GambleFi Portfolio | Buying a Small WINR Protocol Position

It's been a while but I did add another project to the list with WINR Protocol which right now hosts JustBet and Degensbet. This with a small investment just to learn and track some basic numbers the coming months which I will share here. Just like in the Web2 world where there are a lot of different gambling sites and not just 1 or 2 winners, so it likely will be the case in the web3 space so I'm spreading my risk around.

WINR Protocol

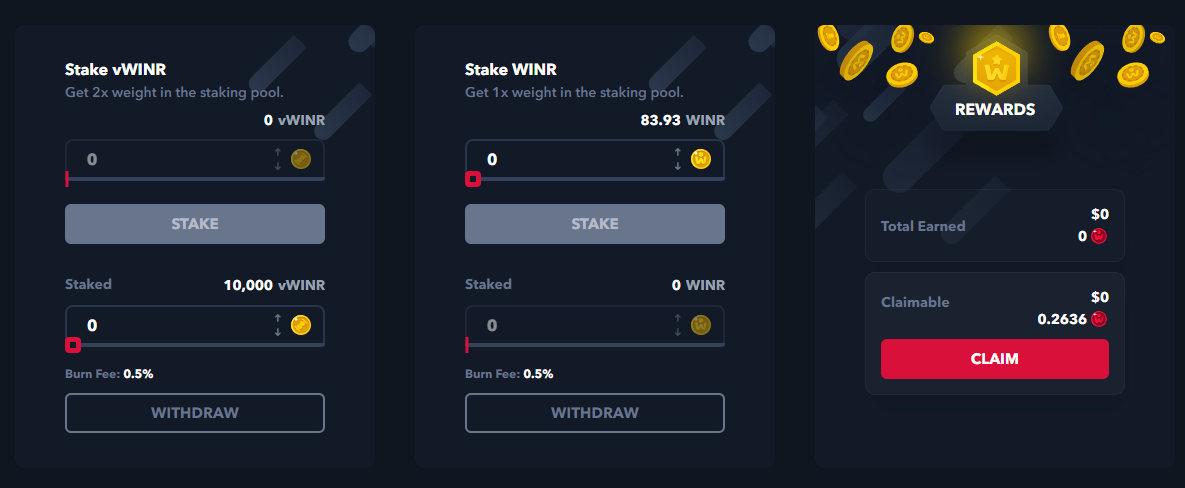

This one has been on my radar for a while but since it's a project that I'm not really interested in using along with the bad circulating token supply ratio which makes the fully circulating market cap high compared to revenue I stayed away. The prince however came down by around -50% after it had a pump so I ended up getting 10000 WINR which I paid 770$ for.

The Basic Idea Behind WINR: I always kind of liked it since it got on my radar way back. Basically what winr does is provide a payout pool for gambling dapps that build on their platform. Since there is a mathematical edge, it is expected over time that this pool grows as winnings from the house go into it. Anyone can provide liquidity to the pool for which they get WLP and there is also the WINR token which gets part of the revenue share.

I still have a long way to go to fully understand everything though and I'm not even sure that I did everything properly to get my 10k WINR staked. It works on the Arbirum chain and will also integrate on Solana. I did get some revenue after a couple days but since the numbers are so small still it's not worth claiming as the gas costs are higher than the earnings.

