Rollbit.com (RLB) | My Buy & Sell Levels

RLB = Utility & Speculation

RLB is the platform token from Rollbit.com and it has picked up a lot of hype and price increase over the past year and it's up a lot not only because of hype but also because of fundememtals as they have a lot of users and revenue stream of which part is used to buy back and burn RLB to make it deflationary as all tokens are in circulation.

Where the Rollbot & Sportbot NFT' s are mainly aimed toward investors that want to get returns, RLB is more aimed toward the crypto degens who want to see 'number go up' in the short term without really knowing what they get into as it's the easiest way to get into the project without the need for 1000$+ in order to get an NFT.

I always try to search for some fundamentals which made me lean more toward the NFTs, but holding RLB when instead when I got exposure to the platform would have been way better. The moment they changed the tokenomics to having a part of the revenue used to buy & burn RLB instead of putting it all in the lottery with part of the RLB used to enter getting burned, the price pumped a lot.

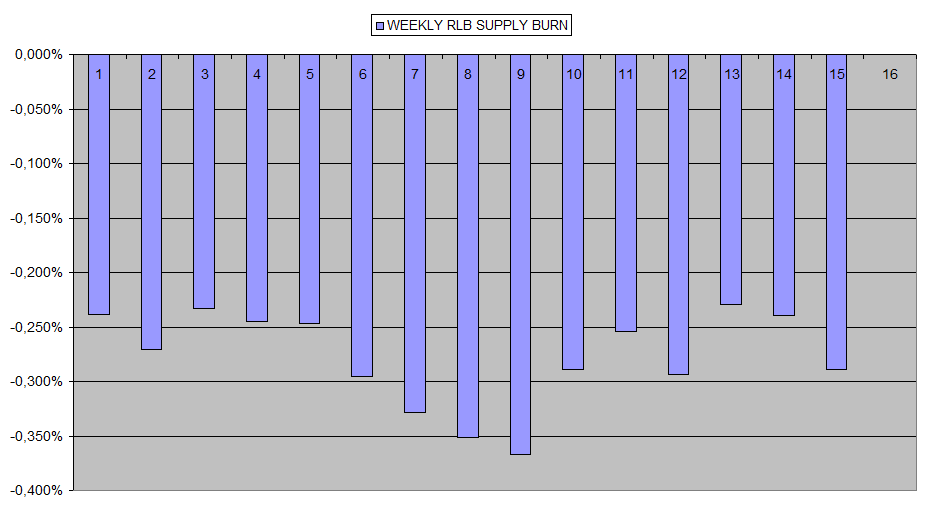

Weekly RLB Burn Numbers

Ever since the Tokenomics change, on average somewhere between 0.233% and 0.367% on the total RLB supply got burned on a weekly basis which is quite a lot. The great thing about this is that this means the price can go up without the need for the marketcap (which eventually counts- to go up along with it.

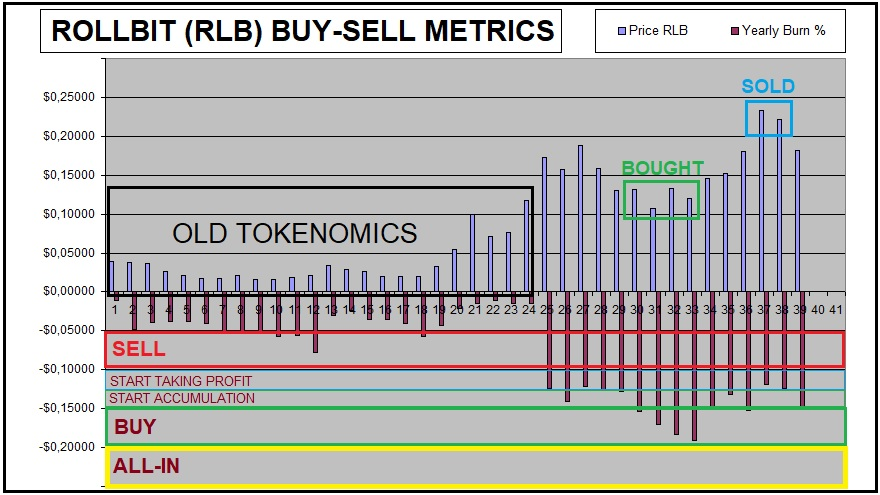

RLB Price Support

So What this comes down to is the Part of the profit will be used to actively buy RLB on a regular basis giving some price support. The lower the price of RLB assuming Revenue is quite stable, the more of it will get bought and burned. The moment the price of RLB goes too high and gets into a speculative bubble zone, a lot less will get bought.

This seems to be giving a dynamic where it's possible to buy at certain levels based on how much is getting burned while taking profit when the price has reacted to this resulting in less RLB getting burned. So far I already managed to get in 1 cycle of this helping me to increase my balance on the site and I hope for multiple to follow in order to benefit more if possible.

RLB Buy & Sell Zones

While the exact numbers are a bit arbitrary whenever the weekly burn is above ~0.24%, I start to slowly cost-average accumulate, I increase this when the weekly burn gets above 0.29%-0.30% and put my entire balance on Rollbit in RLB when it gets above ~0.40%. On the opposite, I slowly start to sell when things start to go below 0.24% and I am all out when it gets in the range of 0.2%-0.15%.

Since the burn depends on a combination of the price of the token and the profit made any given week, I always cost-average buy & sell since that leaves out random crazy good or bad weeks. With the burn last week a 0.289% and the price dropping, I started to accumulate again this week after selling everything I bought before a couple of weeks ago when the burn hit just 0.229% after the price went up a lot.

Warning: RLB Centralization Risk

Not unimportant is to know that RLB holds multiple risks of which one is the centralization. Having funds on rollbit.com requires them to be deposited and you don't hold the key so technically they are not your coins. There is also no real way to tell is behind the scenes everything is operated in an honest way and for all I know they are just making up the revenue numbers and using customer money for whatever they want. This would not be the first time this happens in crypto and it's a risk I'm fine with.

RLB Technical Analysis

RLB has exploded in price from 0.025$ in June this year to now 0.179$. It recently reached a new all-time high and has broken the upward trending channel with a target around 0.16$ which is the 0.618 Fib Level also lining up with a previous resistance top and a support bottom.

Conclusion

I'm looking forward to see how this one plays out and aim to continue using this strategy wich has been successful for me so far. In theory, it should make for quite predictable waves up and down clearly giving indications when to buy and when to sell. I am making a weekly update on my GambleFi portfolio each Tuesday which includes the current RLB Burn % Levels each time (See Previous Report).

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Congratulations @costanza! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 8750 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP