The Stablecoins Market Cap Has Reached 100B! | Regulation Incoming? | Historical Data On The Market Cap

The stablecoins keeps growing and with that attract attention of regulators. There was a recent proposal for a bill that should sort of “ban” some type of stablecoins.

Regulators and central banks don’t want to have competition in the issuing new dollars 😊.

A lot of things are up to debate when it comes to stablecoins and how some of the most popular are acting but will left that one here. What we will be looking at is how the top stablecoins has been growing and is there any significant changes.

Let’s take a look.

The basic function of these tokens is to keep a peg to a fiat currency, in most cases USD. To do this usually an equal amount of money deposited in a bank is need for each token minted as a fiat collateral. Tokens like DAI are backed by crypto collateral usually overcollateralized. HBD has a DEX and a DAO that keeps putting orders around the peg to maintain it.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- Terra-UST

- PAX

- Huobi USD [HUSD]

There is a few more out there but we will focus on these as the biggest ones in market cap.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

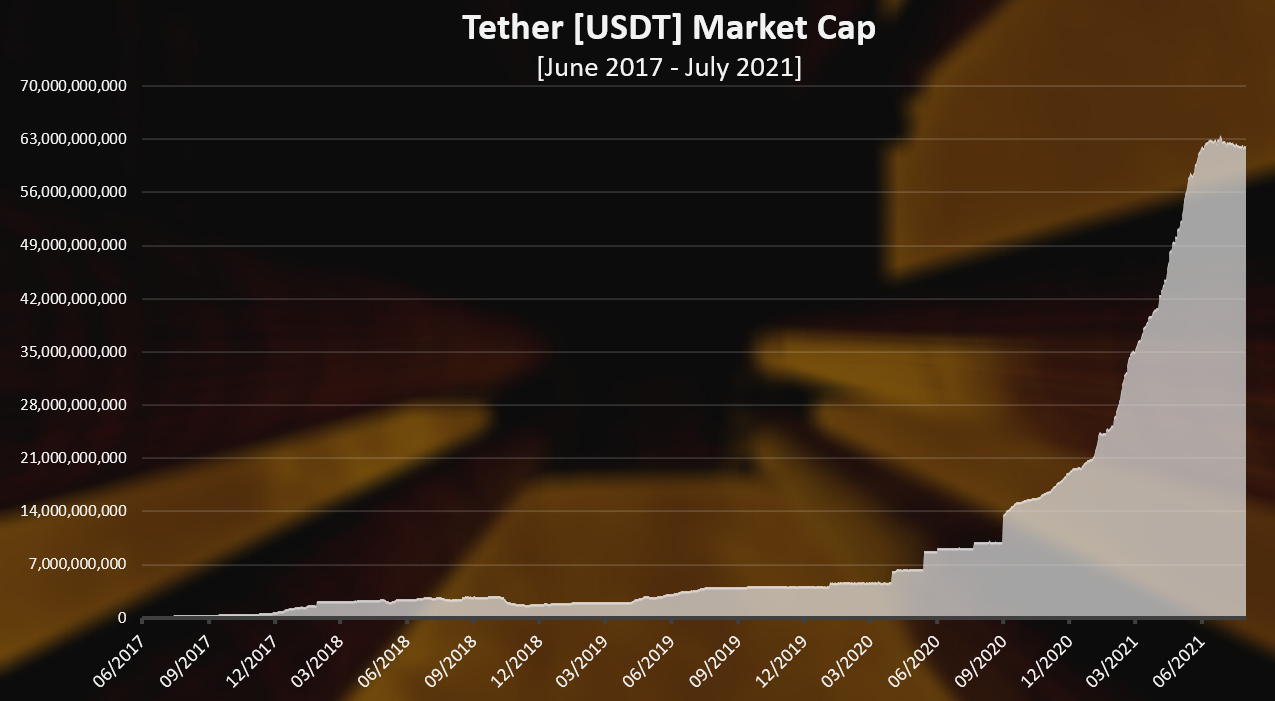

Here is the historical market cap for Tether

As mentioned, Tether has been around from 2015. But until 2017 the market cap for tether has been very low. In 2017 it started to peak up. Started with around 10M at the begging of 2017 and ended the year with 1.3 billion in market cap.

