GambleFi Portfolio | SBET +113% Real Yield APY !

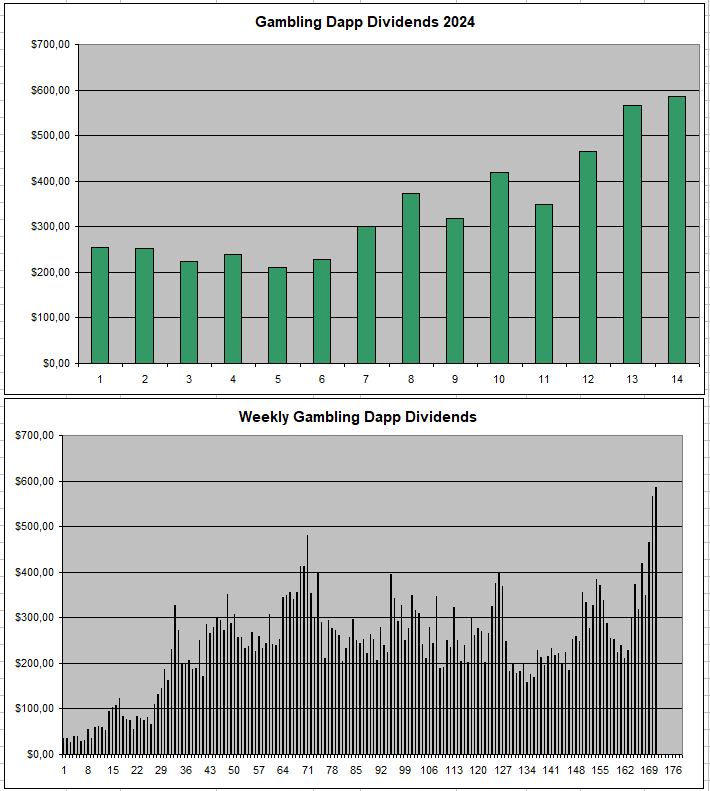

This was a great week breaking my previous record and also since a while doing a small extra investment to continue to grow it. It also looks like a delayed bull run has started for Dividends in the GambleFi Space. Basically, the Bitcoin price increase is getting in more people in the space who slowly started to find their way into web 3 gambling which now is starting to translate into higher revenue and dividends. All this while many of the prices of the coins and NFTs haven't actually increased that much. This gave me a 76% APY on my overall estimated Gamblefi Profolio value.

