How does inflation and recession affects cryptocurrency investment?

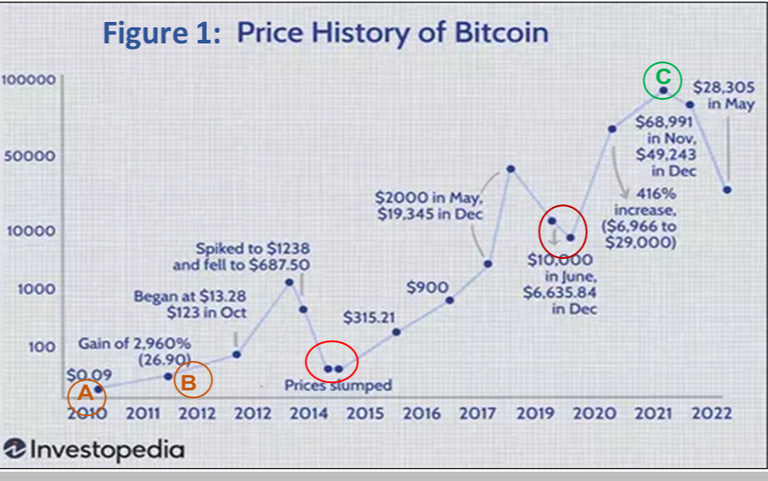

Do you know that Bitcoin's standard price was as low as $0.09 in 2010 and jumped to $0.40 per Bitcoin in mid-2010?

Nobody could have guessed that bitcoin would later follow an upward trend to peak at $68,789 on November 10, 2021.

Does this fact make you feel optimistic about the fate of the hive price? Well, you are logically on the right track! But then, we need to limit the uncertainty in our investment plan to prepare for what is coming (i.e., media hype-warning about a global recession in 2023).

Perhaps let’s take a step back and look into Bitcoin’s historical prices since its invention and implementation in 2009.

As a crypto investor, it is always desirable to make an informed decision when we opt to hold on to our crypto regardless of the media hype. Your input is highly welcome!

How resilient is cryptocurrency against the effect of global inflation?**

We all know that the bitcoin market is volatile and gold is considered more stable. But over the years, bitcoin has proved to be a store of value (worth more over time), which is steeper than gold. Let's take a close look at trends in both bitcoin and gold historical prices relative to inflation.

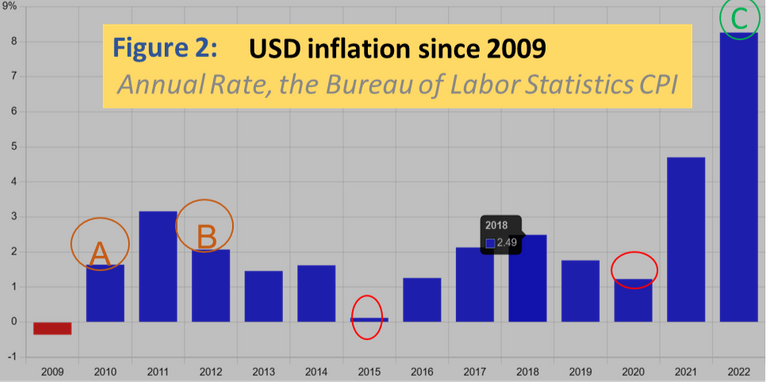

We can use Figures 1, 2 and 3 to analyze bitcoin and gold prices against inflation since 2009, using the USD as our reference point for inflation and gold. We can then align our logical thinking, guided by lessons from past data.

[Image source Figure 1] (https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp): modified using Microsoft Office Powerpoint

Image source: Figure 2: modified using Microsoft Office PowerPoint

1. Lessons from the 2009 to 2015 trends

You may want to note that when bitcoin was introduced in 2009, its price was zero until 2010. Looking at Figure 1, you can see the Bitcoin price trend increased from $0.09 (A) on July 17, 2010, and it rose to $29.60 (B) by June 7, 2011. This trend seems to be responsive to the USD inflation data in Figure 2, which also increased within that period. As time went on, we also witnessed a jump in inflation from 2010 to 2011. Of course, with Bitcoin being highly volatile, there would be some highs and lows over a short period. This is why one needs to think long-term when investing in crypto.

