Quiet Before The Storm

With so much lined up over the next 6 weeks with so many launches this is COTI's big opportunity to show what they are all about. DJED, GCOTI and possibly the biggest of them all the Enterprise Tokens.

COTI as a payment facilitator for businesses is going to be a big player over the coming years. The Trustchain is already being used by a whole host of companies, but will spring into life over the next 4 months. The 4th Quarter this year was always going to show COTI in a new light as a Crypto project on the rise and one that is going to help increase mass adoption for Crypto in general.

What COTI has built and developed over the last few years is all coming together for this period. The MultiDag2.0 which has been launched recently allows for all of other launches to be possible.

Governance COTI known as GCOTI is a token that will be airdropped within the next 4-6 weeks before DJED which is Cardano's stable coin. The GCOTI is not something that can be bought as it is earned via staking and joining in with various other tasks.

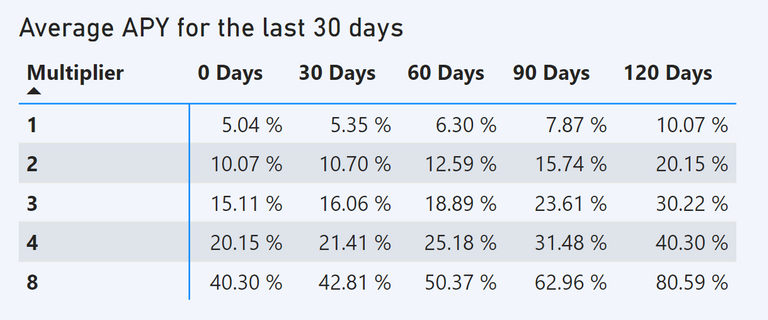

Governance may be a little misleading as it is more of a profit boosting token as it allows you to earn more APR in the Treasury. American holders of the ERC20 COTI token will not miss out (@bozz) as this is something they are trying to airdrop fairly.

I had some concerns as I have liquid COTI in the Treasury not wanting to stake and tying up to another 120 days. The reason was their is longer staking about to be introduced offering more APR and thus more GCOTI being earned as longer staking periods receive more GCOTI and not necessarily on how much is staked.

The one thing I did pick up on in their Twitter live discussion today was the regulation holding back the US from staking is being monitored constantly. COTI has a team in the US monitoring the situation and mentioned the way they have been handling this is benefitting them long term. The meetings they have had with the various Enterprises/businesses have approved of the way the COTI team have handled this on the legalities involved. As soon as their is an opportunity that is right they will open up the staking to everyone who currently cannot.

This has been the quietest period since the COTI Treasury launched in February this year. The APR is the lowest I have seen it, but at least this is still double digits. I am expecting this to be the quiet before the storm as Q4 will change these APR's significantly as 15% is where I see the minimum for 120 days on multiplier 1.

Posted Using LeoFinance Beta

I'm thinking of buying some more coins and I don't know which is better, COTI or ADA. What do you suggest?

That has to be up to you. I have 10% ADA and 90% COTI if I look at that part of my portfolio. Ask yourself what is going to give you more value and rewards over the next 5 years?

Ι get it, thanks!

Yay! 🤗

Your content has been boosted with Ecency Points, by @sagarkothari88.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Great news!