Bulls vs Bears for Bitcoin's Monthly Candle

The market is closer to accept a bullish sentiment but the bears are not into it. Since the investors' approach is still positive against Bitcoin, it gets harder for Bears (those who want to hunt long positions and make money from the red candles) but they are still fighting for that.

After the FOMC meeting, the volatility in crypto has increased as we are getting closer to the historical event of Bitcoin halving and the story of interest rate cut delay is already bought / sold by the traders. So, the ultimate sentiment is more inclined to the bullish side rather than the bearish as we had for 3 years in crypto.

Though we all have a position in altcoins and the altseason will be a fascinating time for crypto, the scope of the crypto is no longer limited to our $2.5T market. Now, the crypto market has become a part of the financial markets with its unpredictably wild nature. This " non - sleeping " market is a great indicator of what's next for the stock markets, the risk appetite of the giants, and the sentiment of the retailers (householders) rather than the whales.

If Bitcoin Closes Monthly Candle above $74K

This would bring both Bitcoin and altcoin season to the crypto market. As you can see below, The top level was around $74K that refers to the resistance level of the channel. The bears and bulls are fighting for two things at the very moment:

- Daily close above $71K today

- Monthly close above $74K (breakout of the channel)

However, such a strong sentiment would spread the other markets, as well. Do the stock markets ready for that?

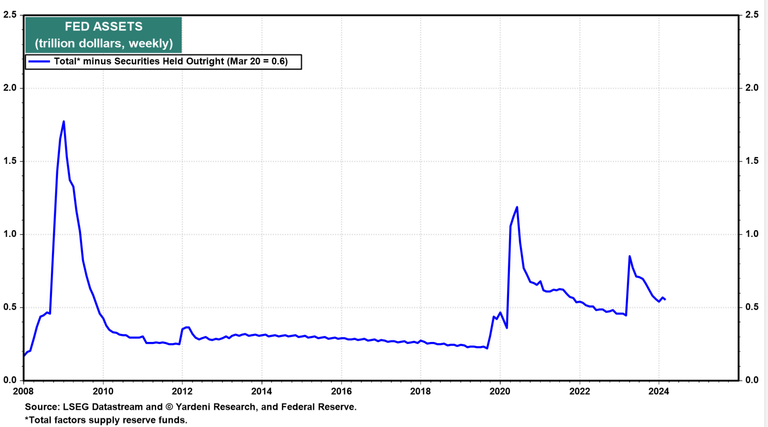

To be honest, I do not see a fascinating time of crypto in the near future. This might be postponed to the months like August or September. First of all, the interest rates are high, the banks are at risk (which triggers massive fear in the markets) and the central banks are indirectly helping the banks to survive during the interest rate hikes.

Apart from that, the risk of recession is growing in Europe and China. The growth rates are not satisfactory.

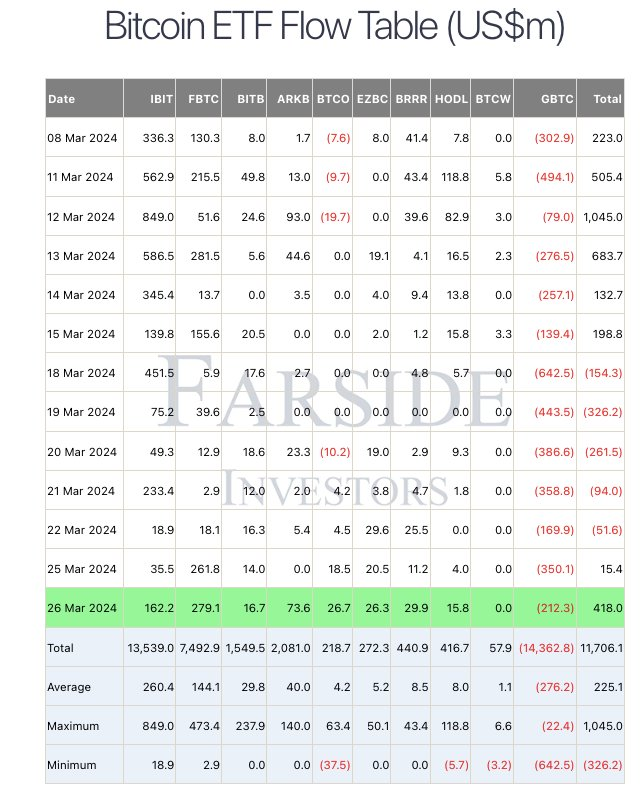

On the other hand, the spot ETF purchases continue to push the price higher. If the bears want to control the demand, they need to go harder.

The current pressure on the markets does not seem to be sustainable. However, the bearish side will try to manipulate and control the market as much as they can. Once the historical resistance levels are broken in the Altcoins as well as Bitcoin, the bears will have no opportunity to deal with the growing avalanche of buying pressure by newcomers and the ETFs.

For now, the bears may still keep up with the bulls as the markets are not 100% ready to jump into too risky positions. However, when the central banks start to be lenient, the results might be different 😉

What do you think about the current state of war between bulls and bears?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

We are on the way up, but there is room for consolidtion.

https://de.tradingview.com/chart/BTCUSD/pihFehxm/