It is never too late to start saving

Invest early is the new financial mantra. Start investing in your 20’s and why it is too late if you haven’t invested yet if you are in your 30’s are some of the topics most financial advisors thrive on.

Start saving now is something we have all heard at some point when we were younger. And let’s assume that you took heed of their words and saving 1USD every day when you started college and continued throughout your 3 years of college days, you would have saved 1095 dollars by the time you finished your 3 years of college.

Well for some, that was never a possibility and it was not a possibility in the 20’s or the 30’s, or even your 40’s or 50’s. But it is never too late to start putting aside some extra money for a rainy day.

Here are 5 easy ways you can start saving now:

Every time you get change for your groceries, start putting them aside in a jar. You can convert it Fixed Deposit’s with your bank or even use it make some investments at regular intervals. You will be surprised to see how it all adds up quickly.

Shop when there is a discount or at discount stores and put the amount that you would otherwise normally spend into your savings.

Reduce Utility expenses – Remember to switch off lights when walking out of the room and the same with water, when not in use, close the tap. Remember a penny saved is a penny earned.

Maintain a budget and don’t forget to include all the expenses for the month and all the expenses you know that will be coming up for the year and include them in your budgeting. Start saving for those house maintenance, car expenses, renewals or tuition fees every month etc..

Start packing your lunch or make your own coffee and tea. Plan your week ahead and cook food before you get hungry. Give yourself a treat at the restaurants and cafes once in a while and start cooking more. Don’t forget to include eating out in your monthly finance budget.

Do you have too much free time, then invest your time to generate some passive income.

There are many ways you can start saving. But here is one that I think that works well.

Create a budget – Reduce expenses – Create an emergency fund – Be generous. Keep aside money to donate – Invest your savings – Stick to your budget.

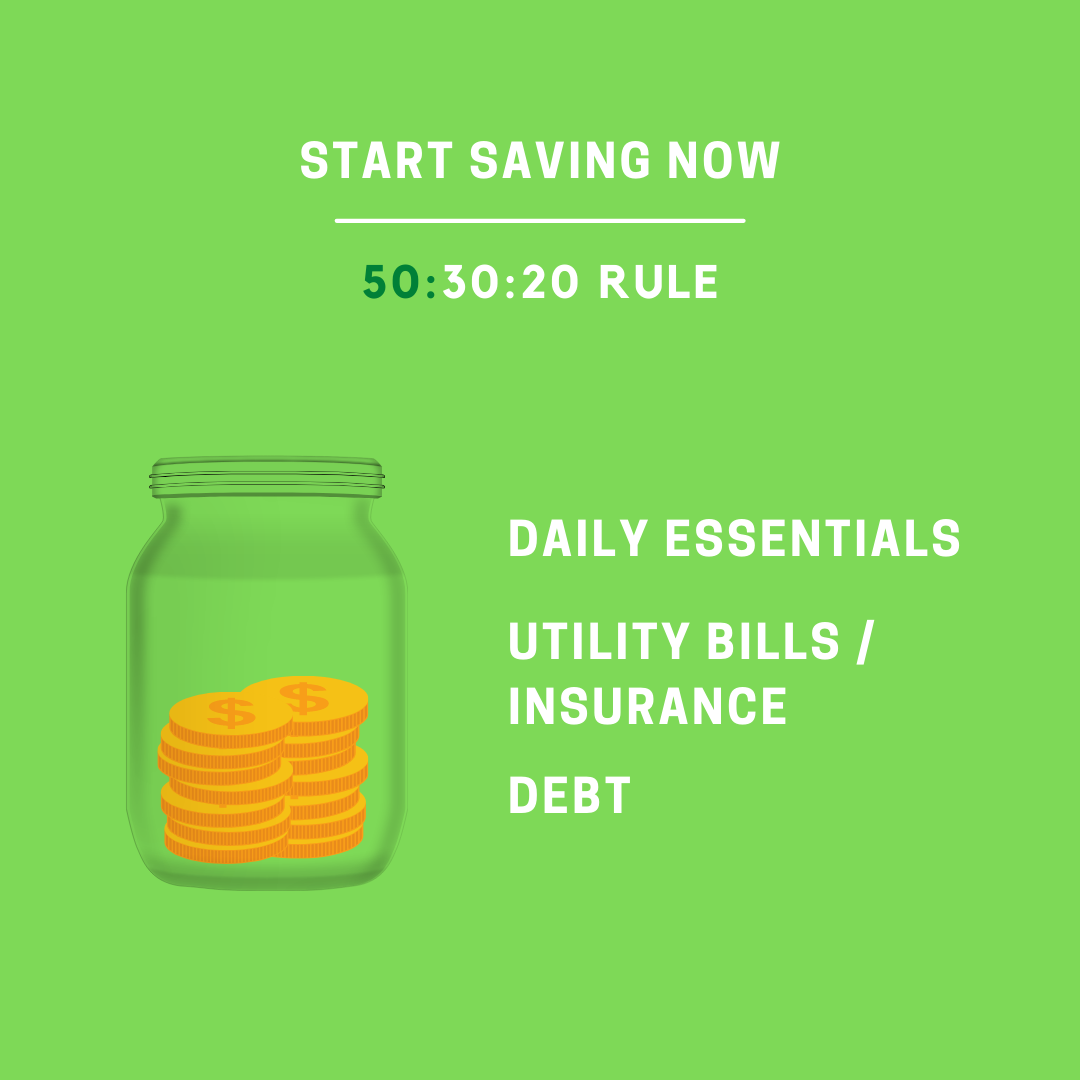

Budgeting can be unique for everyone. But here is a guide I came across a couple of years ago when I was interested in budgeting. It is called the 50:30:20 rule.