In 2017 Tether has increased its market cap by x130!

After the bull run ended in 2018, Tether has seen a drop in the market cap going from almost 3B at the end of the bull run to under 2B.

In 2019 Tether started increasing its market cap, printing more USDT and by the end of the year reached more than 4B.

In 2020 the Tether printer has gone full speed and at the end of year Tether had 20B in market cap.

In the first half of 2021 the market cap od Tether kept growing with more of it being issued and now it is around 62B in market cap.

What is interesting is that in the last month, July 2021, Tether has slowed down the printing, and it has even reduced its market cap by 1B!

USD Coin [USDC]

USDC is a common project between Coinbase and Circle. Its supply should be more legit.

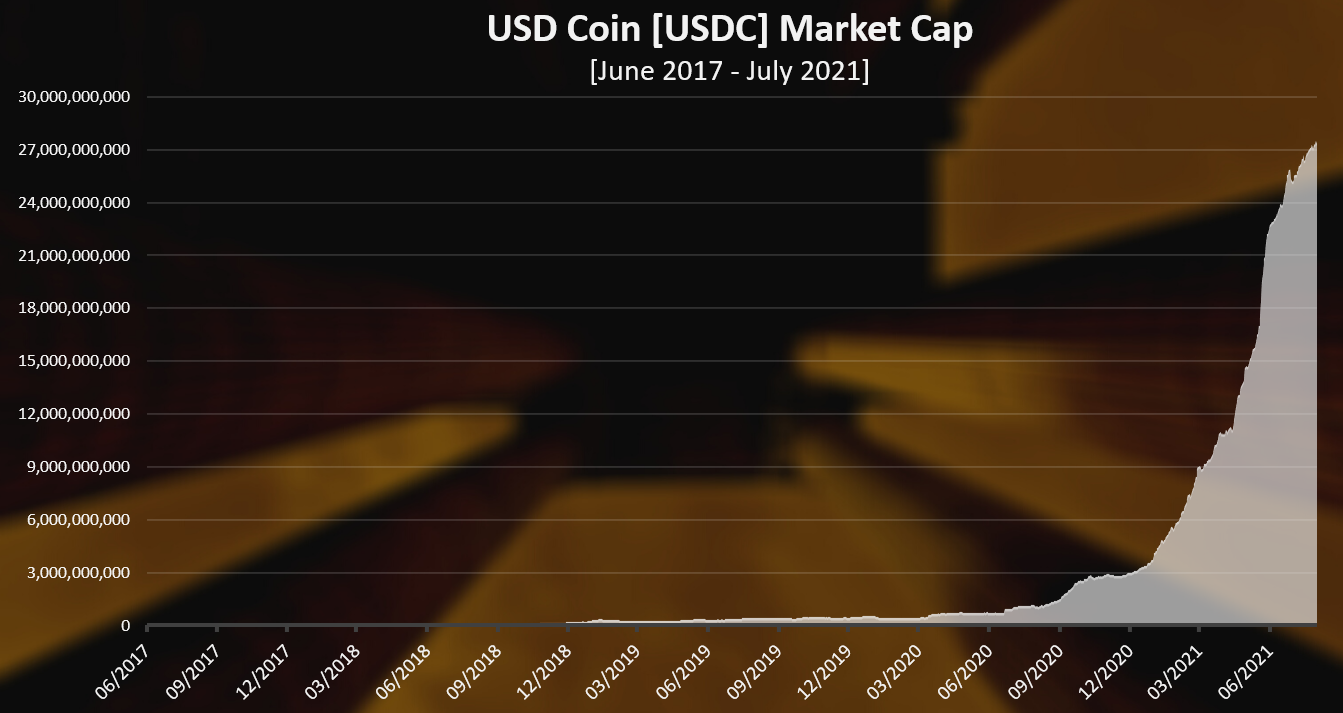

Here is the chart.

I have intentionally left the horizontal axis on a same scale with Tether, to show that this stablecoin, and the others have come after Tether.

USDC started its journey at the end of 2018. Same as USDT, a lot of USDC has been printed in 2020 and in the first months of 2021.

USDC has been growing exponentially in 2021. It has went from 4B at the start of 2021 to 27B in August 2021.

USDC has enjoyed a better reputation in the crypto industry for now with regular audits for its reserves.

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

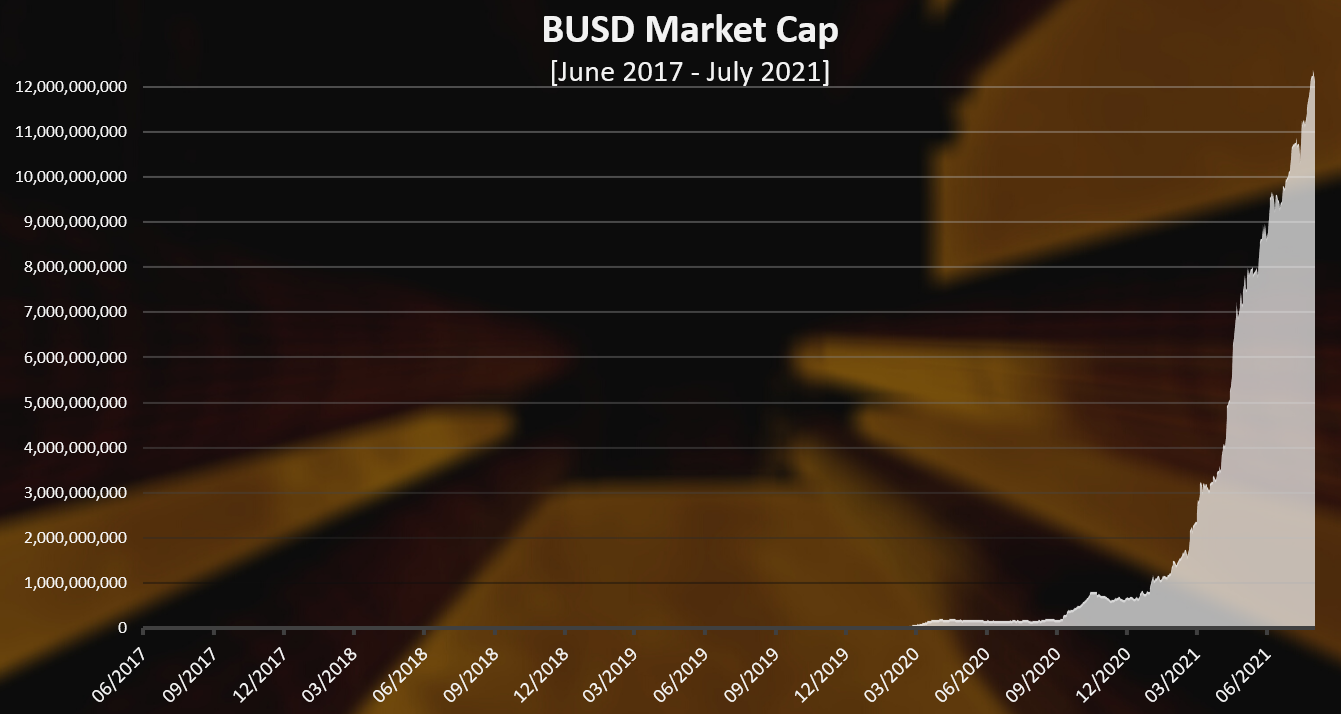

Again, here we are seeing a sharp increase in supply for BUSD in the last period. BUSD has overtaken DAI in terms of market cap. It is around 12B at the moment, still smaller than USDC.

As far as for security goes this is a quote from the official web.

