Showcasing Impermanent And Permanent Loss - Part 1.

Yesterday I shared my experience in my post and from the comments I got, I see a few users can't clearly see how things work in DeFi, so I decided to showcase impermanent and permanent loss and explain a few things as simple as possible. I'm going to skip explaining the basics, you can read more about these things on CubFinance.

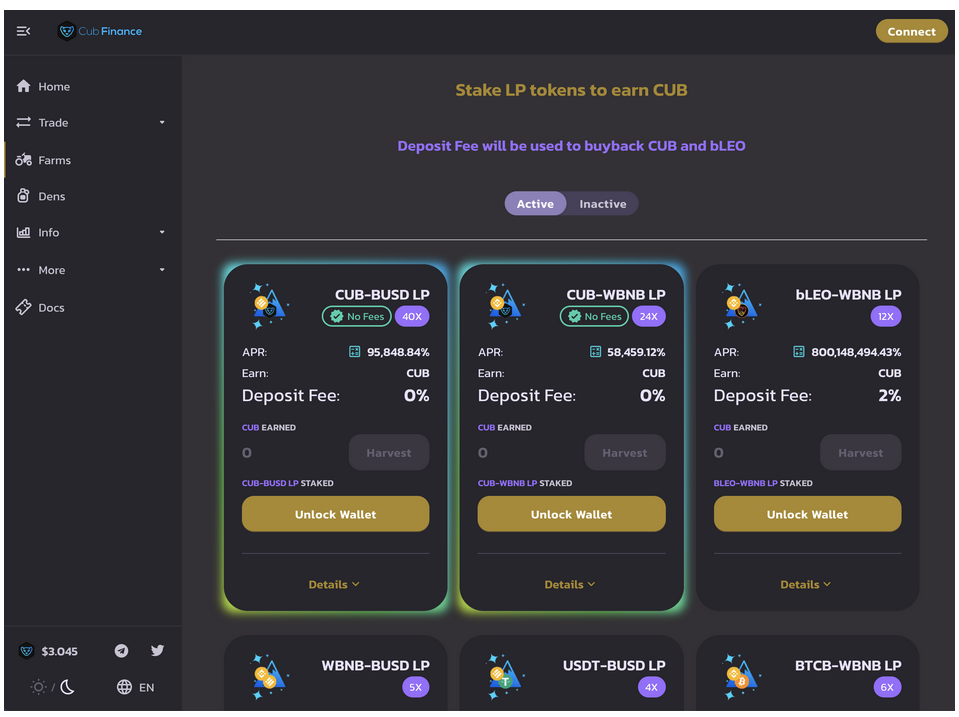

I'm going to showcase my experience, with real numbers, to explain how CUB - BUSD Liquidity Pool works.

CUB - BUSD LP

Let's start with this liquidity pool, where CUB is paired up with BUSD, which is a stablecoin.

Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some "stable" asset or basket of assets. A stablecoin can be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities (such as precious metals or industrial metals). source

Binance USD (BUSD) is a 1:1 USD-backed stablecoin, which means its price will always be around 1 USD.

In order to enter the CUB - BUSD liquidity pool, you need CUB and BUSD as well, you need to match your CUB with BUSD in value.

My initial balance looked like this:

I had 48.46 CUB for which I needed 158.93 BUSD in order to provide liquidity to the pool. This was on the 6th of April, 2021. I didn't write down how much 1 CUB dollar value was at that moment, but it's simple, elementary school math, so I can calculate it any time.

158.93 BUSD/48.46 CUB = $3.2796/CUB

The next day my stats looked like this.

152.82 BUSD/50.41 CUB = $3.031/CUB

As you can see, I got more CUB and less BUSD, because CUB price dropped from $3.2796/CUB to $3.031/CUB.

My goal was to get CUB and not BUSD, so for me the most favorable situation would have been for CUB to go under the price of CUB when entering the pool, which was $3.2796/CUB. On 04.07. I was right on track, on my way to accomplishing my goal.