More on this project in the coming weeks

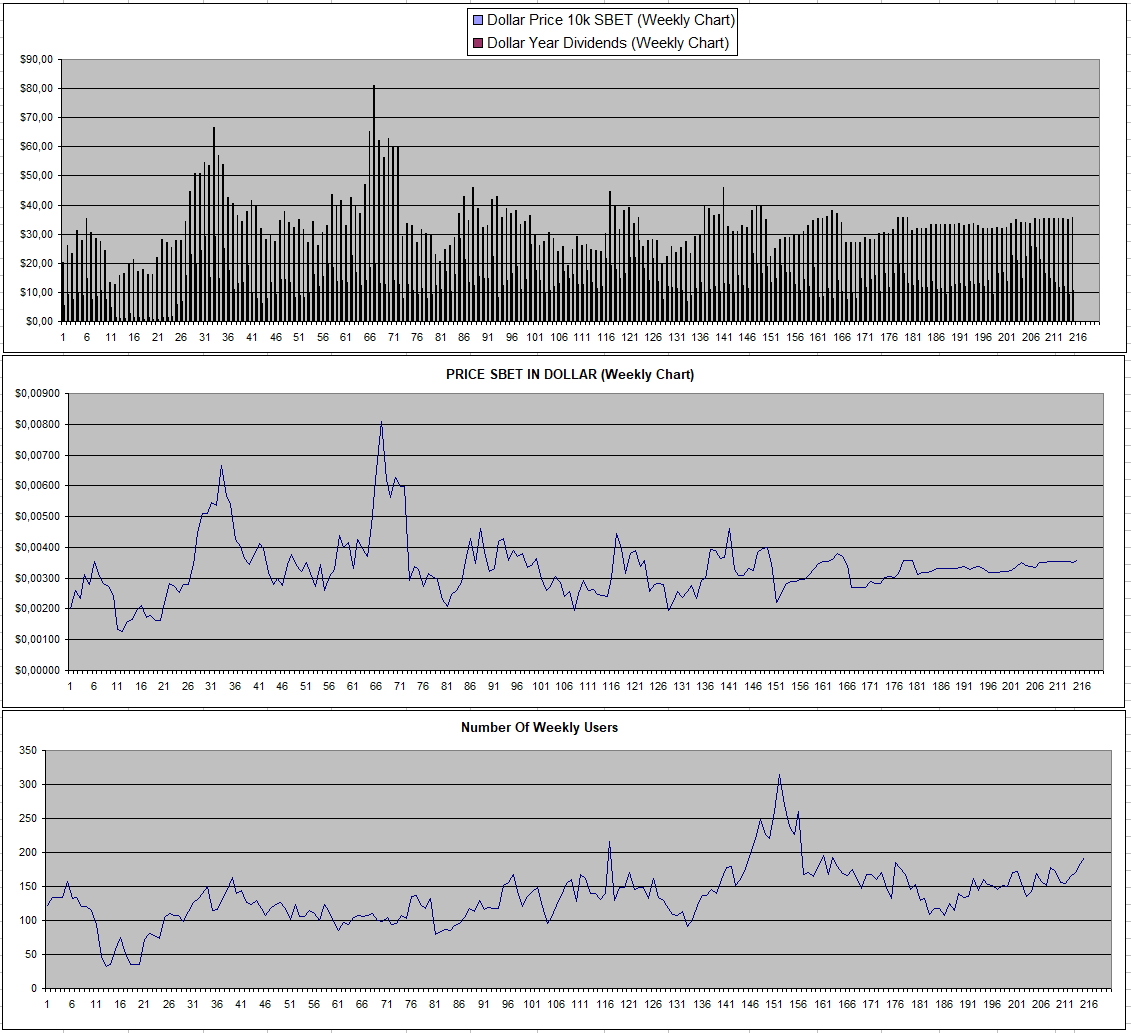

Sportbet.one (SBET)

Not much to say about SBET as there was a yearly SuperBowl Promo where 50% of losing bets would be returned as a free bet which got the users up a bit, aside from this, the price is completely flat and dividends continue to range 25%-50% APY with reliable payouts.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