Binance USD (BUSD) is a 1:1 USD-backed stable coin issued by Binance (in partnership with Paxos), Approved and regulated by the New York State Department of Financial Services (NYDFS), The BUSD Monthly Audit Report can be viewed from the official website.

Dai [DAI]

DAI is the decentralized version for stablecoin. Its run as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

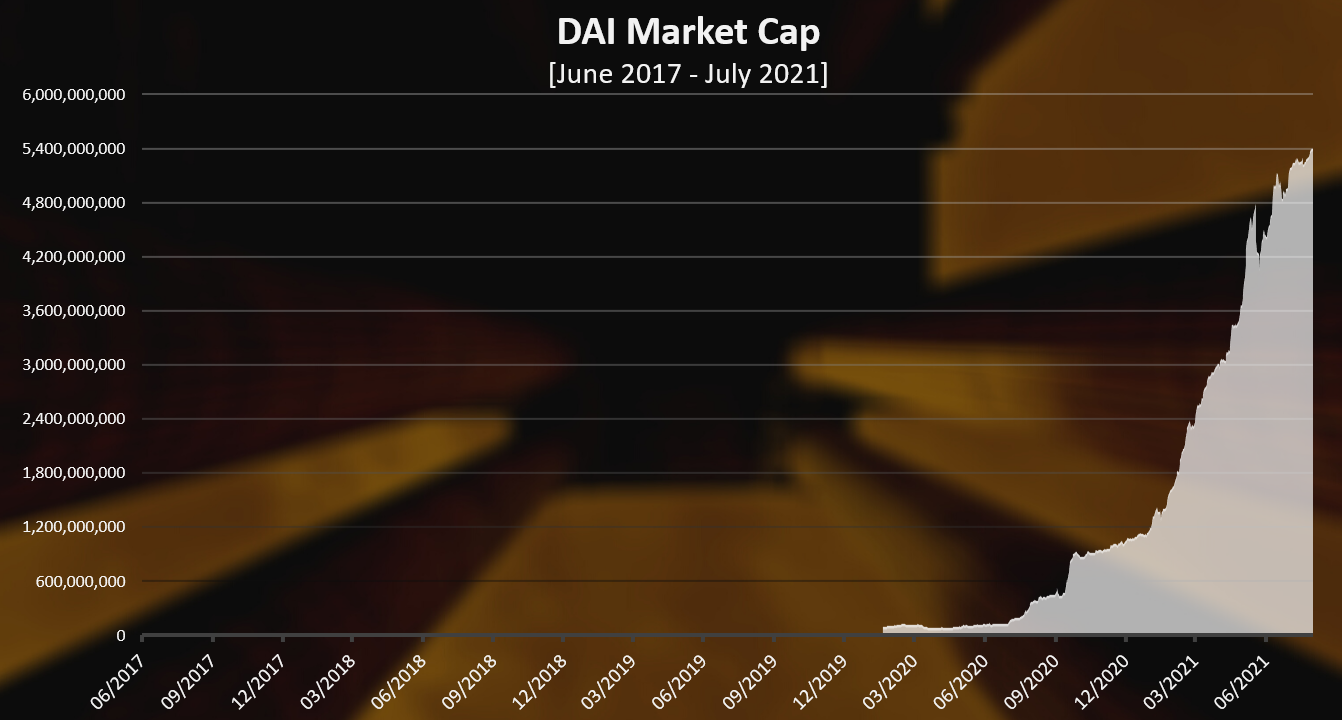

DAI started even later than USDT or USDC. The current version of DAI (multilateral) stared in January 2020. From what we know there was a previous version of DAI, a single collateral one, that started at the end of 2017. Although the market cap for DAI is available only from January 2020.

We can see that the DAI marketcap has grow a lot as well. At the moment DAI has around 5.5B in marketcap.

Unlike the USDT, USDC, BUSD, all DAI is generated in a decentralized manner with collateral locked in a smart contract. The average ratio of the collateral is somewhere 3:1. So for 1B DAI there is an approximate 3B collateral. No fractional reserve policy here 😊.

