Biggest IPO doesn't mean it will be a Hit

Last week Life Insurance Corporation of India commonly known as LIC came up with their IPO and this week 17th May it has made a debut in the stock market which is India's largest IPO so far. I also have applied for the IPO, though I have luckily not got it. The LIC shares were listed on discount all because of the market volatility. And what we have seen from past biggest IPO's that, the biggest IPO does not mean it will be a hit.

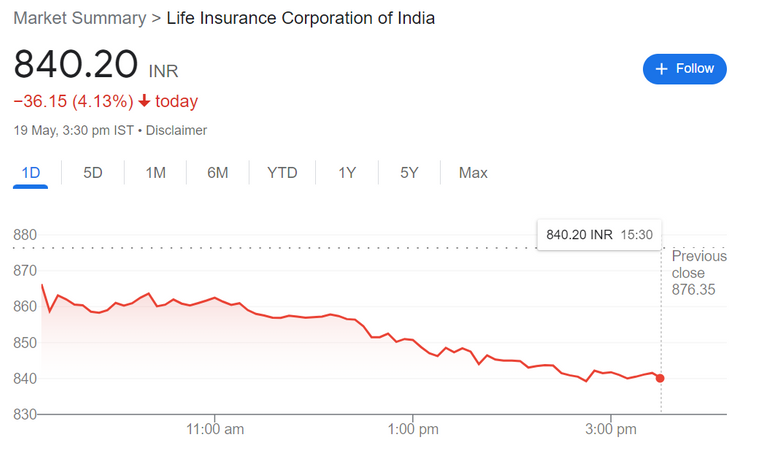

We have seen the two biggest IPOs this year, LIC and Paytm and both of them flopped at the time of listing. The Paytm Share has gone down more than 65% and LIC till now more than 10% from its Issue Price.

PC: Google.com

PC: Google.com

There are other IPOs too which have flopped even though it's being the biggest IPO in the share market. And the trend continued this year too. Surprisingly some good companies with small scale IPOs are doing much better than these big IPOs. So I guess we should not run after big IPOs thinking they will give us good returns because the history tells us that they do not do good on the stock market.

I am hopeful that the price of the LIC might go up in the future as it is a PSU (Public sector undertaking) and we have seen some of the PSU doing really great like IRCTC, PFC and others. People usually do not want to invest in PSUs because they think that it does not go up very well in the future, but the good thing about the PSUs is that they give really nice dividends. People usually buy these PSUs for getting a fixed dividend every year. We are not sure about the dividends of LIC yet, but I guess it will give some dividend yield.

For me, I am planning to add LIC shares to my portfolio but I am thinking the price is a little overvalued and hopefully buy it in the 700 range. I might be wrong, the price will not go so down, but still, I will wait till that range to buy some shares. The problem with LIC is that it mainly has endowment plans and young people are usually not buying many endowment policies, they want to invest their money somewhere else to get good profits as well as invest in good term plans rather than going with ULIPs or endowment plans. I have some of the LIC policy and because of that I have applied for the PolicyHolder quota but didn't get the allotment.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

https://twitter.com/codingdefined/status/1527314702862548993

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

!HBIT

Success! You mined .9 HBIT & the user you replied to received .1 HBIT on your behalf. mine | wallet | market | tools | discord | community | <>< daily