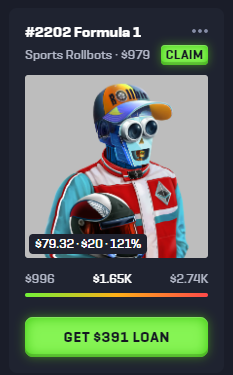

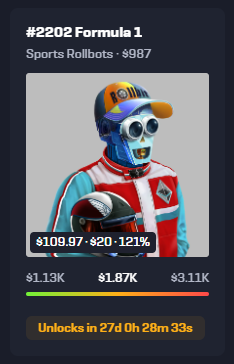

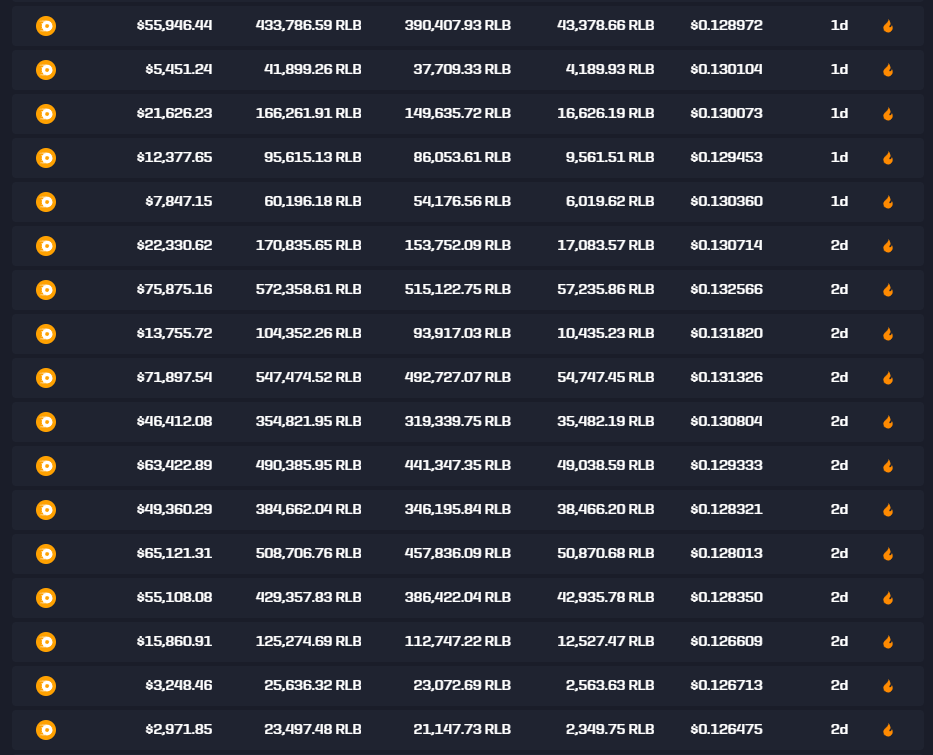

If anything, the sport betting activity on Rollbit increased a lot with what seems to be a new whale who came over from Stake. This really got the earnings that can be claimed from the Sportbot skyrocketing.

| Previous Lock | Current Lock | Now |

|---|---|---|

|  |  |

If I had waited 3 days, the 80$ would have been 110$ which is quite crazy as I paid just 440$ way back for my sportsbot. Nothing holds it back from going all the way down again though.

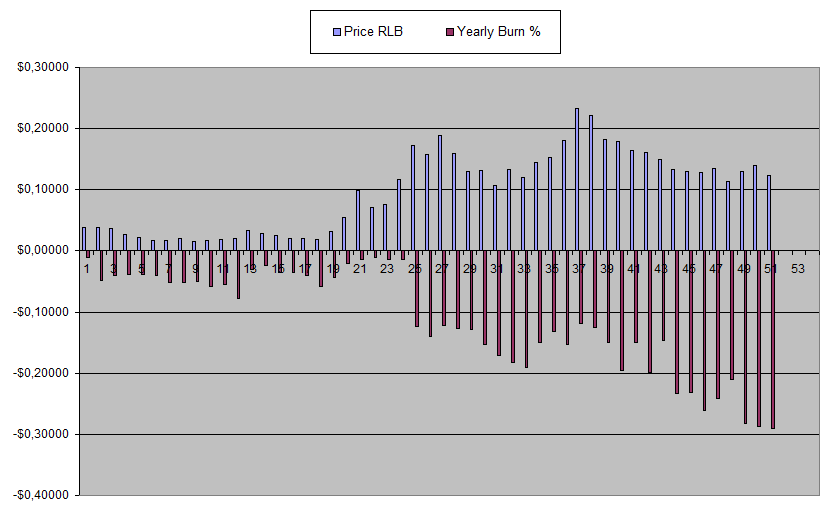

It also kind of baffles me how RLB is not doing better as the burn right now is off the charts

I continue to buy more RLB but to the extent that I'm ok if it all turns out as a project that somehow faked volume in order to get traction getting caught up with it at some point. This gambling sector remains the wild west within the wild west which is crypto afterall.

The yearly burn is reaching sustained levels I never thought it would reach close to 30% of the supply that will be gone in 365 days at this rate and this price.