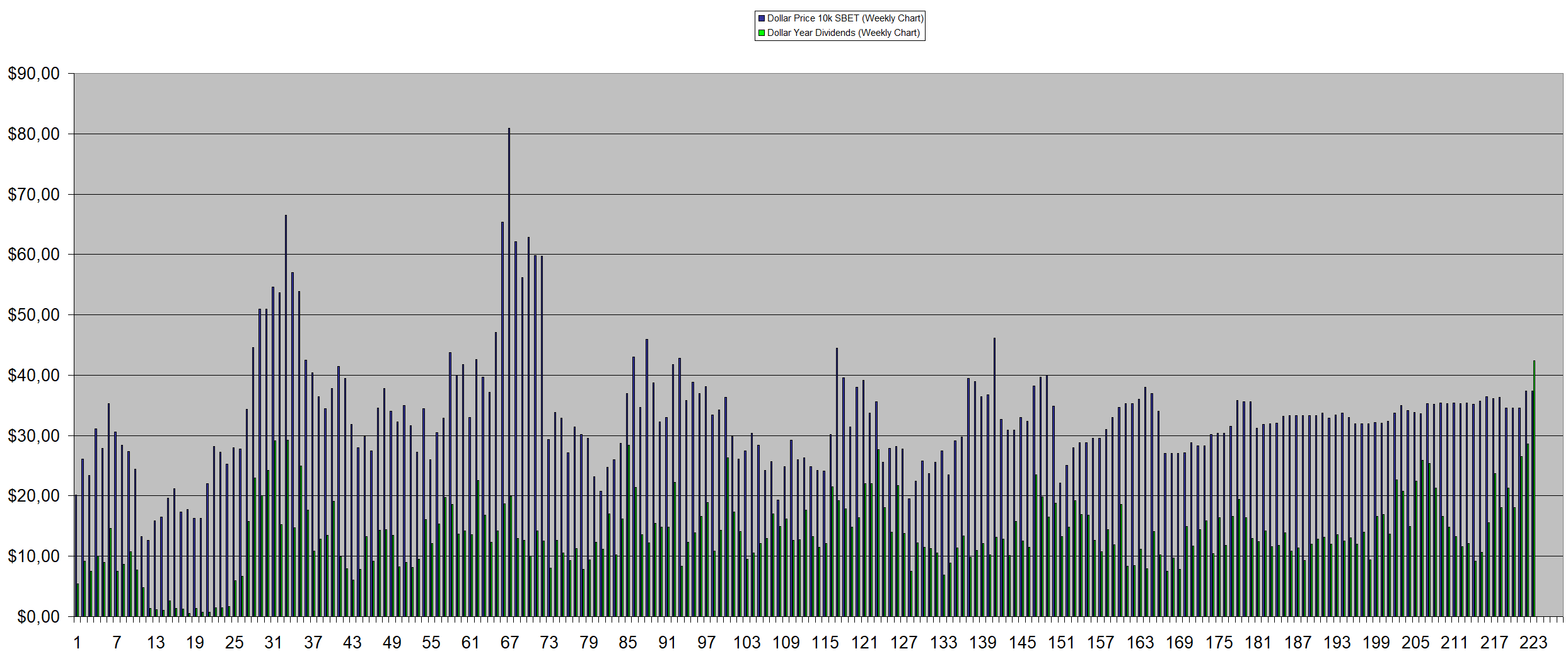

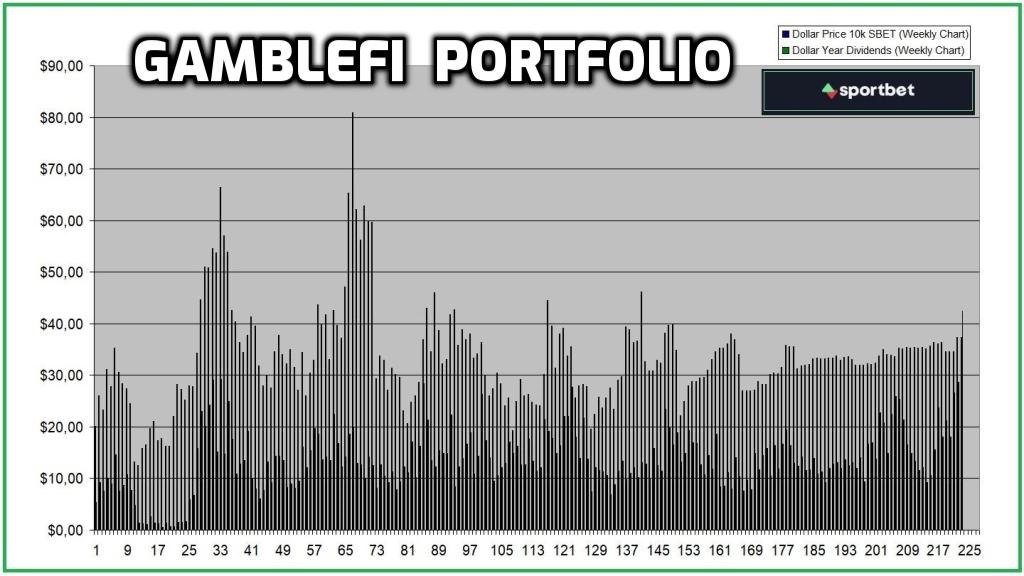

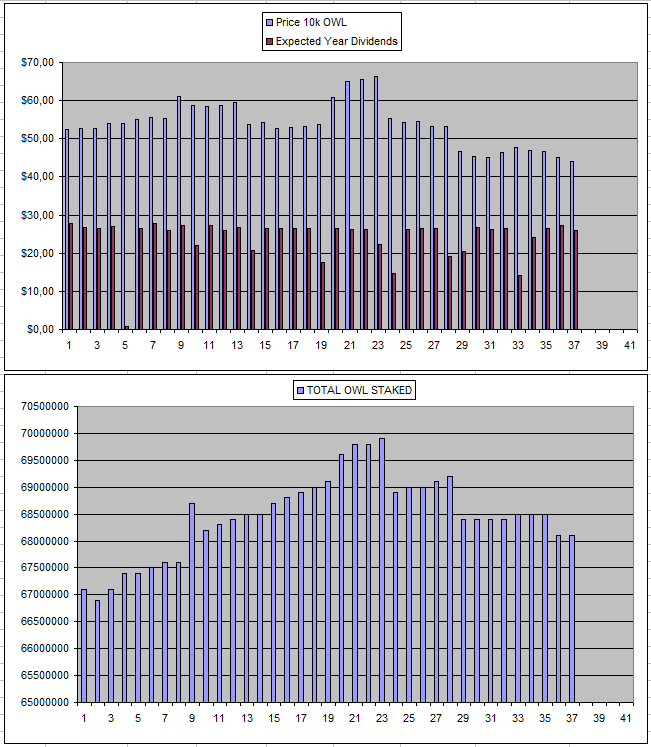

Sportbet.one (SBET)

SBET Dividends have been stealing the show these past weeks with a very nice increase while the price hasn't moved yet which now last week has put it at a +113% APY expectation (that is if the overall volume doesn't fall back). The previous peak of users was during the world cup and the Eurpean Championship will take place in just a couple of months so my hope is quite high.

The difficulty of the SBET token is that it is only trading on 1 exchange (coinstore.com) and in order to stake and get dividends you need to have an EOS account which is a chain that isn't used that much. The reason that it isn't fully holding back Sportbet.one is that they are allowing the option to bet in a centralized way without the need to deal with the blockhain aspect. The great thing is that they have both and the funds and dividends are directly on your own wallet so there is no danger of not being paid out. I have been now in this coin for a whopping 224+ weeks. This got my chart so big that the color aren't coming through anymore so I had to make it larger.

