5 different ways to earn in DEFI

Following on from my article on De-Fi, today I want to talk to you about the different types and ways you can earn through this choice!

Basic Categories:

Decentralized Finance includes many different categories of financial services. We will focus on those that exist and are already in use today.The categories of financial products that DeFi has managed to decentralize are the following:

1. Staking your Cryptos

Probably the simplest ways to generate passive income with DeFi is to receive an interest rate in exchange for depositing your crypto. It looks like a deposit account in a regular bank. However, these days interest rates are quite low, if not negative. With DeFi, the opportunity for returns can be significantly higher compared to a high street bank.

When you stake your crypto assets, you become a transaction validator or a hub for the network. This is very important to the functionality and security of the network, so participants are financially incentivized to continue doing it.

Τhe range of options to choose which coins/tokens you can use for staking or which platforms to choose, is huge!

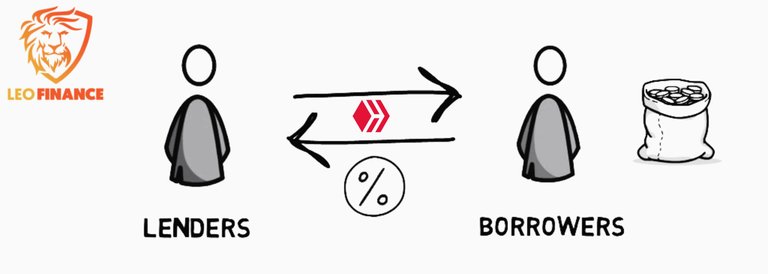

2. DeFi Lending

Lending is another way to earn passive income with DeFi. Similar to staking, which we just explained, you can earn passive income from DeFi lending by depositing your coins/tokens in an account for a period of time. the platform on which you do this in turn leases them to others (borrowers). In return, you get an interest.

Why someone to risk lending his capital? The key element of lending in a DeFi is that the entire lending process goes through smart contracts, so the risk of a borrower defaulting is essentially zero.

3. Yield farming

Yield is another way to park your coins/tokens in exchange for interest or other types of rewards. Essentially what happens is the following. The user of a DeFi platform can place their funds in a liquidity pool. Once these tokens are locked through a smart contract in a decentralized application (Dapp), he will receive a fee or interest to allow his assets to be used across the platform or borrowed and sold. It is like our deposits in the bank, it is at their disposal to use as liquidity for a new loan.

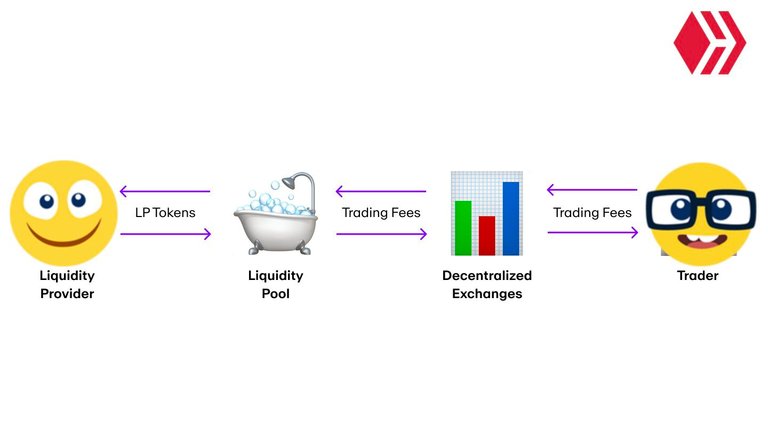

4. Provide liquidity (Liquidity pools)

Liquidity pools are an essential part of DeFi, as they provide the liquidity that is necessary for these exchanges to function. They are created when users lock their coins/tokens into smart contracts that then enables them to be used by others.Typically these are reservoirs of cryptocurrencies that anybody can access. In exchange for providing liquidity, those who fund this reservoir earn a percentage of transaction fees for each interaction by users.

5.Liquidity mining

Is a process in which crypto holders lend assets to a decentralized exchange in return for rewards. These rewards commonly stem from trading fees that are accrued from traders swapping tokens. Fees average at 0.3% per swap and the total reward differs based on one’s proportional share in a liquidity pool.

Posted Using LeoFinance Beta

I think the one i know is stacking

I have stacked some of my coins that has yield me more.

Even here on hive

I i have recently started orivoding liquidity to some pairs in Minswap! I quite simple with cool APY! Thanks for your comment!

Wow that's cool

https://twitter.com/1563202102239055873/status/1591320715579756544

The rewards earned on this comment will go directly to the people( @giorgakis ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Hola @giorgakis

Cuando presentas tus dos opciones, en la primera se traduce la palabra "apostar". ¿Eso no es un ahorro de criptomonesdas? Cuendo una persona hace su apuesta se le presentan 2 opciones: ganar o perder. Y a nadie le agrada perder lo que ha ganado con su esfuerzo.

En la segunda opción que tu explicas: se hace más atractivo que la anterior, ya que todo el proceso evita el incumplimiento del "contrato inteligente" que se hace previamente. Así es bueno invertir prestando activos a interés.

Cada ves mejoras las propuestas de inverción: en la tercera, cuarta y quinta; en donde yo no soy tan inteligente para entender dichos procesos financieros. Considero que debe haber mucha seguridad en el sistema para hacer este tipo de negocio. Lo mejor del caso, es que me agradaron muchos los dibujos ilustrativos que graficamente te ayudan a explicar las 5 formas diferentes de ganar en De-Fi

Saludos!

Hi @giorgakis

When you present your two options, in the first one the word "gamble" is translated. Isn't that a cryptocurrency saving? When a person places his bet he is presented with 2 options: win or lose. And no one likes to lose what he has earned with his effort.

In the second option that you explain: it becomes more attractive than the previous one, since the whole process avoids the breach of the "smart contract" that is made previously. So it is good to invest by lending assets at interest.

Every time you improve the investment proposals: in the third, fourth and fifth; where I am not so smart to understand such financial processes. I consider that there must be a lot of security in the system to do this type of business. The best thing is that I really liked the illustrative drawings that graphically help you explain the 5 different ways to earn in De-Fi.

Greetings!

Thanks Maria for your comment! Iam more to staking and recently i start the the liquidity proving in an Minswap dex!

Source of potential text plagiarism 1

Source of potential text plagiarism 2

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud.

Guide: Why and How People Abuse and Plagiarise

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.