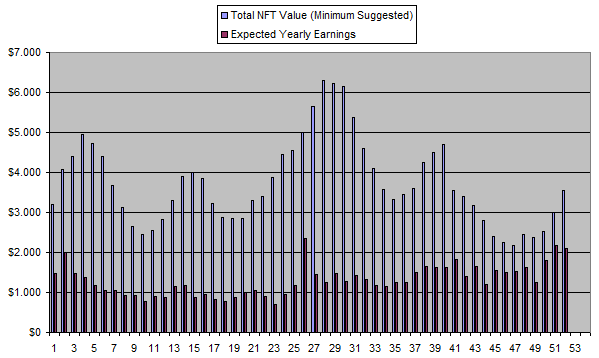

NFT values continue to go up along with the dividends and it will only be next week were the increased rollbot earnings will a counted fully.

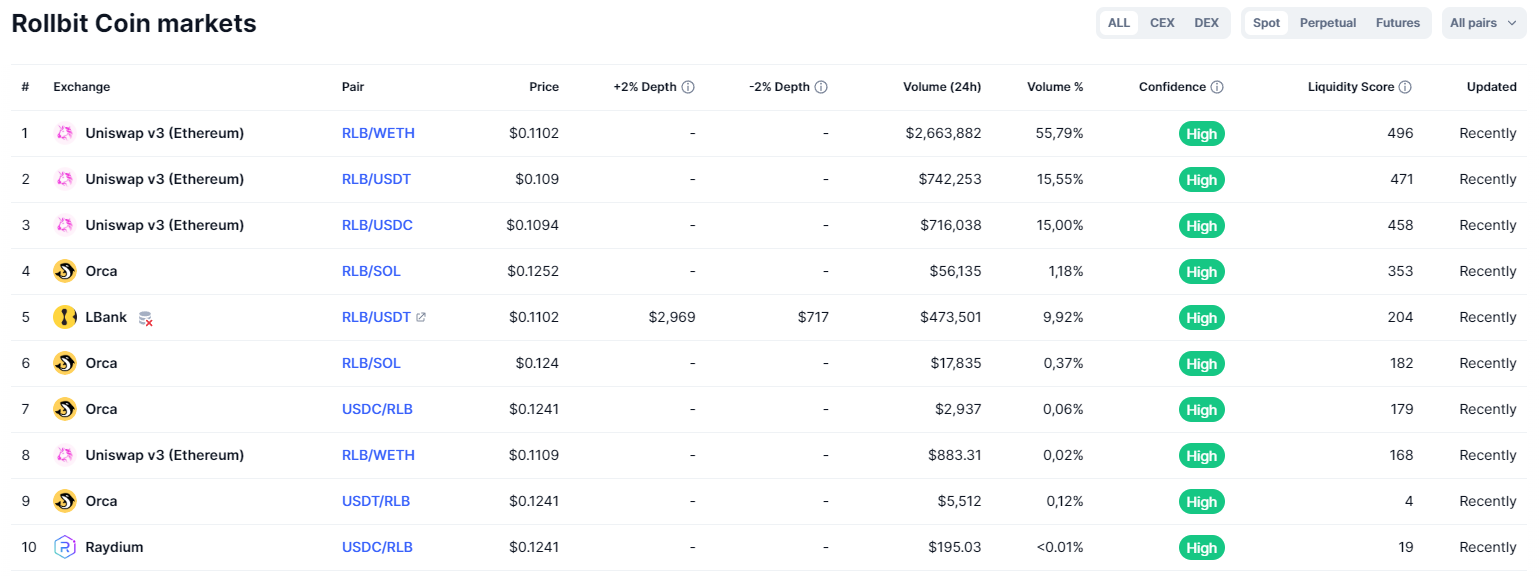

Based on all the fundamental numbers, RLB should sooner than later skyrocket back to all-time highs. Only time will tell what will happen and I'm along for the ride whichever direction it will be. I like to buy more RLB on Solana given the lower fees but price there is just way higher compared to ETH or what it is trading on the website.

None of it makes much sense to me.

