What's going on with Binance?

The year is not over yet, and there are people afraid that Binance will be the next FTX. The unexpected and quick way in which the FTX collapse happened, CZ's influence on the situation, some of his statements after it happened, and the relevance that Binance has in the cryptocurrency market are just some of the reasons that all eyes on the market were turned towards her.

In a tense context like the one that followed, it is normal to create some excitement, after all, some take advantage of the moment to get more public. But it is a fact that there are some circumstances and inconsistencies that justify distrust in what has been done and said by Binance. Is it just FUD and clickbait, or is the crypto giant really in trouble?

The largest brokerage in the world has fought hard to try to guarantee the confidence of its investors. Seeking to offer more transparency and reliability, it made available a report that would prove that it has at its disposal the reserves it needs to guarantee the withdrawals of all its customers. In other words, it would be indisputably liquid and solvent.

But after the release of the report, several information were disputed by experts and experienced investors, raising doubts about Binance's real financial state. Although nothing really serious has been found so far, the highly exalted Proof of Reserves that Binance presented ended up not convincing that much, neither investors nor the market.

Proof of Reservations

As soon as the house of cards that supported its main rival — FTX — began to crumble, CZ made some tweets stating that all exchanges should prove that they have enough reserves to cover their investors' funds, as would be the case with Binance. This would prevent investor tokens from being used in schemes like Alameda's.

Shortly after, Binance's PoR (Proof of Reserve) was published, which basically consists of a report, the result of an audit carried out by a specialized company called Mazars Group, which attests that Binance has in its custody enough amounts to cover all the tokens sent to it by its investors.

However, the result of the publication was quite adverse…

Without the expected effect

The publication of the report should appease frightened investors and also boost confidence in the crypto market, representing a big step for the exchange and the market in general. But things didn't work out that way.

Shortly after the release of the report, alleged methodological and criteria flaws were pointed out, which would make it not possible to categorically state whether Binance proves ownership of sufficient reserves. In fact, the only thing the report achieved was to create distrust that perhaps would not even exist without it.

The report issues

While they were all refuted by CZ and the Binance team, some points about the report created more doubts than certainties for platform users and market analysts. They do not represent serious problems in themselves, but they raise important questions.

The doubts are related to corporate perspectives, regarding the organizational structure and other aspects of the company's governance. But there are also inconsistencies in the numbers, which can be relevant when we consider the whole context:

Lack of information on how Binance's system liquidates assets to cover margin loans: Without accurate data on how this occurs, it is difficult to analyze Binance's ability to recover the entire amount borrowed in the event of a hypothetical major default. Thus, she could become insolvent with her creditors.

Lack of quality assurance of internal controls: Many of the numbers analyzed in the report are passed by Binance itself, based on the statistics it has in its system. But there is not enough information about the quality of internal controls and whether these data are 100% reliable. A flaw in the data could contaminate the outcome of the assessment.

Lack of transparency about the organizational structure: Another important point was the absence of comprehensive information about the organizational structure where Binance would fit. According to Binance itself, this is due to a restructuring that would have been happening for more than two years.

Lack of details about the company's liabilities: When considering a company's ability to pay all of its creditors at any one time, we need to consider the debts it owes to the market. This information was not included in the report (at least not comprehensively), casting doubt on Binance's financial health.

Lack of 100% Collateral for Bitcoin: As per the report, Binance would have collateralized the equivalent of 97% of the nearly $10 billion worth of Bitcoins in its custody. The difference seems small, but it becomes worrisome when considered in the context of what this means that, in fact, she failed to achieve the promised 100%.

Lack of trust in contracted audit firm: The Mazars Group, responsible for the audit and preparation of the report, was put under severe pressure after publication. Apparently, the company stopped providing its services, both to Binance and to other exchanges, after the rain of criticism of the submitted report, leaving doubts about its suitability and technical capacity. This information, attributed by journalists to Binance sources, has not yet been expressly confirmed by Mazars, but neither has it been denied nor disputed.

These are some problems encountered by investors, analysts, and experts in the crypto market. The fact is that, under the circumstances in which the report was presented, at a time when everyone was extremely sensitive and apprehensive, it was practically impossible for it to be enough to restore investors' full confidence.

The backlash was so far below Binance's expectations that the report was taken down. Today it is impossible to access it on official platforms, although it is still possible to find it thanks to users who have saved it on their computers. This attitude of exclusion from the audit was all that was needed to completely discredit the report.

Investigation

Considering Binance's importance in the cryptocurrency market and the growing political interest in all things digital assets, it was only to be expected that some investigation into the company would be ongoing. However, the arrival of information that the American Department of Justice (DOJ), something similar to our Ministry of Justice, had been investigating the brokerage since 2018 for money laundering, among other possible crimes, generated a great commotion.

The investigation gained a lot of traction after the FTX incident, not only because of the political appeal, as hundreds of thousands of Americans were harmed, but also because many influential people are said to be concerned about the safety of the market. No formal accusations have yet been made, indicating that there is no overwhelming evidence to incriminate the company or its directors.