The holders of the governance token Maker, are deciding on the cap of the DAI issued.

Stablecoins Market Cap

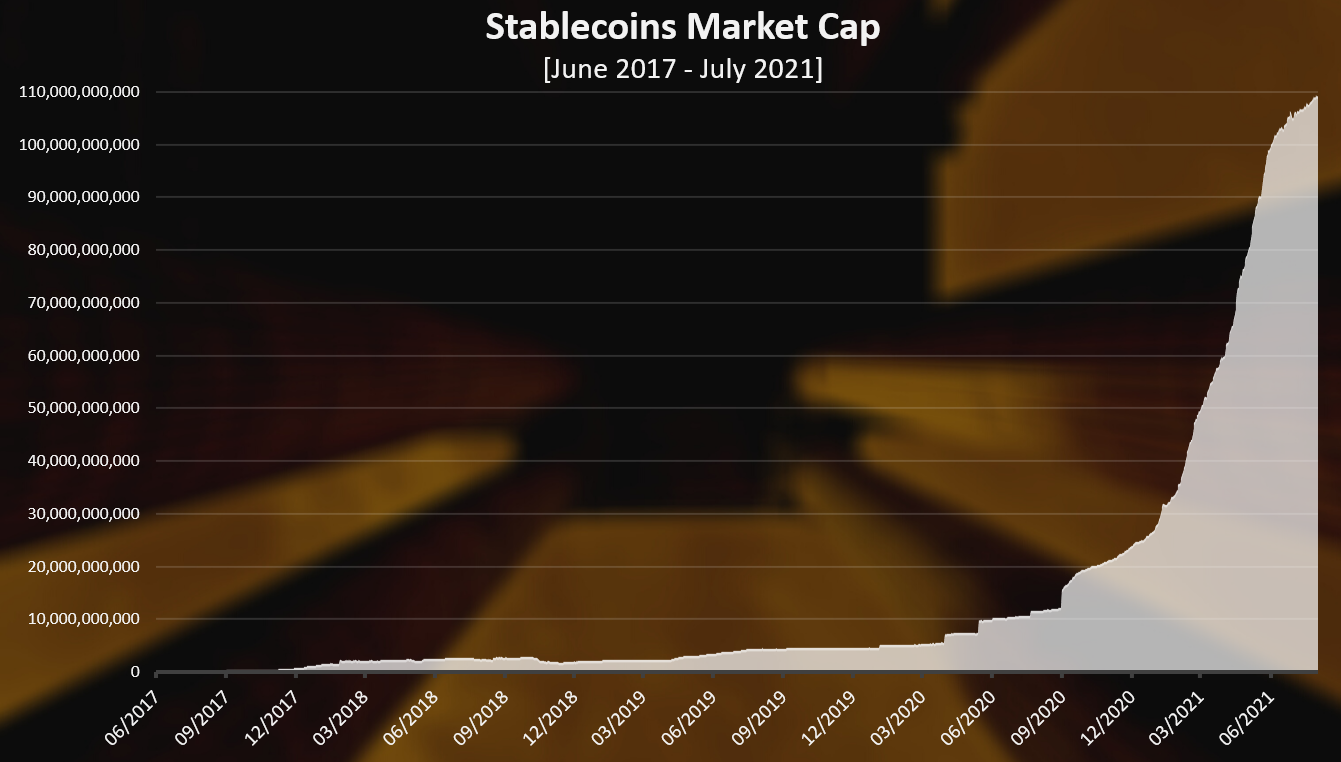

Here is the chart for the total stablecoins market cap.

The chat above includes the stablecoins from the previous list. There are some others but these consist 99% of the market cap.

This is quite the chart. The market cap of stablecoins has literally went vertical reaching 110 billions at the moment of writing this. There is huge growth in the last six months.

We can barley notice a smoothing out now, especially since Tether has slowed down a bit with the printing.