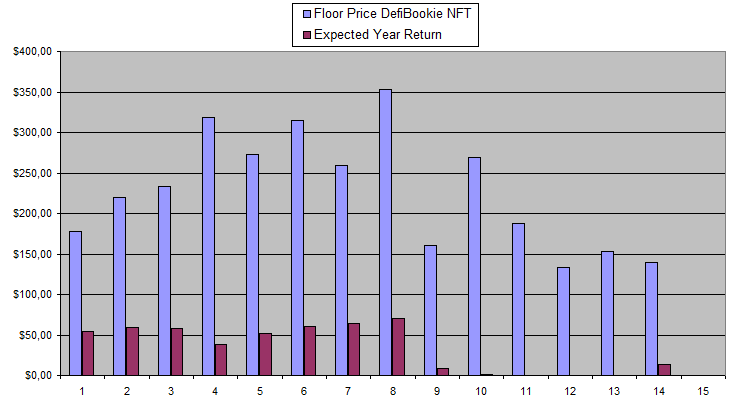

Defibookie (NFTs)

It was nice to see that DEFIBookie actually had some dividends back, and even though they were not much, it still came down to 12.09% APY based on the price I paid. I'm hoping that the Superbowl for which there were a lot of prop bets available made them some good earnings for the coming month. I still like to see the revenue share be spread more over a longer time to make it more stable.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.00$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.00$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

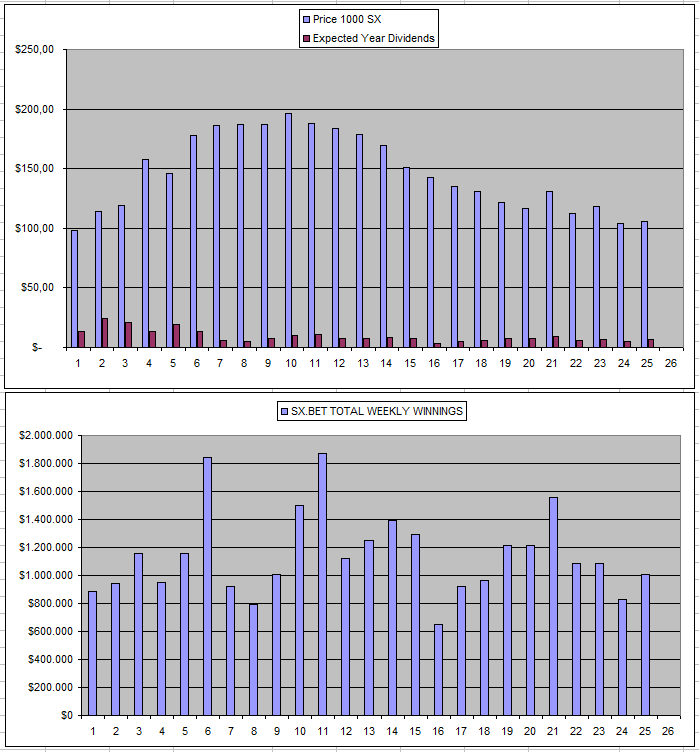

Sx.Bet (SX)

I kind of hoped that the Super Bowl would give a nice increase on the overall volume on the platform but this didn't turn out to be the case really as there were only 1 Million in winnings. It will be an uphill battle for SX but they continue to develop and fundamentally should have one of the stronger platforms so I still see the future potential.

Owl.Games (OWL)

The main thing I like about Owl were the reliable Returns but it looks like they somehow decreased the reward pool as I got less dividends a 2nd week in a row. Someone also sold which got the price down quite a bit and OWL also got unstaked. So pretty much more questions and doubts on a project that already was low on my confidence list. The good thing however is that I already managed to get 21%+ of my original investment back even though I'm slightly down again in case I would fully opt out now. I'm still hoping at some point everything will fall in place which makes me keep my investment but the risk is just too high to buy more.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -67$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +225$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +248$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +48$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42 |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +47$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +749$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.8% | -17$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

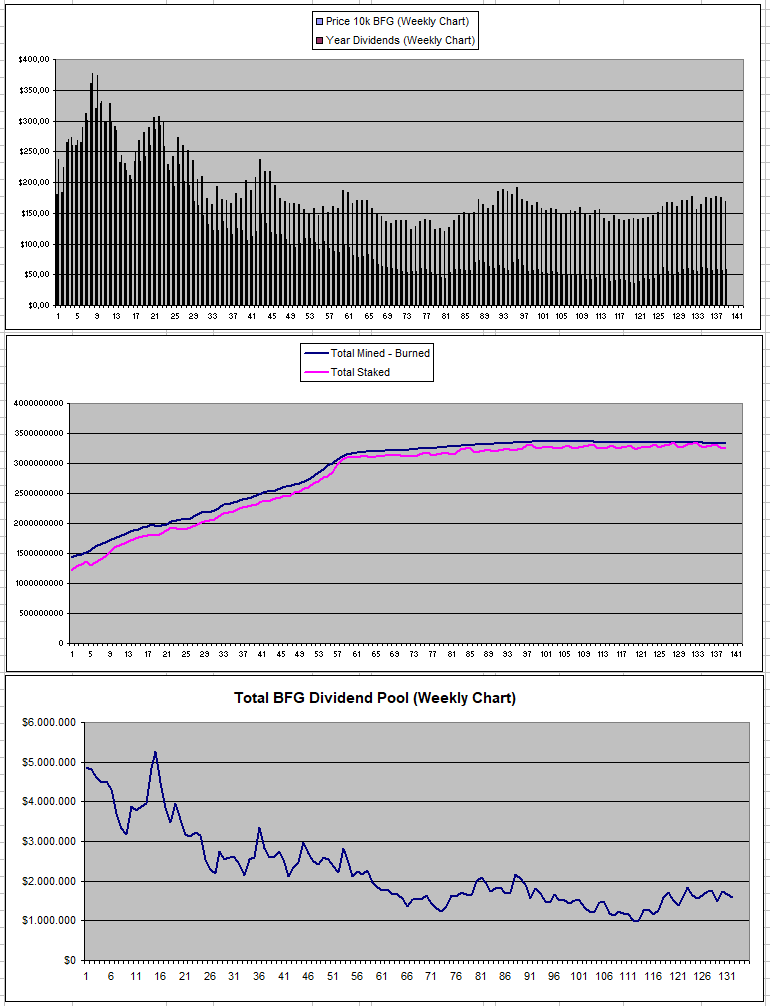

Betfury.io (BFG)

Ther was not much change for BFG with another tiny monthly burn of 0.1% of the supply and a price which stayed the same along with the dividends which are ranging around 50$-60$ weekly many months now for holding 500k BFG.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +29.74% APY |

| Betfury.io (BFG) | +33.13% APY |

| Rollbit.com (NFTs) | +59% APY* |

| Owl.Games (OWL) | +38.55% APY |

| Sx.Bet (SX) | +6.71% APY |

| Defibookie.io (NFTs) | +9.47% APY |

| WINR Protocol (WINR) | Next Week |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

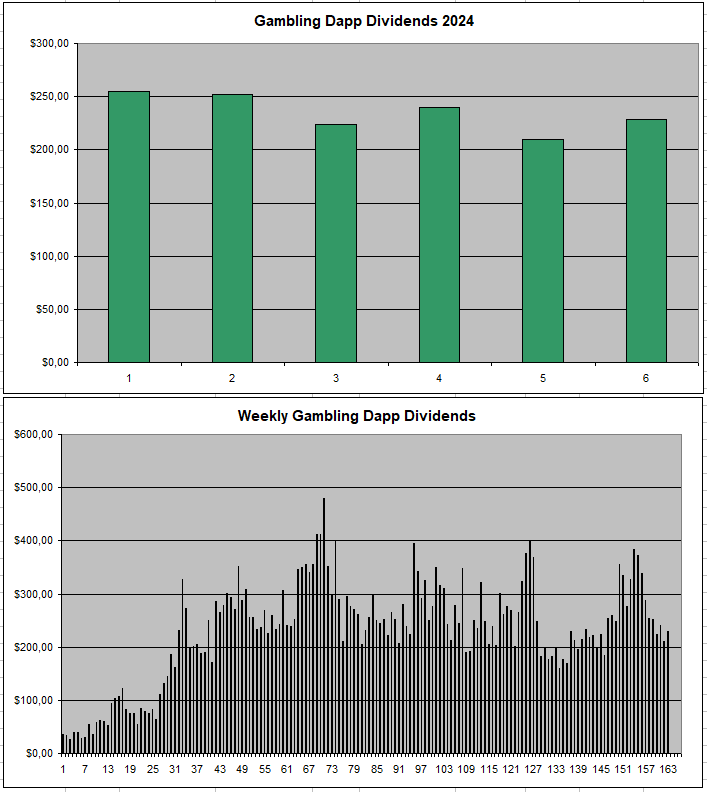

Personal Gambling Dapp Portfolio

I'm still hoping to get back above 300$ in weekly Dividends for holding 5M SBET | 500k BFG | 3 Rollbot NFTs | 600k OWL | 25k SX | 13 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|