Calculating Net Gains of PolyCUB Investment - Week 12 💰

The first xPolyCUB Governance voting was done to adjust the multiplier rates of farms on PolyCUB. As a result of the voting stage, the PolyCUB farms, the multiplier rate of pHive / PolyCUB farm has increased to 1.75 from 0.5 levels.

As stakeholders of this project, we prioritize our platform's decentralized and autonomous model. Since the developers' tokenomics and operations are perfectly managed, the stakeholders do not have to worry about their investment.

The only role adopted by the investors is to help the platform reach many people and generate more value for the PoL, Farms, and Kingdoms.

The token has gained a lot value from the dip level ($0.13) that we tested. The voting triggered xPolyCUB war for sure 🔥

Update

Last week, I added $150 pHBD / USDC liquidity to my investment (25th of May) to participate in Provide Liquidity Week Challenge.

With this investment, the total investment reach to $1,650 since the launch of PolyCUB platform.

The Performance of Investment - Week 11

In total:

-$261 from USDC / PolyCUB pool

-$42 from WETH Pool

+$155 from xPolyCUB staking

+$20 from liquid PolyCUB

= -$127 net gains on our initial investment

Note: The net gains from our investment were -$153 last week.

This is the immediate effect of the %10 pumps on PolyCUB.

The Performance of Investment - This Week (W11)

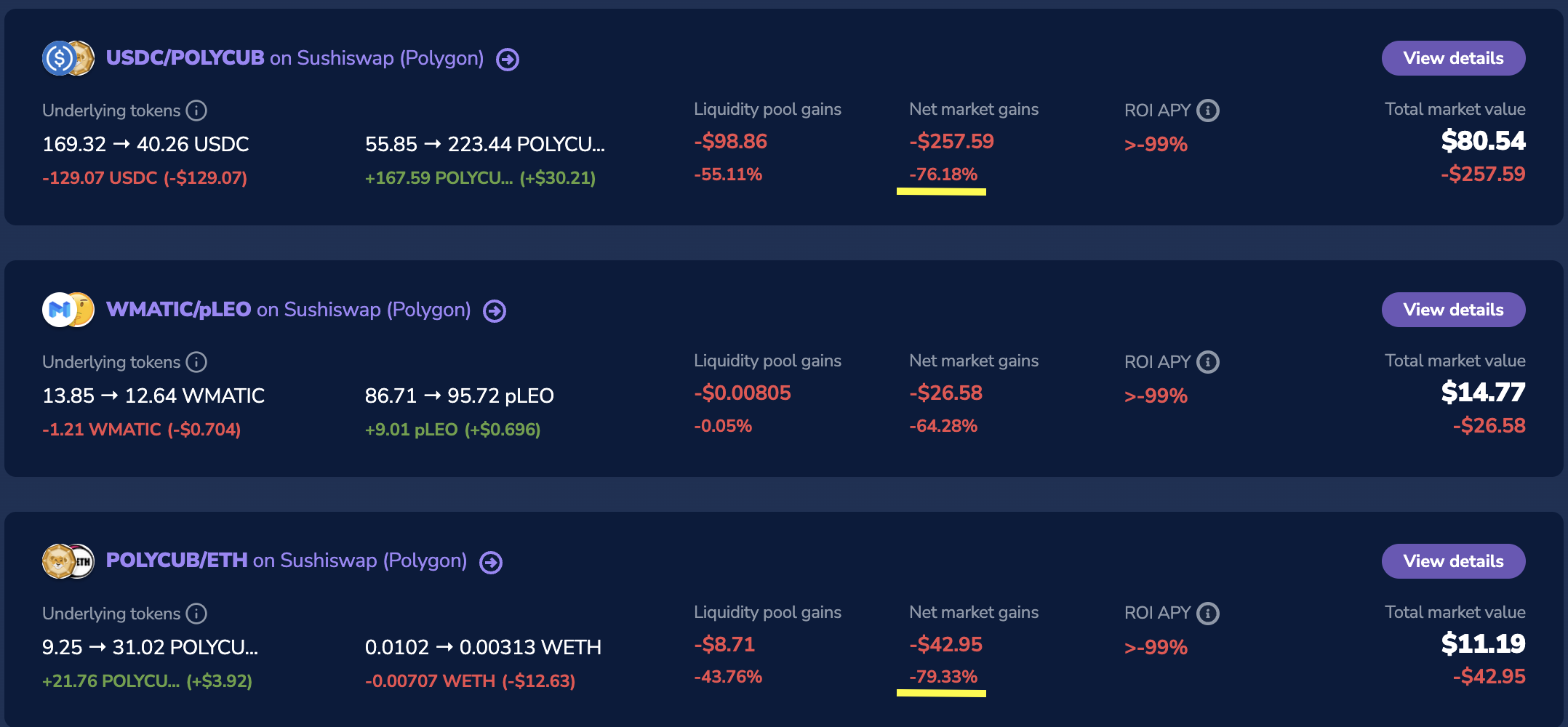

There is nothing much different in the performance of PolyCUB / USDC and PolyCUB / WETH Farms. Both of them are swinging between -70-80% market gains for a couple of weeks.