I would have bought more myself this week if I hadn't already invested big. There is also very little liquidity and buying 300k SBET (~1200$)would push the price up by 5%. The total circulating %arketcap right now is below 2 Million.

Looking at all of it, I might just increase on my own bags a bit more. It's going to be interesting to see where things are going with the dividends the coming weeks.

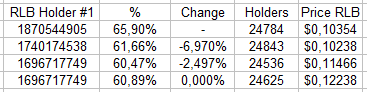

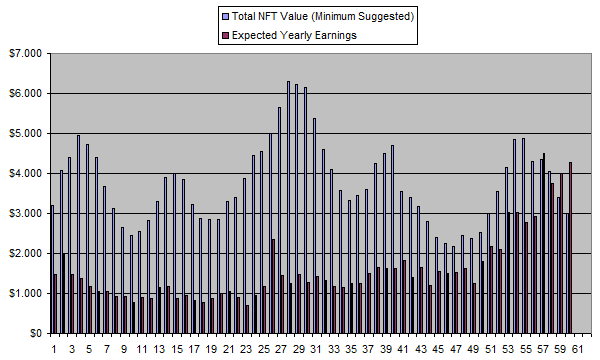

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The main thing that caught my eye for RLB this week is that there was a combination of the Biggest holding wallet not going down while the price went up. There has also been set a date for coins that are left on the Solana chain to be burned (making it so that everyone that had coins there but didn't convert lost them). I'm kind of puzzled by the move as buying on Ethereum is so lame and impossible for most due to the fees. So the only way to buy is on their own site giving them your money which always remains tricky.