Storm of withdrawals and restrictions

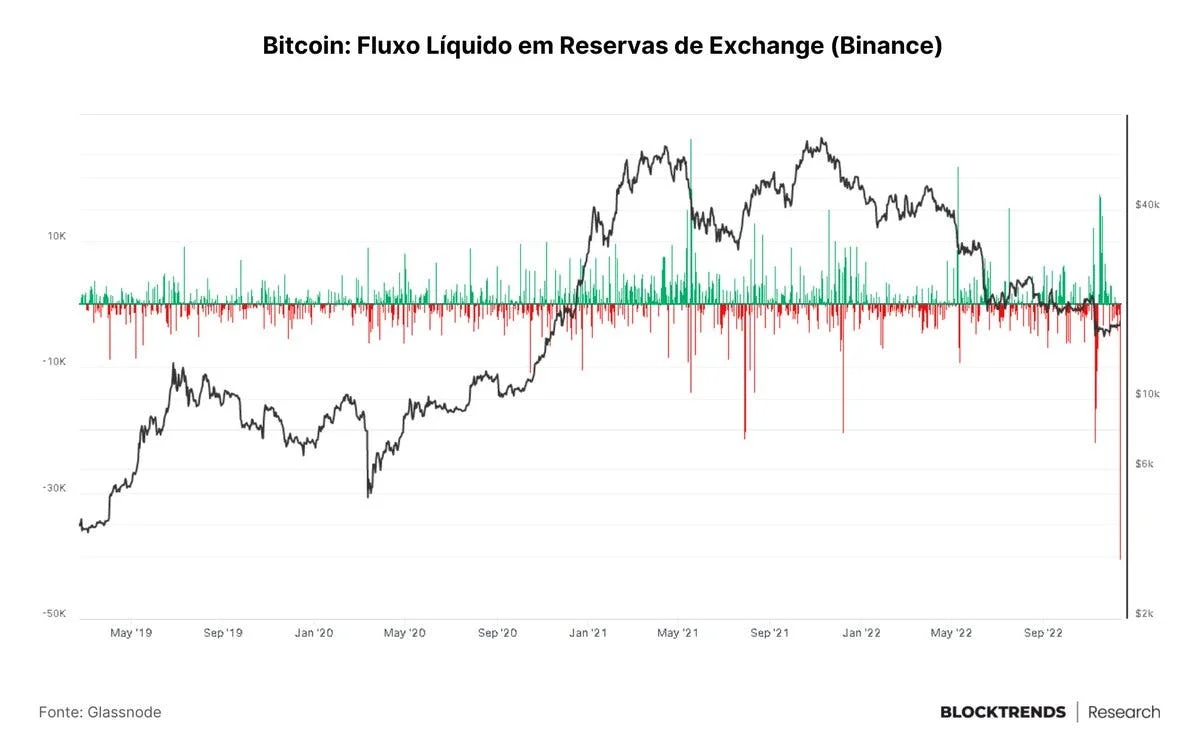

Even with the lack of hard evidence on Binance, both in terms of possible flaws in the report and the DOJ investigation, market circumstances and the size of Binance are enough to fuel panic. As a result, the broker saw a rush by investors to withdraw their tokens.

In just 24 hours, on December 13th, accumulated withdrawals reached almost four billion dollars. This led to problems and restrictions for some investors to withdraw their funds, creating even more FUD. The situation quickly normalized and, it seems, the worst is over.

Sensationalism and genuine concern

Much of the tension surrounding the Binance situation is not down to the exchange's issues, but to market circumstances. CZ's role in the FTX crisis was certainly a catalyst for everyone to turn the spotlight on his company, but the fact is that this was inevitable considering the context.

Some news websites and Youtubers try to gain an audience by negatively citing Binance, because people are hungry for information, and this ends up making the issue seem bigger than it is. But yes, there are points of attention involving the broker and, especially in such a long and tough bear market, it is possible that more concerns will appear and that it will suffer some defeats.

Merkle Tree for PoR

As a way to increase the transparency of its transactions, Binance has added a feature to the platform that allows users to track transactions on the blockchain using a Merkle Tree system. So they can have access to more data in a more practical way.

Merkle Tree is a data architecture model that allows multiple transactions to be grouped into a single hash. It is necessary to have a basic knowledge of how a block explorer works and blockchain in general to extract the full potential of the tool.

Huobi could be next

The next big exchange (6th in the world by market capitalization) facing a tough time could be Huobi. The controversy raised by Binance hit it hard. According to data reported by Huobi itself, about 43% (almost half) of all its asset collateralization is based on its own token, the HT.

This could be a sign that they are doing the same as FTX did with their token, FTT. However, it is necessary to verify in more depth how the HT token is collateralized, if it is not purely a token issued according to the company's will (as happens today with the fiat system).

This means that your financial situation is alarming to say the least if we take Proof of Booking as a criterion. But even with a new burn-and-buy system, its native HT token has been in decline for quite some time, retracting nearly 40% this year.

For all this, many people believe that she may be the next one to face problems. The impact should be much smaller than that caused by the fall of FTX, but it is important to be very attentive in times of great instability like the one we are experiencing.

Quality of Reservations

There is an interesting metric that can be queried via on-chain data, which is the quality of bookings. This metric measures the dependence of an exchange's reserves on its proprietary token and shows that Binance does not have as big a problem as some think it does.

Data from CryptoQuant in a recent report shows that Binance reserves are 89% “clean”, that is, without relying on its own token.

Precaution and Strategy

That's why it's essential that you stay well informed and keep updating yourself on everything that happens in the crypto world. While Binance is unlikely to disappear overnight, especially now that its importance has grown, that does not mean that it is 100% safe, let alone the funds deposited there.

So remember, keep your tokens safe so that you have custody of your assets. Never leave your main asset, the one you are not willing to lose, in the possession of anyone. It's repetitive, but it's true: NOT YOUR KEYS, NOT YOUR COINS!

Stakings can be tempting, but they reward precisely for having a risk attached.

Posted Using LeoFinance Beta

https://twitter.com/1276003421938692101/status/1605705942225621001

The rewards earned on this comment will go directly to the people( @cryptosimplify ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.