Hence, the USD was on the verge of recession in 2015 (red circle)

This suggests that the demand for goods and services was lower than it should be, and this tends to slow economic growth. As shown in Figure 1, the cryptocurrency market was also affected. The Bitcoin price slumped and bottomed out between 2014 and 2015, but rose again in 2015 much sooner and experienced an upward trend through 2016. Looking at Figure 3, gold trended higher for many years before making all-time highs in 2011 of nearly $2000 per ounce. Have you noticed that gold and bitcoin followed similar trends between 2009 and 2014? But gold had a brief dip and has since been moving lower, but could have possibly found a bottom in 2016.

2. Lessons from the 2016 to 2020 trends

In 2016, when inflation slowly increased, bitcoin's price also increased, closing at $900 by the end of the year. In 2017, we can see Bitcoin climbed up to reach $2000 in May and shot up to $19,345 at the end of 2017, which coincides with an increase in inflation. There was quite a steep upward trend for bitcoin between 2015 and 2019, when compared to gold. Gold had a brief dip and has since been moving lower within that period.

Nevertheless, Bitcoin has registered a steep improvement over gold as a store of value when they both recovered from recession between 2015 and 2020. In 2019, bitcoin experienced a dip, which was also associated with its volatile nature but could also be due to the ease of inflation in 2019 to 2020. This would mean high demand versus supply.

3. Lessons from 2020 to present trends

Fast forward to November 10, 2021, when inflation skyrockets and bitcoin also peaks at $68,789. similar trends with gold, although gold was less volatile when comparing the min (dip) and max (peak) prices. The lesson we get from this dynamic is the volatility of the bitcoin market and its resilience in minimizing the effects of inflation.

Years of increased inflation also show bitcoin appreciation and that has been steeper than gold. The upward trends of bitcoin were more prominent than the downward trends, regardless of the inflation status. These trends can aid in making a sound judgement on Bitcoin's resilience when preparing for what is coming in the future of your cryptocurrency.

Is Bitcoin affected by inflation?

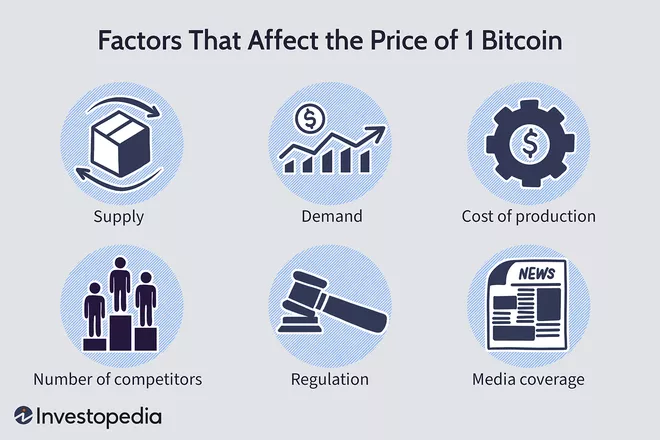

Bitcoin is quite volatile, and its overall rising trend is clearly responsive to inflation. If you look at Figure 4, there are quite a number of factors that determine the fate of bitcoin prices, both in magnitude and direction. These factors drive its volatility, and this roughly applies to most cryptocurrencies. source.

In practice, there is no doubt that Bitcoin's price is affected by supply and demand just like most assets, commodities, and other investments or products. This means Bitcoin demand is said to increase when there is a limited supply. In simple terms, Bitcoin's price is heavily affected by how much people are willing to pay. Of course, media outlets, hype, government regulation, and the number of investors' perceptions will have a major impact on bitcoin or cryptocurrency prices (see [source] (https://www.investopedia.com/articles/investing/052014/why-bitcoins-value-so-volatile.asp#citation-16)).

Image source: Figure 4: by Alison Czinkota

Thank you for reading!

.........The End......

Humbe 2022

submitted to #Leofinance

Posted Using LeoFinance sup> Beta

There are similarities in the upwards and downwards trends of Bitcoin and gold, though Bitcoin is more volatile, Bitcoin also exhibits better price appreciation in comparison to gold.

With both being assets worth owning in portfolios, I see Bitcoin as digital gold.

This is true and has always impacted the price of Bitcoin and Altcoins, it is each person's responsibility to research before investing in cryptocurrency.

Posted Using LeoFinance Beta

@joetunex

True there are similarities, I think alot of people are just afraid of the unknown with bitcoin given that it doesn't have a long history of existence so it is more of choosing what we are familiar with. And it's volatility just put low risk takers off.

Indeed When it comes to media hype and all the government regulations. That's when one will really need to do a research and base the decision on the their appetite for risk.

Seeing how volatile bitcoin is, short term investors and low risk takers may not find bitcoin suitable for investment. The goal has to be atleast 5yrs investment.