Dot Plot & Powell Day of Markets

The central banks are important players of the global finance as their monetary policies directly impact the market sentiments. Since March 2022, we have been following the interest rate hikes or stable interest rate of 5.50% in the U.S. The decision by the FED is never limited to the economy in the United States. From the developed economies to developing ones, the policies of the FED decide on the attributed value of almost everything.

When the central banks follow a tight monetary policy, the interest rates make the fiat money valuable against the assets and commodities. In such cases, the narrative that " cash is the king " finds a place for itself. However, once the interest rate cuts start to take place, the value of fiat money start to drop as the investors will shift their funds to the cheap assets that lost their value against USD, EURO or other fiat money.

This is the reason why we support that the value of a currency is decided by the interest rate that the central banks decide to be paid for. If the rates start to go lower, then the fiat money, the DXY index of USD in the current case, will get into a downtrend unless there are external factors such as geopolitical tension, war or bank - run in the giants of economies.

Will the FED lower the interest rates in March?

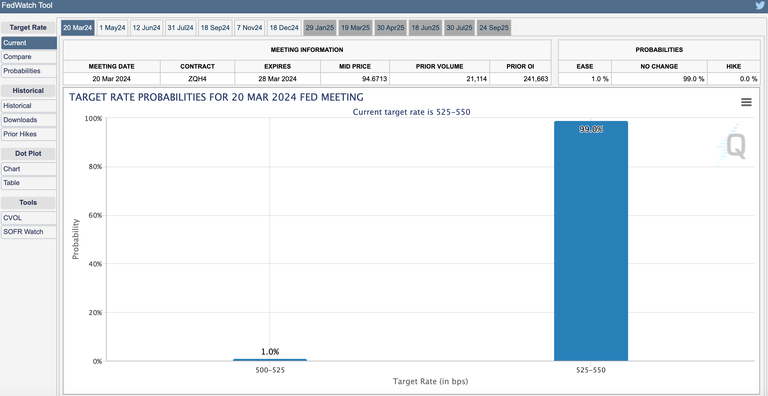

This is not a possible scenario that investors follow. Rather, the consensus is on having stable interest rates until June 2024. In such days, every investors should have an eye on FED Watch Tool by CME as the policies will influence your financial decisions, too!

As you can see above, the current interest rate is expected to be the same in today's FED meeting. The interest rate cut possibility is not even on the table (1%) for the investors.

This is not the reason why investors care about this month's FED meeting. Actually, there are two reasons why markets impatiently wait for the FED decisions.

1 - The speech by Powell will hint whether there will be an easing or we will continue as tight as today.

2 - The dot plot will be released to see how many interest rate cuts are projected by the other governors of the FED.

These two things are likely to turn the market either purely green or red depending on the stance of the FED on the ongoing inflation in the U.S.

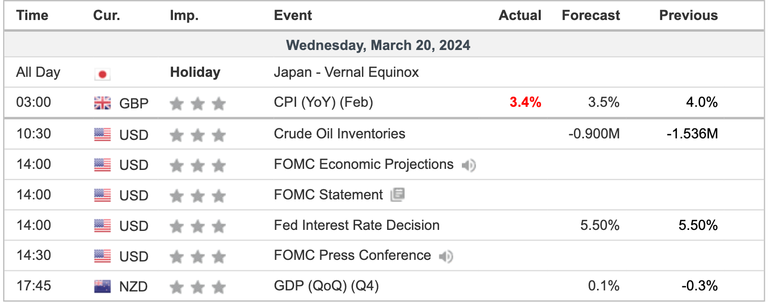

As you can see the Economic Calendar by Investing above, the inflation rates are going lower all around the world. The lower the CPI and PPI data, the lower the interest rates. The global markets will start to buy this narrative because the positive atmosphere is contiguous.

CPI data of GBP was better than expectations. Unless the fear of a recession breaks out, we may see green stock markets and a stronger crypto market through summer.

Let's wait for it. At 14:00 (GMT) we will get the interest rate decision and after 30 minutes, at 14:30 (GMT) the speech by the chair, Powell, will hit the markets 😅 Having some volatility today should not scare you. It is an ordinary FED Day.

What do you expect from the dot plot and Powell?

Share your ideas below 👇

Hive On ✌️

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks for that ✌️

!DHEDGE !PIMP

You must be killin' it out here!

@trumpman just slapped you with 1.000 PIMP, @idiosyncratic1.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/3 possible people today.

Read about some PIMP Shit or Look for the PIMP District

The Fed are always under some sort of pressure when trying to balance the economy I must say. No easy task, that's what fiat gets you doing every season.

Congratulations @idiosyncratic1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 6500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP