US Market of Free Trade - US Free Trade Agreements Discussed

US Market of Free Trade

A Custom Brokers Perspective on The United States Trade Strategy

If you saw my introduction post you'd know that I'm actually a licensed customs broker, but unlike most customs brokers, I only became a customs broker to understand how to optimize supply chain without having to pay for the premium service by removing all margin opportunities for a freight forwarders and/or consultants by managing this directly for the company I work for.

One thing that is apparent is that unless you know trade, you do not and don't pretend to because it's very complex. It's apparent that even the media has little to no understanding of the US's former and current trade strategy. If they did, their reporting would be in-line with the actual effect the US has had on existing Free Trade Agreements today, but more importantly how US companies leverage free trade agreements in a practical way.

So I've been a sourcing manager, category manager, and directly involved with multi million dollar single PO decisions and all the analysis that led up to them. In manufacturing, trade is essential, because all raw materials are commodities, meaning price should always win; e.g. lumber, iron ore, basic steel components (widgets, nuts, basic prefab), etc. For anyone who's looking to make something they must be more competitive, and if your not looking at your spend and optimizing it then you lose your competitive edge.

The number one way all major manufacturing industries and their top companies reduce their spend is by reducing their cost. Companies look at it this way, if your profit margin is 20% than for every $1 in operating costs you save that is equal to $5 in new business. Most companies don't see huge compounding gains in new business, especially in more mature industries, so reducing costs is the only way top players will remain in their top position. This market effect also creates a constant supply chain opportunity!

I specialize in reducing costs, and I have found most success in industries heavily reliant on basic raw materials, working free trade agreements is absolutely the number one way to outperform all competition. So, how do you work free trade agreements? The basic rule is how to determine how free trade agreements outline how country of origin is classified, because these agreements specify country of origin in their own way that's not consistent with the world trade organization's standard; obviously, since it's a free trade agreement directly between countries or groups of countries.

The most shocking thing many who are not familiar with US trade and the regulations, is that all the recent media scares about the disruption the US has taken on trade - in reality, all the changes Trump has introduced and his stance with China has had no impact on any existing free trade agreements before Trump except the new NAFTA deal (which was mostly written by Dems funny enough). Why, because all the other free trade agreements, and there are still many, have the same exact rules and duty reductions specified in the tariff.

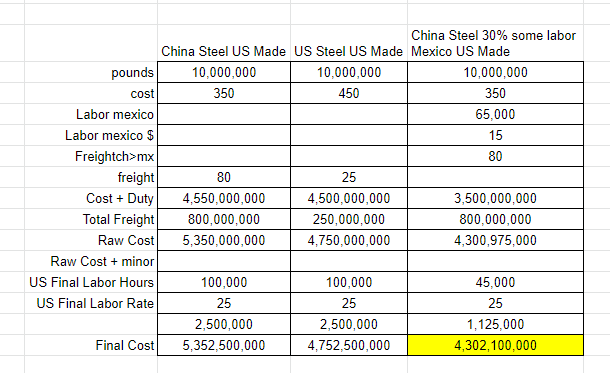

Example of how to Leverage a Free Trade Agreement

US Steel Cost = $450 per ton + Low Freight

China Steel Cost = $350 per ton + 30% duty + High Freight

Steel Need to Make US Good = 10,000,000

3 Scenario Cost Proposal

In the three scenarios above, two include getting the cheap china steel. Obviously you could get it direct but pay a 30% duty or get the China steel and do minor work to it in mexico that is basic to save you labor hours in the US too.

In the end the total cost is measured and the scenario to purchase china steel and send it to mexico wins! Then, next thing you know the US manufacturing company closes down their factory reports to shareholders why and their plan to save X by moving minor fabrication to Mexico, and here we are today!

Did you like this topic?

I'm only testing the waters out here, depending on how this post does I may dwell further into my perspective on US trade. It's so complex and would require an entire series!

About The Leo Community

The Leo community is full of passionate bloggers, entrepreneurs, investors who are primarily interested in finance and investing. Much of the content published by Leo community member's focuses primarily on blockchain and other news associated with trends in the market, technology updates, technical and fundamental analysis. If you're the author or curator of a lot of content relating to investing, passive income streams, business ideas, entrepreneurship or any other blockchain news then the the Leo community is an excellent place for you to add to your check-in schedule.

Remember you receive additional author + curator rewards by posting on Leo's platform directly. Many other Leo community members, myself included appreciate when you do post on the Leo platform because using this along with the other awesome Leo tools like, Hivestats.io, LeoPedia.io and the Hive Exchange with the lowest transaction fees LeoDEX because the use of these sites contribute directly to the overall wealth of the Leo community since the ad revenue Leo generates buys back and burns Leo!

Posted Using LeoFinance

Posted Using LeoFinance

@crytoknight12 I love the post on the topic very different from any other post I see on leofinance...year more trade about your job and trade tariff would be cool.

Posted Using LeoFinance