Comparing SLV to PSLV For My Next Silver Play. Which Is Better

Looks Like Silver Might Hold On and Continue This Upward Trend.

I thought Silver was done and was going to get manipulated back down tot he $20 range or below before picking up support again. Not saying it won't happen still, but I am pleasantly surprised it has turned around and appears to be getting ready for some more action.

Ways to Invest In Silver

LONG TERM

Physical - Let's get physical!. I think its the best way to hold it long term. Holding it is like holding your keys. If you don't hold them, you don't own them. Then again, buying and selling Physical is an expensive for premiums on both the buy and the sell. Great for decades worth of wealth assurance, not great to get into or out of quickly

Silver Stocks

Read several posts lately about getting into mining stocks. This is something I may look into down the road as it seems like a good play to make money, but it also add additional risk. Silver might do great, but if buying individual companies always adds risk. Not sure if there are funds that track Silver Miners - a post for another day.

Silver Trusts (SLV PSLV)

These trusts invest in and should closely mirror the price of silver. They are a great way to make a play on metals, no matter if you think Silver is underpriced, or want to mitigate market risk with precious metals.

Lets take a closer look

After a recommendation from @tbnfl4sun - I decided to dig into PSLV a little bit. Looks like PSLV is run by a billionaire precious metals fan who also supports silver mining. One of the biggest selling points I found across multiple articles is that PSLV only buys physical silver. They store it all at the Royal Canadian Mint. Sounds like a great way to do business in the physical silver world. I am sure that it has some costs associated with storing silver, but any Silver Bug knows storage is key!

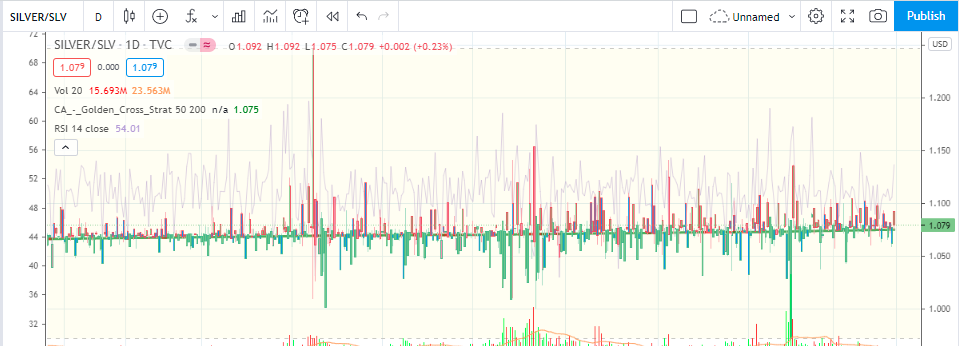

I wanted to see how PSLV tracked against the silver price so I use trading view and divided SILVER / PSLV and got this chart.

Not quite sure that looks right. It appears to me that there is a lot of movement in the price of PSLV that is not corelated to the movement in Silver. This has me a little concerned because any investment I make is based off the price of silver and the direction I think I will go. This adds a bit of confusion to my plans.

SLV is run by JPMorgan - if like silver, typically anything JPM is not well liked. They have been caught playing around and ignoring some rules with silver - and paid fines for it. It appears the cost of the fines are just a cost of doing business at some point and the profit still outweighs the risk.

But I want to be fair and take a look. Most the articles mention that while SLV has a lower cost ratio - it's prospectus does not say they just buy and hold physical silver. The thought is it might be using derivatives to manage the price and match the movements. This may do a better job of matching price movements but you are not investing in real, physical silver bars.

Lets look at the SILVER/SLV chart and see if it looks the same as PSVL/SLV

Maybe I am reading them wrong but I think the SILVER/SLV chart show how closely it matches. This would represent a really close result to the prices changes I see in Silver.

Just to double check, lets check SLV/PSLV. As you can see below, they do not always move together. Something is driving variance in between the trusts that should be very closely aligned.

Final Thoughts.

SLV

- While run by a company I may not like, it is almost a mirror or SLV price movements

- May/May Not buy Silver Bars - May use a portion of Options to cover price movements

- Best Trust to Track the price of silver

PSLV

- How a stacker would build a trust. Buys and Holds real metal.

- The Trust to buy if you want to feel as close to buying real silver as you can without doing it personally

- May contribute to the stupid shortage of physical and higher premiums.

Direction

Honestly, I don't know. It may depend on the day, if my ethics win out and I choose PSLV because they are a Stackers Trust, or if I buy SLV because I don't hate money, want lower expenses and an closer track to silver price. If I want anther silver play, both should an ok choice to track Silver. Since this trade is not long term, nor am I trying to feel like I own silver, I think both will be on the table.

Probably not a great analysis - one without a decision. I have no plans to buy in the next week in my accounts. After reading as many articles as I could find, I think its clear. PSLV is the best SILVER fund out there, and SLV is the cheapest option to track the price of silver.

What will you buy and why?

sincerely,

@cluelessinvestor - aka a random nobody on the internet spewing nonsense

This post NOT financial advise, it contains my personal opinion and experience and is intended for educational purposes. Perform your own research and analysis prior to making investment decisions.

Posted Using LeoFinance Beta