Economic & Crypto Calendar (May 30 - June 2)

Today the markets were closed in the U.S. due to Memorial Day. While the markets were not open, the crypto ecosystem had a slight pump with the sentiment getting more positive after the agreement on the debt ceiling in the U.S.

Although it was just one of the news effects on the markets, it is also quite positive to eliminate at least one hotly debated concern.

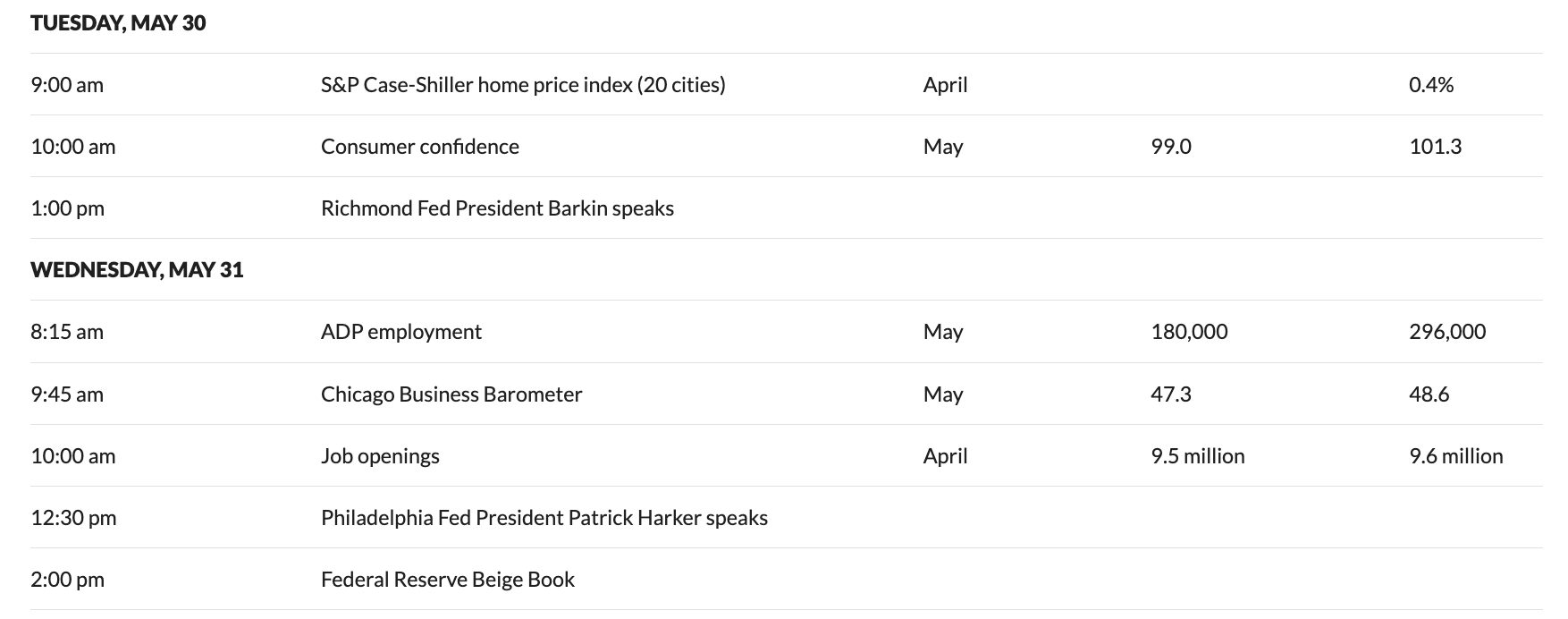

Economic Calender of the U.S.

I use MarketWatch to track the economic calendar of the U.S.

As of last week, the concern of the market has changed. Formerly, the debt ceiling was the main point that was seen as an "uncertainty" but the new favorite narrative of the market is "deep recession" considering the performance and the expectations of consumers & managers.

Tomorrow, on Tuesday, we will get the Consumer Confidence Index and the expectation is to see the levels below 100. We may interpret the data as dropping confidence rates among consumers. Less confidence may bring less money spent and growing expectation of mild recession(!)

The drop in the ADP employment rate can also be a strong sign of a slowdown in the economy on Wednesday.

We will combine both Job openings and ADP employment rates to make a forecast.

The week of full of tension! Thursday is the day for jobless claims. If more people are jobless, it is seen as a positive sign because there won't be a need for extra precautions by the FED. After the claims, we will get solid numbers of employed people in the U.S.

