Nothing Is New, Just Updated

People new to crypto may think this is a new science, invented when BTC entered our life. Cryptocurrency is indeed new. Bitcoin is the first the first decentralized cryptocurrency, released in 2009 but the tools used for technical analysis are far from new.

source

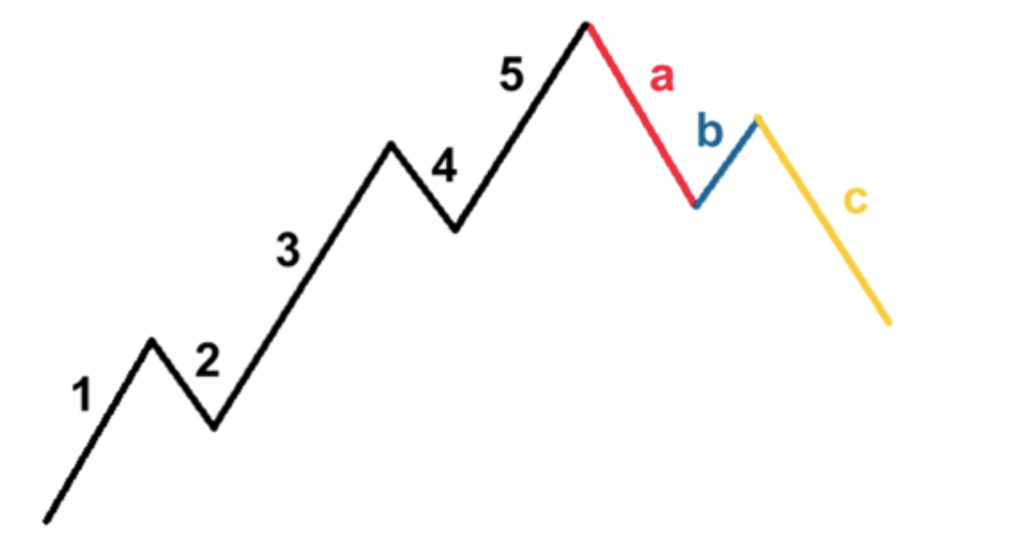

Elliot Wave Trading Pattern

Developed in the 1930s by Ralph Nelson Elliot, the Elliot Wave Theory is a based on the concept of repetitive patterns influenced by investors’ psychology. Ralph Nelson Elliot was a US based analyst and after spending years analyzing stock market data, he wrote the book “The Wave Principle” in which he described his theory. It has found wide acceptance in traditional trading and is now a common indicator used in crypto trading. source

If you've seen crypto charts, you may have noticed the Eliot Wave pattern drawn on them.

source

The Japanese candlestick charting that is the base tool for crypto is also not new. Munehisa Homma was the first to use this kind of technical analyses in the 1700s, in the rice market. Today we don't make a move without looking at the candlestick charts.

source

Fibonacci Numbers And Lines

Fibonacci numbers are used to create technical indicators using a mathematical sequence developed by the Italian mathematician, commonly referred to as "Fibonacci," in the 13th century. source

Fibonacci was also known as Leonardo Bonacci, Leonardo of Pisa, or Leonardo Bigollo Pisano. The Italian mathematician was considered to be the most talented Western mathematician of the Middle Ages. Imagine how talented he was if his sequence of numbers have been used for sock analyses to predict prices for decades and are now used for ctrypto analyses.

These are two tools heavily used in crypto technical analyses and are not the only two that date back to other centuries. The famous Bollinger Bands, these are a technical trading tool created by John Bollinger in the early 1980s, almost 4 decades ago. These tools have been used to analyze stock market movements.

Transfer Of Transaction And Responsibility

So why are these tools new to us then? The answer is very simple. Stock trading has been possible only through brokers in the past. You could not invest in stocks yourself, the whole process had to go through brokers, who had access to the stock market.

Now with the technology developing with neck break speed, everything is possible. You can trade from home, using your phone, you don't even need a computer. Stock markets are open on Monday and closed on Friday. The crypto market is available 24/7, everywhere in the world.

So the right to transaction is transferred to you. So is the responsibility though. Yo push the button and suffer the consequences, win or lose.

The only thing that is not transferred is the knowledge! Stockbrokers need a license to practice. To become a stockbroker you need a high school diploma, bachelors degree (in Accounting, Economics, Business, Finance, recommended), participate in an internship, find a sponsor and ass the licensing exams. To trade crypto you need to register to and exchange, complete the KYC and need some cash to start.

So basically no one is forcing you to study, to learn. You can jump in both feet without knowing anything about crypto and many do. This is why they say dumb money go to smart hands.

Nothing Is New, Just Updated

Back to the main idea of the post, nothing is new, just updated to modern standards. Some of us use these tools every day because it helps us determine where the market is going and set up our plans.

I steel think it's amazing how these tools can work after so many years.

Posted Using LeoFinance Beta