The nest day in the morning it seemed like things are not going to go my way as I woke up to my balance looking like this:

I was still in a good position as I was holding more CUB than when I joined the liquidity pool but still less than a day before. CUB was at $3.111. Then whales started to make waves and in a minute my balance looked like this:

Cub was at $3.258 and showed an upward trend, so this is when I (thought I) exited the liquidity pool. In fact, I withdraw from the pool, but didn't withdraw my liquidity. What does this mean? Well, I withdraw from the pool, which means I didn't get APR for my liquidity, but the ratio of my CUB/BUSD was still subject to recalculation based on CUB price movement.

When I did withdraw my liquidity, my balance looked like this:

because CUB went up to $3.800 in the meantime. I wrote about it in my post yesterday.

When evaluating my investment I have to compare my final results to my initial portfolio. What's happened between is just impermanent gain or loss and I'm going to talk about that a bit later. Now let's analyze my results.

My initial goal was to farm CUB and earn CUB through the price drop. My bad, I did not write down how much CUB I farmed in these two days as I was more concerned about how much I lost or gained, but it was around 0.8 CUB or so. (48.46 CUB in a pool with around 412.03% APR for 2 days will not make you a whale.) Have I stayed in the pool for a longer period, I would have earned more, worthy to take into consideration when doing risk-management :) I'm going to leave it out though and see what I got in dollar value.

My primary mission has failed if I only look at how much CUB I got, as I joined with 48.46 CUB and exited with 45.0453 CUB because CUB price went up from $3.2796 (at the moment of joining) to $3.800 (at the moment of exiting).

As total dollar value, my portfolio grew from $317.86 (at the moment of joining) to $342.386 (at the moment moment of exiting). That's a $24.526 increase (in 2 days). However, dollar value of your portfolio is not the only aspect you have to look at when evaluating your progress.

Impermanent And Permanent Loss

Now let's talk about impermanent and permanent loss.

Impermanent loss happens when you provide liquidity to a liquidity pool, and the price of your deposited assets changes compared to when you deposited them. The bigger this change is, the more you are exposed to impermanent loss. In this case, the loss means less dollar value at the time of withdrawal than at the time of deposit. source

The quote above defines impermanent loss as less dollar value at the time of withdrawal than at the time of deposit. In my case, my portfolio showed impermanent loss from the minute of joining, as the dollar value of my portfolio was less and less every day, except for when I pushed the button and (I thought) I withdraw my liquidity.

So basically I had impermanent loss every day, which would have been permanent loss, if I would have withdrawn my liquidity in one of those days. Based on the definition above, I escaped loss and registered gain as I closed the day with $24.526.

This is nice, but you have to look at what's important for you, what was the main goal you joined the liquidity pool for. Many of the CUB DeFi liquidity providers have stated they are not interested in holding BUSD as it's a stable coin that will always be around $1. Their (and mine) main goal is to get as much CUB as possible, through farming and not only.

Where's The Gain

Imagine when CUB DeFi was launched a month ago or so, no one was holding CUB as the airdrop only came after, so the only way to join the farms and/or dens was to buy CUB. The price of CUB started somewhere around $14 if memory serves me. Buying 1000 CUB at $14 was equal to $14,000. Matching that with BUSD, it meant $28,000 in total.

Since then, the dollar value of CUB has dropped to less than a quarter, which means the impermanent loss of those wallets in dollar value must be huge. Now you may ask where is the gain.

source

CUB price dropping can also bring you a nice profit in CUB while you're losing BUSD. It may look like a loss but imagine with how much CUB those portfolios have grown during the last month, not to mention how much CUB must have those crazy APR's been earning and those CUB most likely have been in the den, earning more CUB. And the earning process is not over, as we're going to see a rise in CUB price very soon. Some say it's going to reach $30.

CUB DeFi is a long term project, CUB has to mature to be worth to sell. Selling at these prices is a waste in my opinion, so accumulating and hodling for now is the best atrategy.

This is the case with farms, when you're paired with a stablecoin, tomorrow I'm going to post about other farms, not involving stablecoins.

This is the part when smart users have a pre-written text, about this is not financial advise and bla bla bla. I don't have any as I'm not that smart, but I have to warn you, this is indeed not financial advice, it's based on what I've learnt during roughly one month I've been here. So you do as you please, do due diligence and don't take my word for it.

Posted Using LeoFinance Beta

https://twitter.com/nobordersNB/status/1380583236393402373

I regret that I have not invested since the beginning of the announcement

But I have doubled the staking

Posted Using LeoFinance Beta