The harvests and xPolyCUB multipliers are hedging the unrealized losses at some price levels. Especially when the token value is above $0.60, there will be no negative return of the investment even though the price of PolyCUB dropped from $6 in the first week.

xPolyCUB Staking Revenue of W11

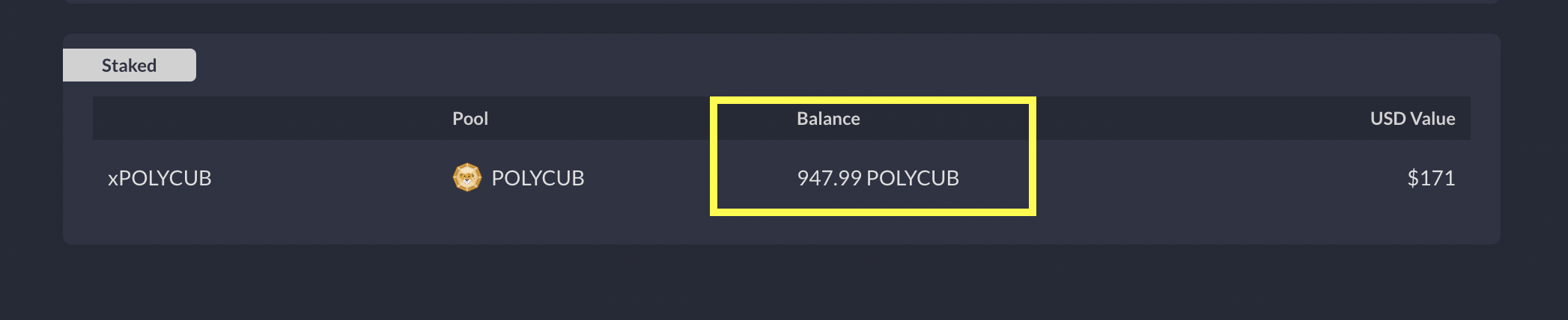

The staking balance of xPolyCUB is exponentially increasing day by day. Since the unlocking window was reduced to 30 days in the earlier voting stage, there are also some tokens from early harvests to add up over there.

As you can see on the screenshot, there are about 3 PolyCUB tokens to be claimed and staked on xPolyCUB. Yesterday, the number of token to be claimed was below 2. It means that the tokens are dripping after 30 days from the harvest 😌

In total:

-$256 from USDC Farm

-$26 from pLeo Farm

-$43 from WETH Farm

+$171 from xPolyCUB staking

+$29 from liquid PolyCUB

= -$125 net gains from the initial investment.

+10 PolyCUB unlocked and increased since last week.

Stablecoin Experiment - Hive Staking & pHBD / USDC Farm

We started getting unlocked PolyCUB from our second investment in which we added liquidity to pHBD / USDC Farm.

The tokens unlocked in this experiment will also be added to xPolyCUB staking to compare the performance of Hive Staking and pHBD pools at the end of the year. This week, it is the first time xPolyCUB staking will be initiated 🤩

From a $128 HBD investment, $2.13 interest is received with a 20%APR rate. On the other hand, the amount is $5.20+ in PolyCUB investment when locked and unlocked tokens are considered.

TL;DR

The first xPolyCUB Governance voting resulted with some major changes for PolyCUB farms. Even though the multipliers are revised, they are still generating decent amount of money with juicy APR.

Last week the overall performance of our investment was -$127 and there was no token being unlocked yet. This week, we will be able to compound the unlocked tokens with xPolyCUB tokens to stake and grow the portfolio.

This week we have -a $125 return of investment + 10 PolyCUB tokens to increase xPolyCUB staking. When the price of PolyCUB stays above $0.60, all re-investing accounts will have a positive return.

For Stablecoin investment, pHBD pool generated $5+ value in locked and unlocked PolyCUB tokens while Hive Savings got $2.13 in HBD. I believe both of them are great returns for investment, choose your side to get the best APR for your investment 🦁

Posted Using LeoFinance Beta

you are getting closer to break-even!

Posted Using LeoFinance Beta

The unlocking has started and it will accelerate the process to get to break even. Looking forward to seeing the situation in Q4 2022 🔥

Posted Using LeoFinance Beta

Isn't this the 2nd governance vote and not the first? I am confused because the first was to change the 90 day lock period to 30 days.

Posted Using LeoFinance Beta

It is the first one that we decided on the multiplier rates. The earlier one was about the window of unlocking ^^

These stats don’t look bad at all. If the price of pcub can maintain this momentum ver the next months you’ll break even soon enough

Posted using LeoFinance Mobile

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment !STOP below

View or trade

BEER.Hey @mistakili, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Just $0.60 will be enough to get break even point. Not bad for sure :)

.

Waiting for sentiment to change. The bull-run will be amazing for PolyCUB for sure :)

.

Thanks for the review and commentary.

Posted Using LeoFinance Beta

Thanks for the report on your investments and the project changes.

Posted Using LeoFinance Beta

Thank you for your visit mate :)

your welcome

Posted Using LeoFinance Beta