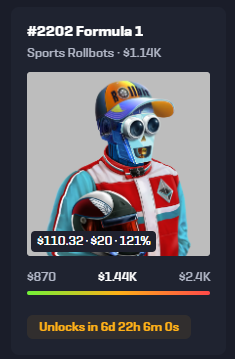

The Stakestinks Whale is still active during the weekend which is making it so that the revenue share on the sportsbots is holding up. I have 1 days left before I can claim again and will likely just do so as prices of Sportsbot right now feel very low.

| Last Week | This Week |

|---|---|

|  |

The burn despite the increased price of RLB has reached an all-time high again at a rate of 36% of the entire supply that will be burned over the course of a year at this pace.

The dividends based on the minimum suggested NFT price and the previous claim I did also reached above 100% APY.

The Price of RLB has been in a clear downward sloping channel for a while and it soon should hit the top. This might be followed by a break out or a heavy resistance level. given the insane burn, I would not be surprised to see a real pump at some point.

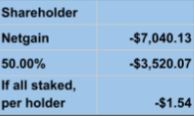

Defibookie (NFTs)

There was a report on the 'earnings' at the start of the month which again showed a loss, this time now of -7040$ including all the costs to run the site. On a total betting volume of just 217k which equals a -3.2% ROI. Either they are getting really unlucky or the site is still leaving odds that can be exploited by sharp money.

So there will be no dividends the coming month aside from maybe another airdrop. Overal, at a sub 300k market cap, all of this is calculated into the valuation and this one remains a high risk high reward project. The good thing however is that I already

Tomorrow likely the revenue share report for March will come which I'm not yet expecting much from it and assume there will be no revenue share the coming weeks.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 221$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 164$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 151$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

| Week 24 | 1710$ | 137$ | 1956$ | 0.000$ | 369.881$ | 21.6% | +615$ |

Sx.Bet (SX)

Getting more users remains one of the hardest things in crypto for any project and SX.Bet also seems to be struggling as the overall winnings went down again compared to last week. Dividends are still being paid out with inflation as the fees are cut to 0%. I'm hoping that both the Grand Slam Season which tends to be a sport suited for Exchanges and the European Championship will give the platform a boost.

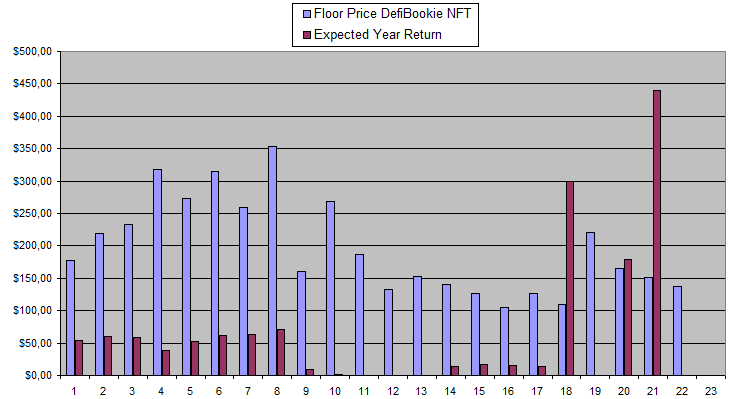

Owl.Games (OWL)

No changes in Owl this week and I do expect another drop next week as time after time again the devs fail to replenish the pool on time. Overall Owl has been a big disappointment despite the good dividends which isn't really that much of a surprise as they ban anyone who asks critical questions on their discord. I continue to slowly but surely earn back what I invested so far hoping something will change and things will move forward but not really expecting it.

I did reduced the table a bit just showing the monthly results before 2024.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

