Uniswap just had its first governance proposal on vote and it failed!

The most popular DEX on Ethereum just had it first governance proposal and the voting failed.

https://app.uniswap.org/#/vote/1

For some of you that got lucky and got some UNI coins, just in case you didn’t knew the key utility of the UNI token is governance.

Here are the things that at the moment the UNI tokens holder control:

- Uniswap governance

- UNI community treasury

- The protocol fee switch

- uniswap.eth ENS name

- Uniswap Default List (tokens.uniswap.eth)

- SOCKS liquidity tokens

The first proposal was about the the tresholds for making proposlas and the quorum for voting them.

The current rules are that a 4M UNI are required to make a proposal and 40M for a quorum to vote that proposal. These numbers were considered as to high having in mind the total delegated UNI. At the moment of writing this UNI has around 200M tokens in circulation, meaning 40M represent 20% of the current supply.

The proposal was set to lower the numbers to 3M for submitting a proposal and 30M for a quorum to vote a proposal.

The proposal came from Dhrama who allegedly control a 15M UNI.

Having followed these discussions from the beginning, Dharma has prepared a proposal that we think achieves the goal of making governance more accessible, while still ensuring that Uniswap governance is not subject to unilateral deleterious actors. We propose a threshold of 3m UNI for proposal submission, and 30m UNI as quorum.

And the results?

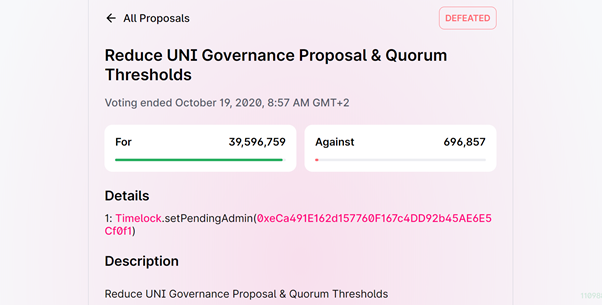

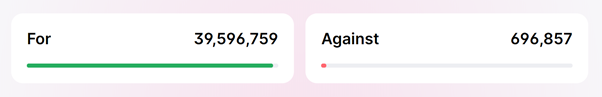

39.59M voted for! A 0.41M less than the required quorum.

The majority of the votes (98%) are almost all for, but the limit of 40M was not met. Talking about a close race!

The irony in the situation is that this failed voting proves the justification of the proposal itself. 40M UNI quorum for a proposal to pass is a lot. At least at the current levels of the UNI supply and the development of the governance system.

UNI has a relatively high inflation in the first years, so it is expected that in a year time from now this numbers will not be as hard to meet, and the once that are interested in governance will have accumulated enough to be able to make proposals and change the rules of the DEX.

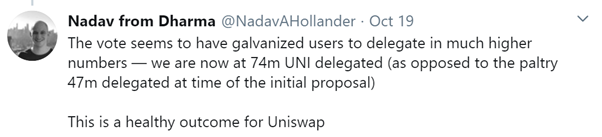

The silver lining seems to be that the delegated UNI has increases by 57% from 47M to a 74M. Going forward there should be more quorum for future proposals.

Not sure are they going to repeat the proposal and try again. I guess they will be measuring their strength before submitting another one.

It is always interesting to follow these governance topics in the blockchain sphere. Especially for protocols and cryptos that have on chain governance. (hint Bitcoin doesn’t have one 😊)

The governance topics can be a lot of fun and emotional. Hive had its spectacular governance fight resulting in a hardfork.

The governance utility of the tokens seems to be taking a central place for some of the projects. It’s a way to decentralize the project. Let its token holders decide the future.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1318869307930136576

Governance is a very delicate thing like you said, I guess for some of us on hive here, we can watch how it unfolds to also see probable mistakes and learn from it.

Yea it is ... and its interesting to watch these blockchain projects implementing governance and how they go.

Posted Using LeoFinance Beta

So, what does the failed proposal imply?

Posted Using LeoFinance Beta

It just means that the initial rule of 4M tokens to make a proposal and 40M to be voted in remains.

Posted Using LeoFinance Beta

Does that indicate, it does not have good governance ? or it's just the proposal had flaw or not well accepted ?

Posted Using LeoFinance Beta

It indicates the thresholds are set to high!

it's tough having a governance token when there's also value involved plenty of users are also not interest in it, they're just there to trade the token, with something like HIVE say you can kind of opt-out of the drama and say by not staking or even unstacking to show your discontent and selling, ETH tokens don't seem to have that versatility needed to run a governance token yet.

Posted Using LeoFinance Beta

So...they were voting to lower the quorom and vote thresholds but it failed because it just barely missed the quorom threshold. That's irony for you.

Posted Using LeoFinance Beta

What would be a better word to describe the situation?

Posted Using LeoFinance Beta

I wonder if no proposals will pass at all until the next distribution?

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

so all in all not a bad outcome,

incentivised the community to delegate more and get more interaction with the protocol.

might not be a bad buy at 3 usd

Posted Using LeoFinance Beta