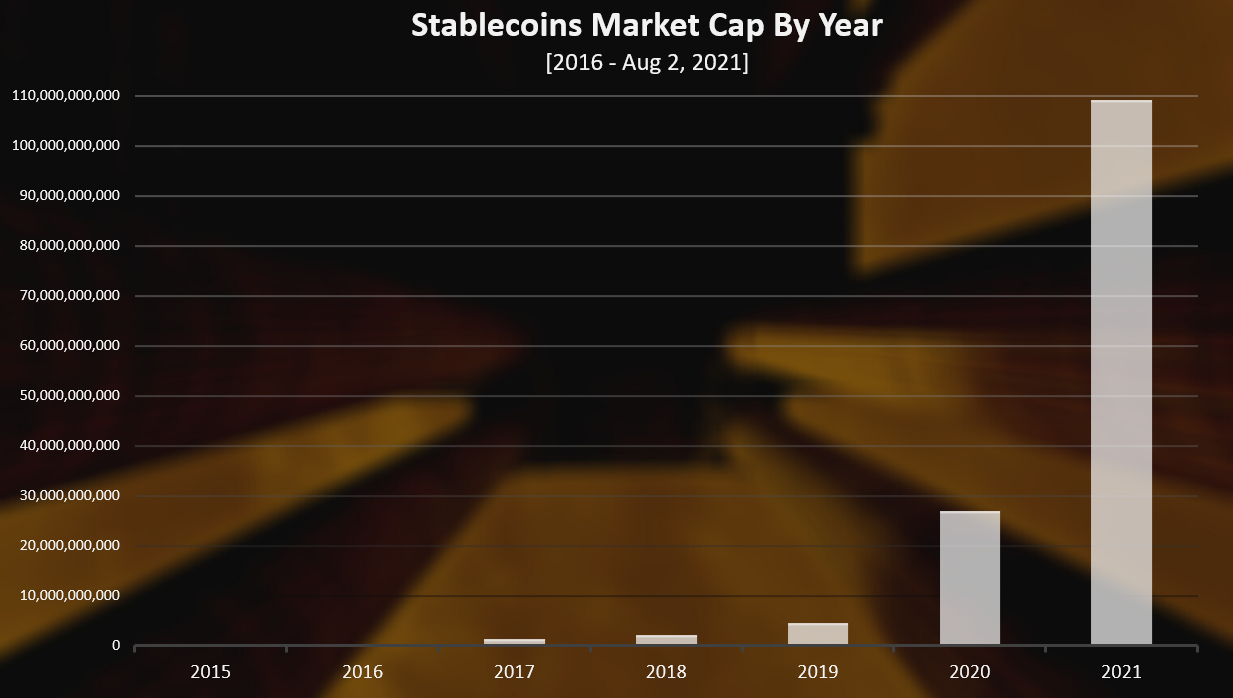

When we put the chart above on a yearly basis, we got this.

The market cap is for the end of the year.

We can see that the numbers for 2015 and 2016 don’t even show on the chat. The market cap for stablecoins in these years in in a few millions with only Tether USDT around. In 2017 the stablecoins market cap reached 1B for the first time. Since then, the market cap of the stablecoins kept increasing each year, even trough the bear market.

In 2020 the marketcap of the stablecoins increased for more than 20B, going from 4B to 26B.

In 2021 till August 2nd, the overall market cap of stablecoins has grown from 27B to 110B, almost 4x the market cap, adding another 83 billion.

No wonder regulators are now starting to look more closely to stablecoins!

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

As we can see Tether USDT is still dominating the stablecoins arena, with 62B marketcap out of the total 110B. A 56% dominance. USDC is on the second spot with 27B (25%), then come BUSD and DAI.

Overall in 2021 stablecoins have grown massively. A 82 billions rise in market cap. What is interesting is that Tether has slowed down in the last month, while USDC has kept growing, taking over a bit of the market share of Tether. BUSD has also grown a lot, but not at the same scale as USDC. DAI as the only big stablecoins that uses smart contracts and decentralized governance, has been growing at slower pace.