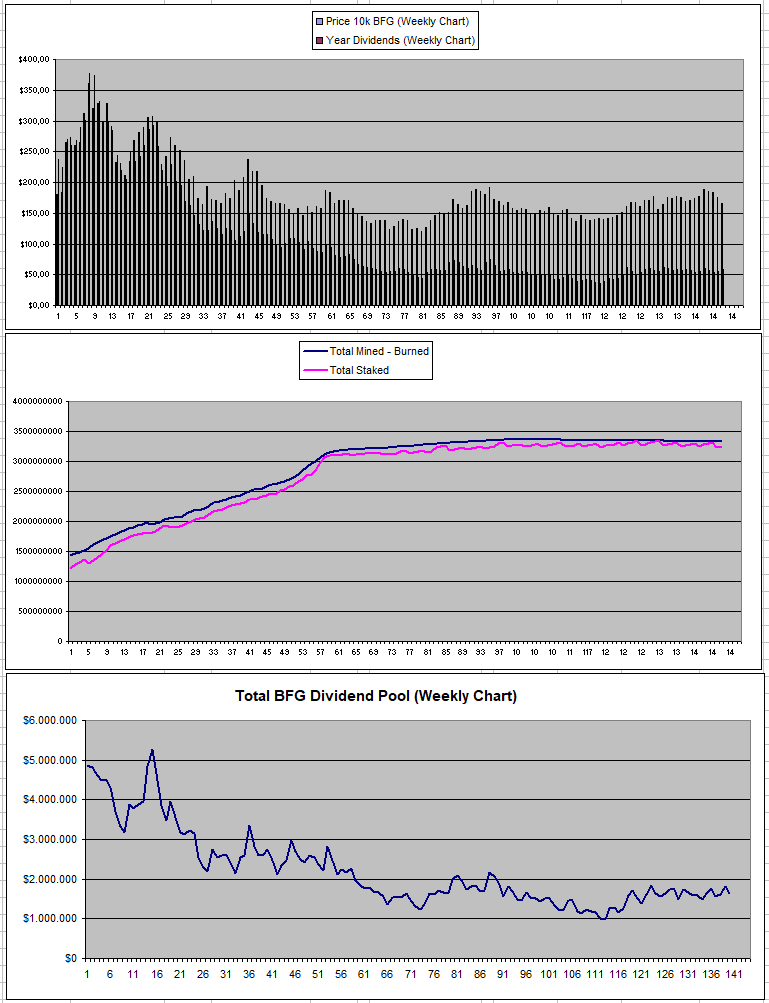

Betfury.io (BFG)

BFG saw a slight increase but price seems to be on a small downtrend.

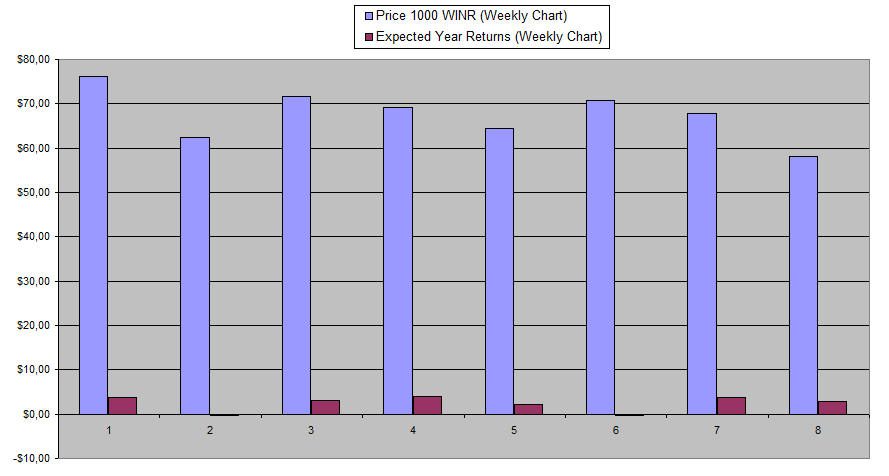

WINR Protocol

In my personal experience with WINR, everything is just overly complicated while the returns are low and the platform is not something I'm drawn to to even properly test out. I still like the thing they are trying to do though but something needs to chance for me to change my sentiment on it and be willing to invest more.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +113% APY |

| Betfury.io (BFG) | +35.59% APY |

| Rollbit.com (NFTs) | +141% APY* |

| Owl.Games (OWL) | +59% APY |

| Sx.Bet (SX) | +14.83% APY |

| Defibookie.io (NFTs) | +0% APY |

| WINR Protocol (WINR) | +4.89% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

I set another record last week of earning 585$ in passive earnings for holding 5M SBET | 500k BFG | 3 Rollbot NFTs | 600k OWL | 25k SX | 15 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha