Cash is the worst hedge against inflation.

Hello everyone...

If we look at the world economic outlook, we will see that there is growing inflation that is destroying weak economies and that is silently affecting the strongest ones like the United States, where inflation has been in constant growth in recent years, if we want a clear example let's look at Turkey or Argentina, weak economies that this year have been positioned as the losing economies, leading their currencies to be mere collector's items because of the huge loss of value.

Even the dollar is no longer considered as a stable currency with which you can safeguard value, that is why multi-millionaire Ray Dalio mentioned something that many people refuse to believe, having dollars in cash is no longer considered a wall against inflation and that cryptocurrencies are a better option.

"Don't judge anything on your returns or your assets in nominal terms, in terms of how many dollars you have. Look at it in terms of inflation-adjusted dollars, And so in cash, like this year, you will lose 4% or 5% to inflation. So pay attention to that, because I think that's going to be the worst investment."

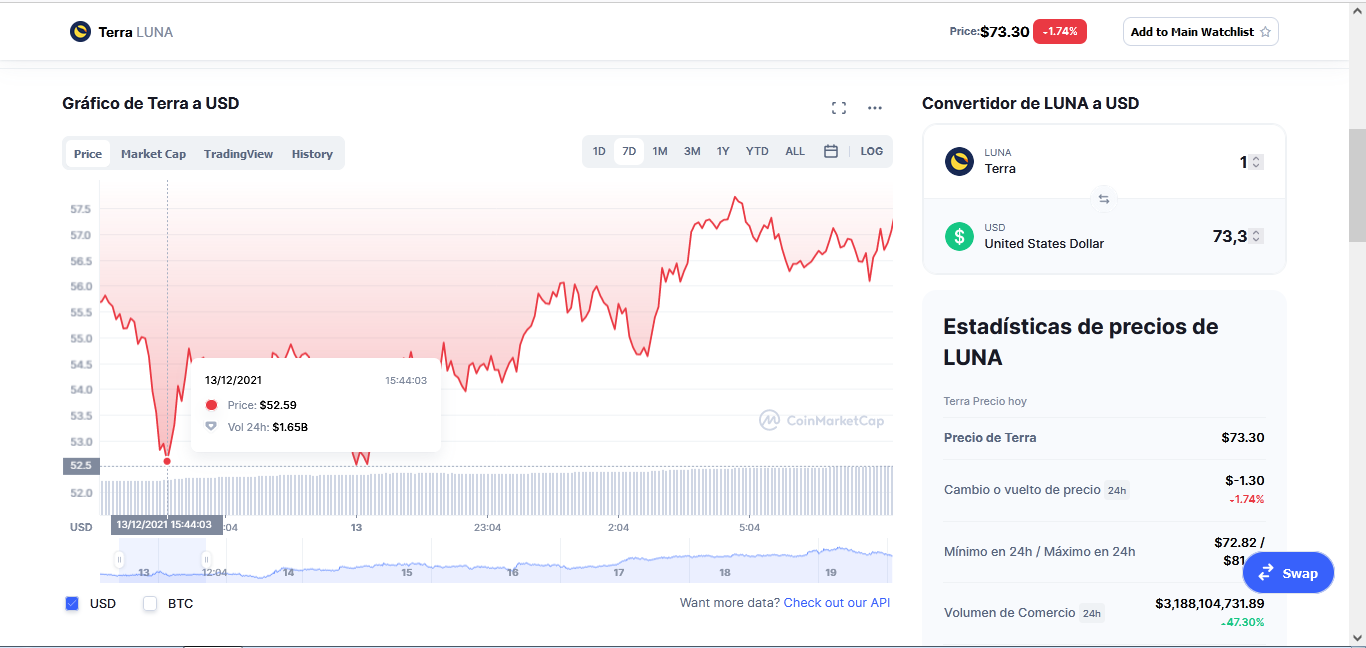

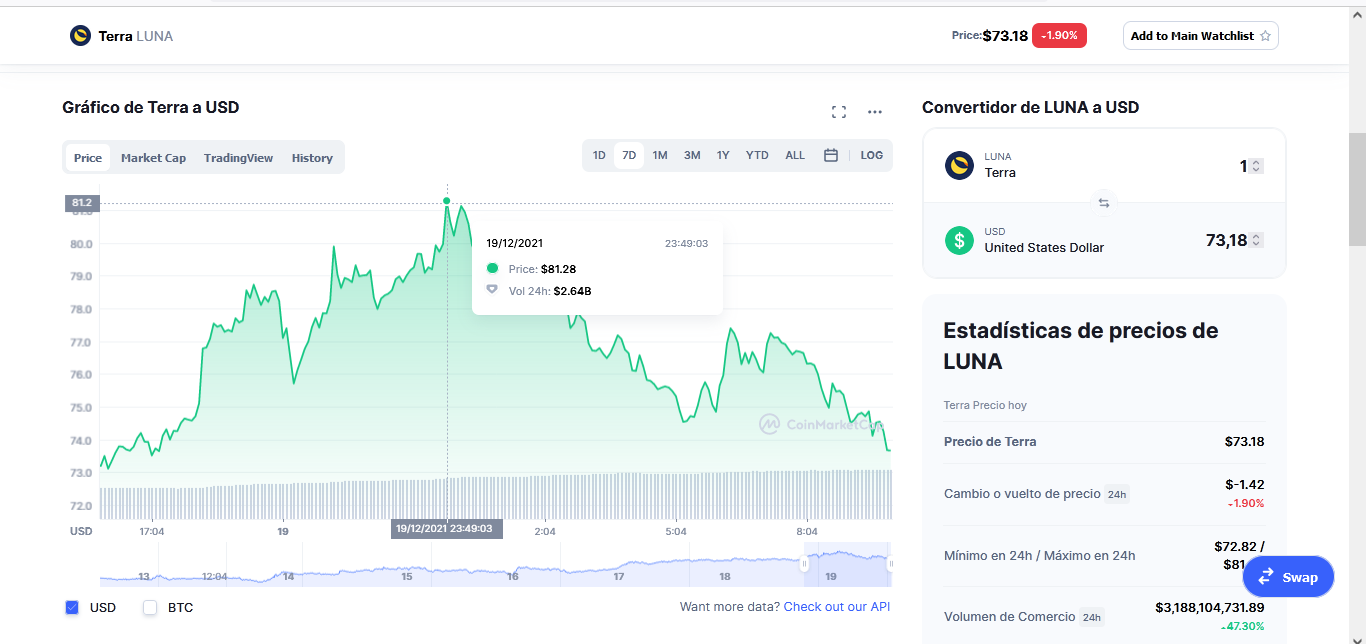

Ray mentioned that the dollar is losing about 4% or 5% a year (maybe more) so imagine you have $1 million and to protect yourself you have it all in cash in a coil at home, well after a few months you will lose between $40K or $50K. Now imagine that you had bought that million dollars in Terra (LUNA) on Monday, December 13 when the price was $52.59, well today and with the rise of the market to $81.28 you would have earned more than $500K and your money far from being devalued by 5% would have been revalued by 54%.

|  |

|---|

And this is just one example of all that cryptocurrencies can do to give good returns on your money, so while all fiat currencies are losing value every day, cryptocurrencies are gaining it. That's why diversifying investments and thinking about cryptocurrencies in the long or medium term can be one of the wisest strategies you can hear from a billionaire like ray dalio.

Posted Using LeoFinance Beta

Of course, right about the time everyone screams inflation, things are starting to reverse themselves. People seem to think this stuff is linear instead of cyclical.

The reality is we will likely see disinflation in 2022 or, if things get bad enough, deflation.

Do not forget, Dalio is famous for his "cash is trash" line. He believes one should never be out of the markets.

Posted Using LeoFinance Beta

Well, in this world everything can change quickly and turn for the worse in a second, it will be a question of seeing how it goes next year.

Posted Using LeoFinance Beta

The signs are there but you are right, we will have to see what unfolds. The slowdown in China is obviously a major concern since that is the world's #1 exporter. If their economy is slowing that is a reflection upon the rest of the world.

The Bond Market might be pricing this is as is the Eurodollar futures (LIBOR). The inverting yield curves is never a good sign.

Posted Using LeoFinance Beta