Just for context the market cap of HBD is around 6.3 millions, and if we add the HBD in the DHF, that doesn’t count as debt we are at 11 millions. The whole market cap of HIVE at the moment is around 150M. If HBD becomes more stable and more liquid in the future it gain give the Hive network a ton of value. This is possible it just requires some time. By design the HBD is far more capital efficient then the DAI model.

What stablecoin are you using?

All the best

@dalz

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

how can I get votes from the Encouragement program? @ecency

Posted Using LeoFinance Beta

Encouragement votes are cast by our curators and we try to vote more unique authors every day

ok got it ☺️

the stable coin has helped me in my trading so I can know how much I have made in trades because unlike btc they stay stable

I also just moved some HBD TO SAVING for 10% apr

I want to ask can I do that with hive too? or not will I receive 10% on hive too?

Posted Using LeoFinance Beta

I was a fan of DAI, USDC, and TUSD. With ETH gas fees so high, I've not used them as much. I tend to make small transactions, which makes the fees more costly. I am thinking about using HBD for savings. I am curious how much loss there is between 100 HBD and what I would get in a bank. There would be some loss, I imagine, in the exchange to convert to LTC or DASH, plus transaction fee.

What hampers HBD is that it doesn't trade on any of the platforms available to me other than H-E or blocktrades.

Yea, hbd on more exchanges is needed. As more liquidity and users jump on, we should be able to do that. Also hoping to get hive and hbd on some major dex like uniswap and pancake

Highest yielding stablecoin right now may just be HBD at 10%

10% is quite atractive!

Important bit is being unable to be censored or take down by government goons. If crypto needs the grace of government to exist - it's not a very good crypto.

Pirating movies/games is illegal. It's still happening. If we can build a decentralized network with reasonable stable value.... it's going to be impossible to take down.

For that we can't have stablecoin backed by some asset in bank. Luckily HBD and few others aren't backed by money in bank.

Posted Using LeoFinance Beta

Yes, hbd most likley can fly under the radar.... also not to big for now :)

With the way peg work HBD will take a long time to be big enough to get attention. So we'll be safe till we're too big to take down 💪

Yea, we grow in silence!

Posted Using LeoFinance Beta

The higher it goes the more they are going to target it and heavily clamp down on it. Unlike a cryptocurrency that's not pegged to a dollar value a stable coin is just like using USD in the system of which they have full control over. So yep regulations coming in hot.

Posted Using LeoFinance Beta

Nice article. Can’t wait for HBD to be listed on exchanges. We are a huge community with massive potentials.

The only regulation I hear about is sabre rattling from the USA.

They want to collect more taxes.

I think if they try this money will just move out of the US and projects will not let US citizens interact with them.

The US will fall behind.

I am already moving my business entities offshore to prepare for this.

Posted Using LeoFinance Beta

I used mostly everything you mention for exchange purposes.

Dai not so much.

USDC through Coinbase.

BUSD through BNB and BSC

Stable coins at first I was not sure

their purpose but not it is getting clear

they are the LP for crypto in general.

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 90000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I've been using USDT because it was the first one I found out about. I might switch to USDC though, after reading a lot of stuff on the controversy around Tether

Posted Using LeoFinance Beta

This is a great stablecoin reference article and will be reblogged for the https://coin-Logic.com audience!

So we are stacking HBD and putting it into savings.

We lend USDC from Nexo as a loan against our Bitcoin and ETH holdings. Send the USDC to use for bills, etc on a Coinbase debit card, which then pays back 4% in XLM which is then sent back to Nexo to earn 5% APR. Then as the XLM grows, we use it to pay back the loan. We also use Defi rewards from BNB to pay back the loan as well and then keep building collateral once the loan is paid back. This gives us more USDC to spend/trade/ or whatever we use it for. Sometimes to build more defi yield exposure!

Posted Using LeoFinance Beta

That's interesting use case :)

Landing/borrowing can be powerful when done properly.

Posted Using LeoFinance Beta

I believe the stablecoins will be the gate for people to try cryptocurrency.

Posted Using LeoFinance Beta