According to this rule, 50% of your income should be budgeted towards daily living and includes:

- Rent / Mortgage

- Food – Monthly grocery budget

- Transportation (inclusive of public transport passes / Car payments / insurance / fuel / maintenance

- Utility expenses

- Medical Insurance

- Debt – start paying off any debt you may currently have. And I think this is one of the biggest factors to track when you want grow your savings.

30% of your income should be budgeted towards leisure and includes:

- Eating Out

- Holiday

- Movies

- Pursue Hobbies

- Electronic Purchases

- Shopping

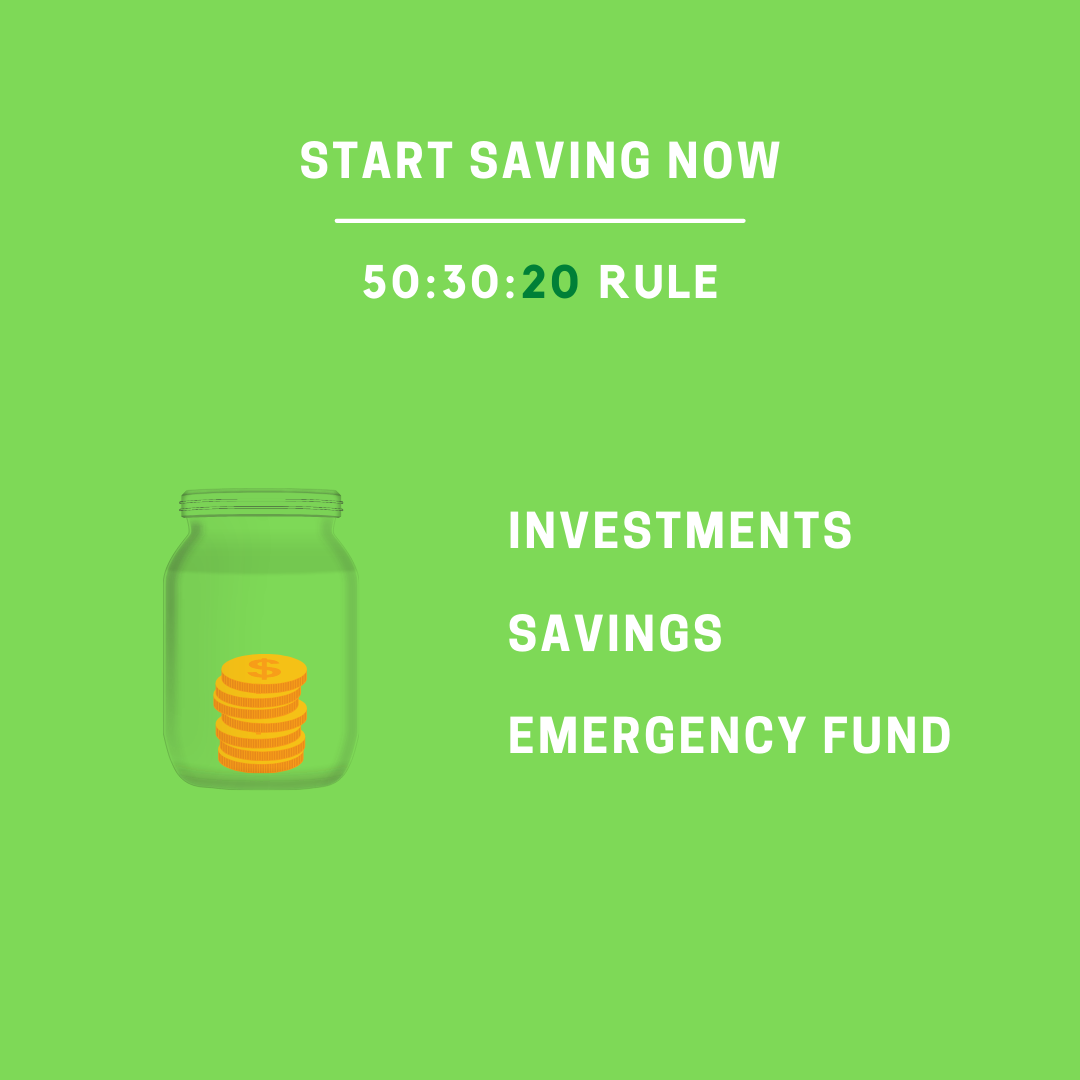

20% of your income should be budgeted towards savings and investments:

- Savings – Bank

- Investments

- Property

- Most importantly – Emergency fund

This is the general rule and you can allocate different percentage of your income within these broad guidelines.

Thank you for reading.

Image created on Canva

Source:

Freepik - Image by rawpixel.com on Freepik

Pixabay - https://pixabay.com/vectors/jar-glass-empty-jar-glass-jar-162166/

Posted Using LeoFinance Beta

Great tips for saving money and they are easy to do too. Thanks for sharing.

I agree. I consider HBD savings now a legitimate form of savings. It has me exiceted

Posted Using LeoFinance Beta

Congratulations @eyewaa! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 60 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

You might be interested in the Saturday Savers Club on the @eddie-earner account. We ❤️ savers 😍

You can also win EDS (best savings token on Hive) and EDS mini miner tokens 🙂

!CTP

I enjoyed the read, but now you'll have to do an episode on how to do Savings on Hive! 😁

Came here from ListNerds!