1 important point: The median expectation is very low, only 188K, and we may see a higher number of employed that may turn the markets red. If the unemployment rate exceeds 3,5%, this would be a bullish sign for sure!

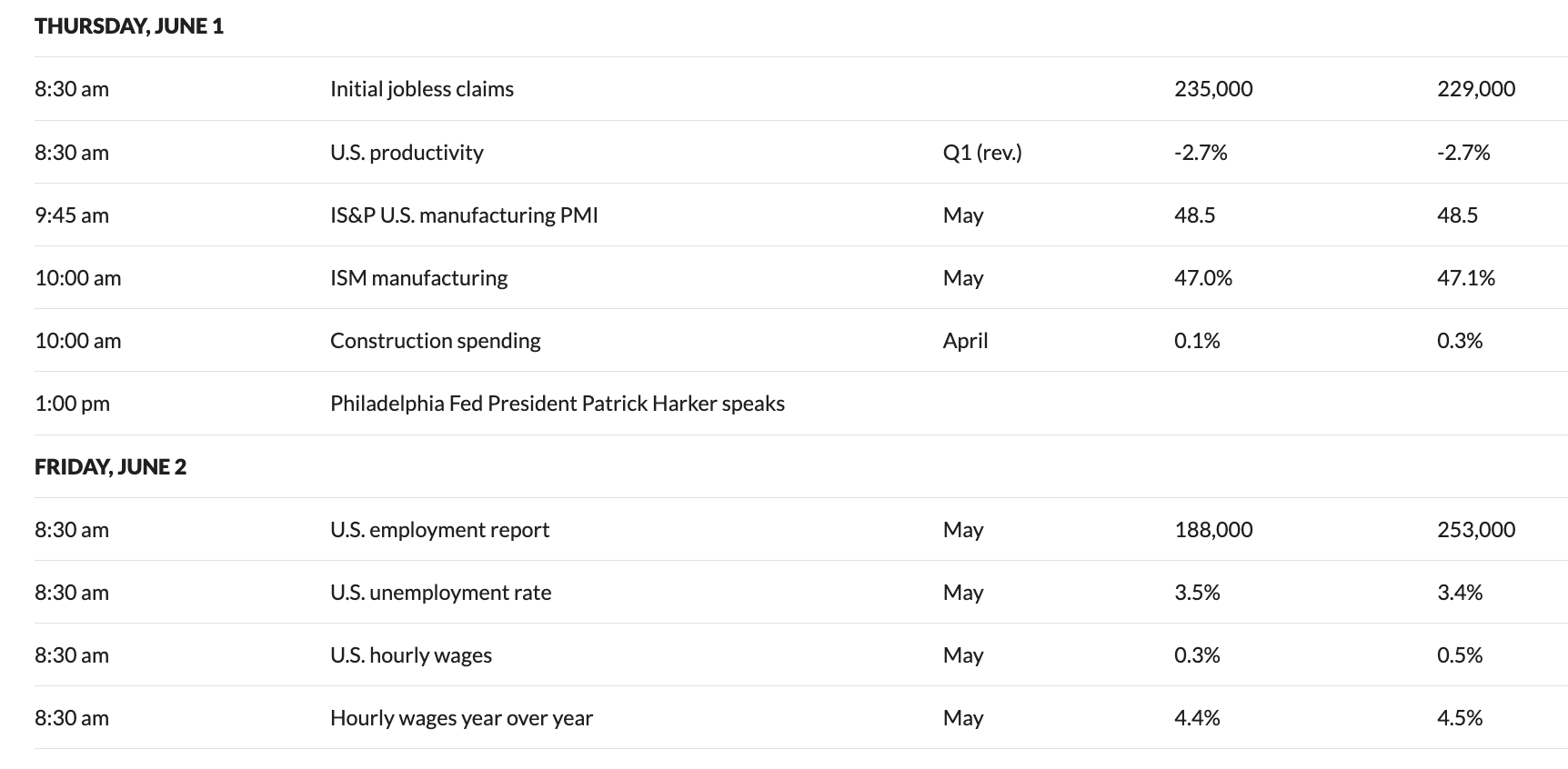

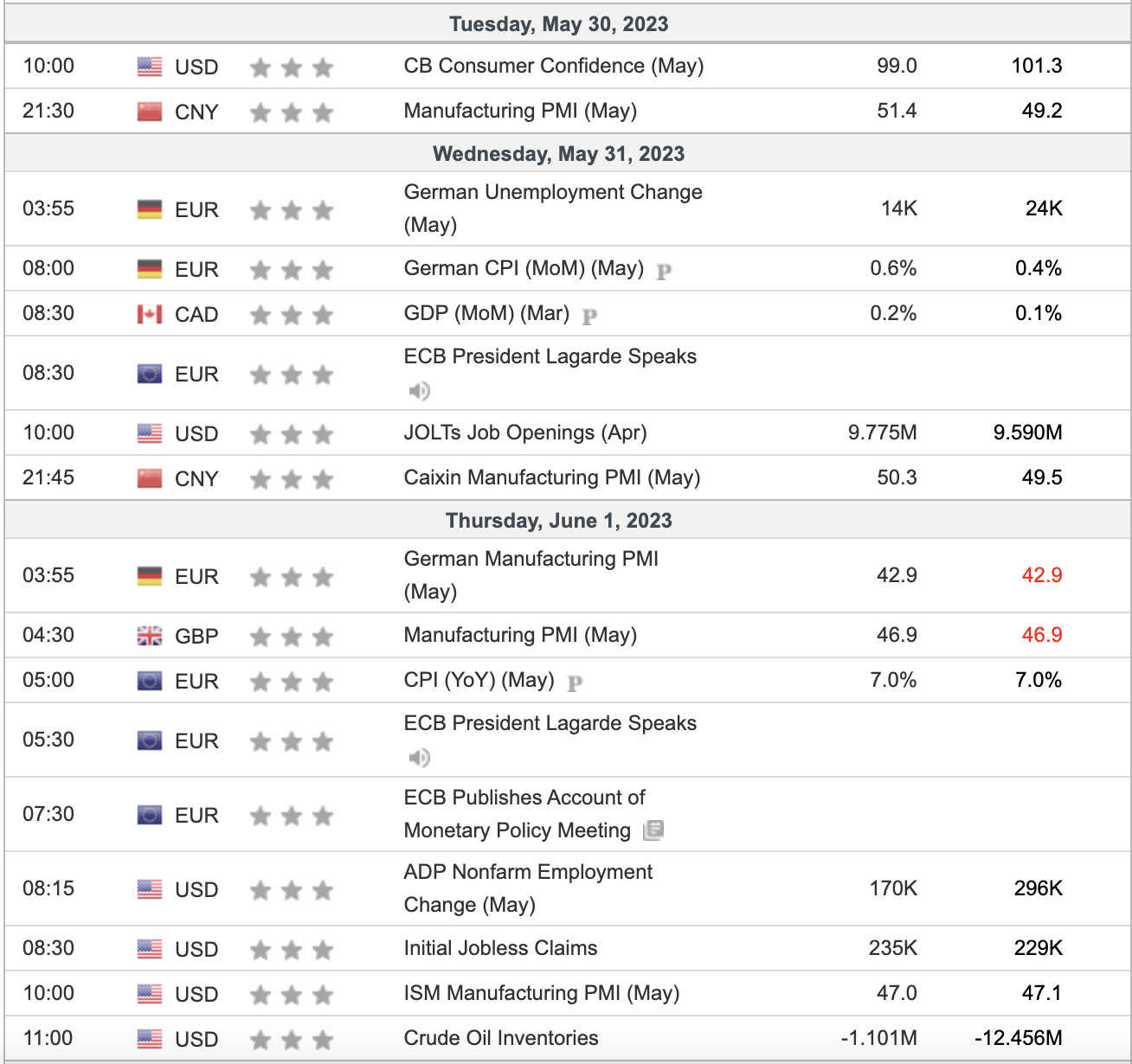

Economic Calender of G20

There are some basic expectations from the G20 countries: Do not let recession stop the economy and affect the markets. Majorly, eyes are on Germany, the U.K. and China.

When it comes to China, the reliability of the data is seen as doubtful by some analysts. However, I do not want to focus on that part and be more optimistic about that issue.

The growth of China, and the heat of the economy, are pretty important for the whole world as China is the factory of all economies with cheap production costs and labor. We need a recession-resistant sentiment in Asia.

