How to protect your investment against market crash?

"Do not keep all your eggs in one basket!"

The narrative has always been markets crash, recoup, and then crash again. One should then buy low when the market crush and sell high to enhance their returns when the market recoup. But now that Crypto Market has tapped into a new low bottom - It is tempting to only invest in crypto as attracted by the low price. But one can't overlook the basic rule that emphasizes diversifying your investment and not just putting all eggs in one basket. When planning when to buy and sell, one needs to also plan to protect your investment from possible losses.

Why you should diversify your investment?

When you diversify the goal is to lower your risk and spread the chances of yielding more returns even if one of your investment experience a loss. This means one gets to balance risk and reward in your investment portfolio. Let's take hive, for instance, the platform offers a chance to monetize your time and potential making it an ideal place to invest your time and effort to grow your money.

This is also a better starting point which is feasible even when one doesn't have any money or income to start investing. But once you start generating some money from monetizing your content, this can serve as a source of income to invest a fraction in another project.

What are the other options and criteria for a good investment?

In addition to crypto, one can also explore Equity options which allow one to buy a fraction of shares and earn dividends. The question remains as to which one to consider for a good investment.

If one is to consider stocks to diversify then there are three criteria to consider. We are always going to need food as humans and any well-established food retail stands a better chance of being sustainable and growing in the future. And the reality of climate disasters (floods, fires, and earthquakes) that are beyond our control and the need for continuous infrastructure development will always put the construction company at the forefront.

There is also a greater potential for nations to invest in renewable energy as a solution to mitigate all those climate-driven disasters and infrastructure costs meaning a company that shows a high potential to contribute to that initiative stands a better chance to give more returns and remain relevant for long-term investment. These three criteria can be a baseline to determine the value of what one chose to invest in for future returns.

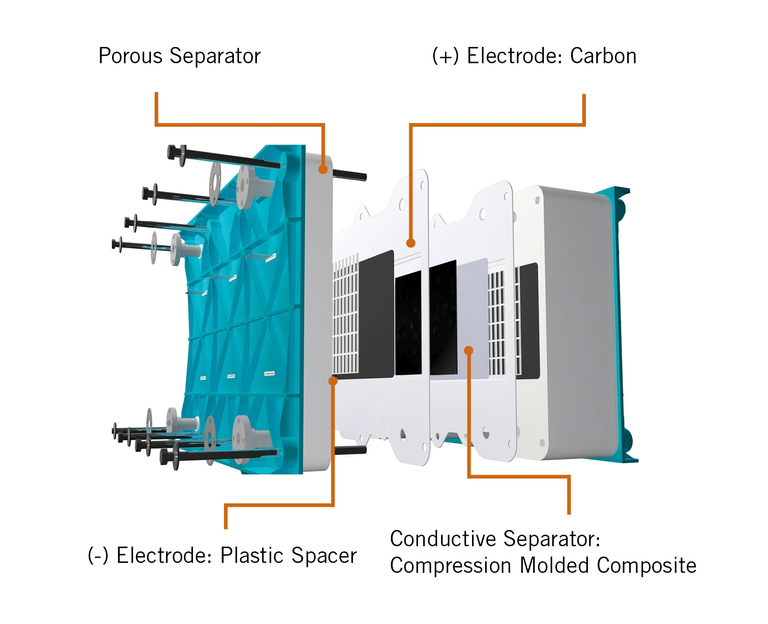

Any project that seeks to provide a sustainable clean energy source also has a high potential to yield more returns in the future. For instance, there is an ESS project projected to take Tesla's spotlight in the nearest future and it can be worth investing in now while it is still going for a low price. Its success rate has the potential to overtake what Tesla can offer regarding clean energy and it is inventing an environmentally friendly battery which is harmless compared to Tesla's invention.

The battery company ESS went public through a SPAC with Acon S2 Investment Corp. and starts trading on the New York Stock Exchange under the ticker symbol GWH. source

One thing to note for this type of investment is that it needs patients and having the chance to buy when the project is just starting gives one a better chance to make more returns in the future. One option could be buying a small fraction with a long-term goal and you can always take the dividends to invest on hive platform or add to your passive income.

Thank you!

Posted Using LeoFinance Beta

I mainly crypto investment-focused at present, but I am keen on diversifying into other areas that potentially can do well in the future. Thanks for sharing the sectors you mentioned, they are worth keeping an eye on.

Posted Using LeoFinance Beta

It would be good to also identify one that would work on long-term returns. Especially now when there's this carbon market and tax policies. Anything that pushes for clean energy is worth looking into.

I have seeing great investors saying if they are going to love buying things from a shop or company they make sure they invest in it so that a fraction is pais back in dividends. I think that's classic.

On that note, You should be investing in pick-n-pay and ocean basket.😅🤔