America"... Well last years USA is like to be against themselves.I read that Russia plans to link the ruble to gold ... something it had adopted since 1897 but, like many countries, abandoned this relationship during World War I as governments printed money to finance the war. ... Personal theor. It is very likely to happen again because at the present stage, Russia produces every year about 10% of the gold mined worldwide and is a major producer of both energy, metals and grains. Same time Usa printing has never stopped! Guess who is against who!

LOL I like that one, yes they have been betting against themselves, but that's what happens when you have the reserve currency status, we saw the same thing with the UK, and Holland before them.

I have read that they want to back it with gold, maybe they do in certain times, but I don't think it would be fully backed, maybe partially to hedge it, but if they backed it with gold fully it would make them uncompetitive in the fiat world for their commodities as the ruble would continue to strengthen making their exports more expensive.

It's all about trying to balance with other countries devaluing rather than strengthening or weakening your currency. You stiill want to maitain that income, which you can ofcourse use to develop skills, industry diversify from commodities and sure stack more gold

https://twitter.com/LeoAlpha2021/status/1520289386935422976

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I think they blew it, petrodollar as we knew it is over. The so-called leaders of the U.S. screwed us out of our wealth!

(I lost all my gold in a boating mishap)

Posted Using LeoFinance Beta

It sure does look like the petrodollar is on its last legs, will be keen to see how energy-producing countries set up their baskets for accepting payment in the future, will it be yuan, rubles, their local currency, bitcoin?

Nice!!!

Posted Using LeoFinance Beta

Lol hook a brother up with a job in Russia

The sanctions have done more harm to the west than that of Russia.

Did Russia just shut off the gas to Hungary and Bulgaria for not paying in Rubles? Saw that headline in passing earlier this morning.

Posted Using LeoFinance Beta

I think so too, it's an absolute clown show, so I see countries like Bulgaria are buying gas grom Greece while Poland buys it from Germany. It's so dumb, because they just buying Russian gas at a mark up from these other countries, the level of stupid is insane, it's really like a high school popularity contest

Dear @chekohler, Do you think Russia will get richer because of increased exports of oil and natural gas?

I think the US beat the Soviet Union in the Cold War because it is the country that issues the dollar, the most used currency in the world!

I don't even think they need to increase their exports, they can just sell the same exports at a higher price due to the inefficiencies created by the West.

I think it was more than that, I also think that the communist policies eventually created so many poor signals in their economy that it had to collapse the USSR, but I think the Russian federation have not forgotten those lessons, whereas the US, have long forgotten the power of capitalism

Dear @chekohler, everybody know Russia is a strong country and everybody know without gas and oil from them it will be a disaster next autumn, but our goverments looks like they play with the fire.

If you do not mind, i would like ask you what do you think about my latest post: https://leofinance.io/@intellihandling/we-can-do-it