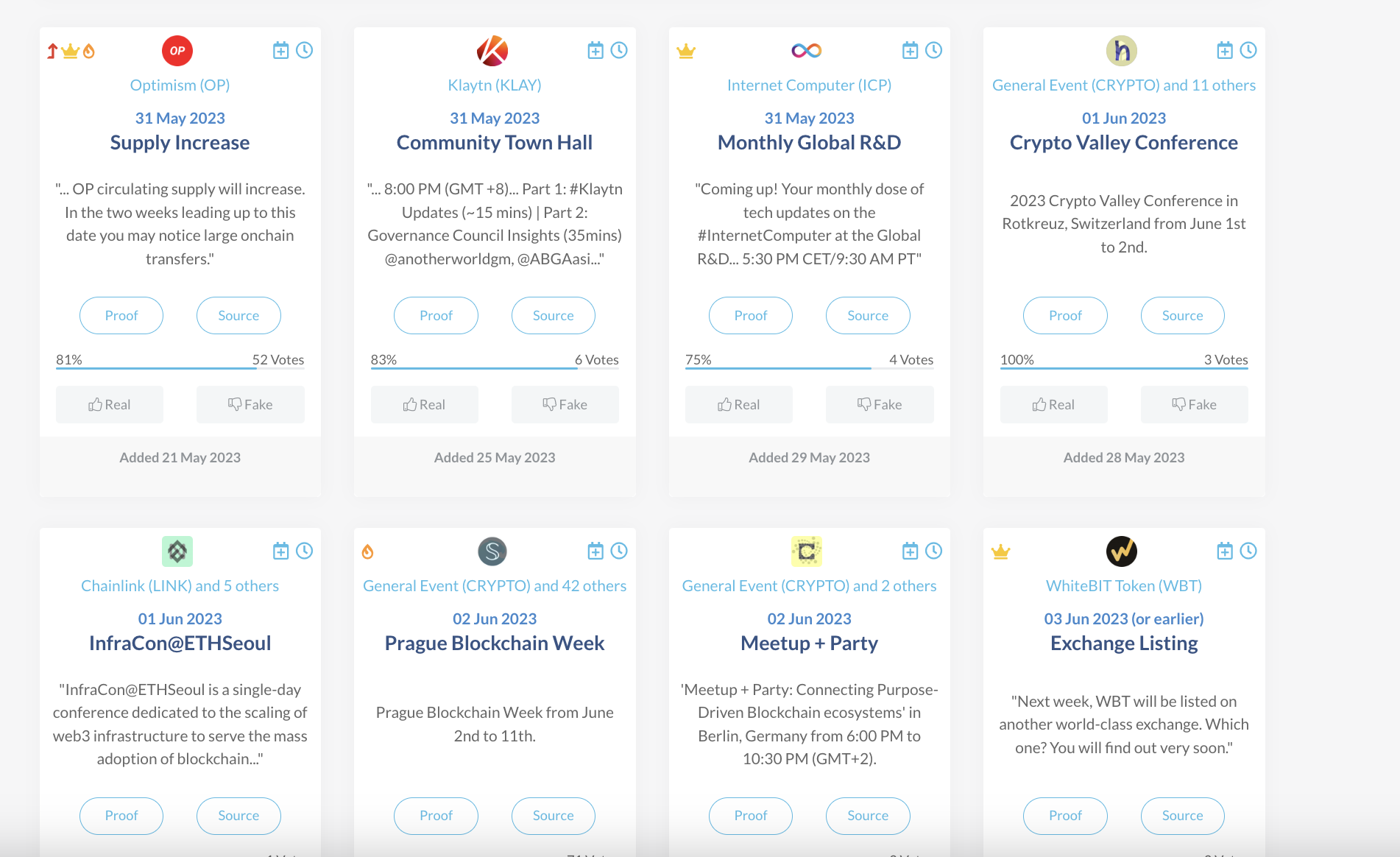

Crypto Calendar

Actually, there is no big launchpad event in crypto. Tenet made 17 x last week but there won't be such a big event on DAO Maker or Seedify for now.

The only event that I'll have an eye on is the increase in the circulating supply of Optimism Layer 2 token. We may witness a little dump on the price of it with this news. Also, I'll be paying attention to the distribution of the second month's SUI token allocation on OKX and Kucoin.

More focus will be on the macro economy this week.

What do you expect from this week? Are you prepared against any pump or dump in our ecosystem?

Hive On ✌🏼

Posted Using LeoFinance Alpha

https://leofinance.io/threads/idiosyncratic1/re-idiosyncratic1-2rjk9xfsc

The rewards earned on this comment will go directly to the people ( idiosyncratic1 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Congratulations @idiosyncratic1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 110000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

The economic calendar clearly depicts the market moves, even the market structure works. But many Gurus and experienced investors and traders who have been in the system of crypto for years focus on the Economic Calendar and mostly on Sentimental news. We clearly understand how this means. The closing of market at US for most Banks would slowly move the market, and hence no major activities would be seen. For instance when trading other crypto pairing with US Dollar, one must be careful either the US Dollar being Based currency or the Crypto being Based currency.

That is why most Crypto investors predict market using the economic data release. And this is one of the calendar I like when it comes to Micro/Macro Economics.