Farming Liquidity Volume of Meme Coins

Today I did something that I've not done over the last 3 years. I bought a meme coin. It is a different way of feeling as I do not see any future and utility for them like 99% of us but it sounded reasonable for me to make a small amount of purchase.

I bought some Pepe coin not because I believe it is better than BabyPepe, AIPepe, Shibaindoge, moondogeinshiba, or whatever. The mere reason was to farm liquidity on it by using concentrated liquidity pools on Uniswap V3.

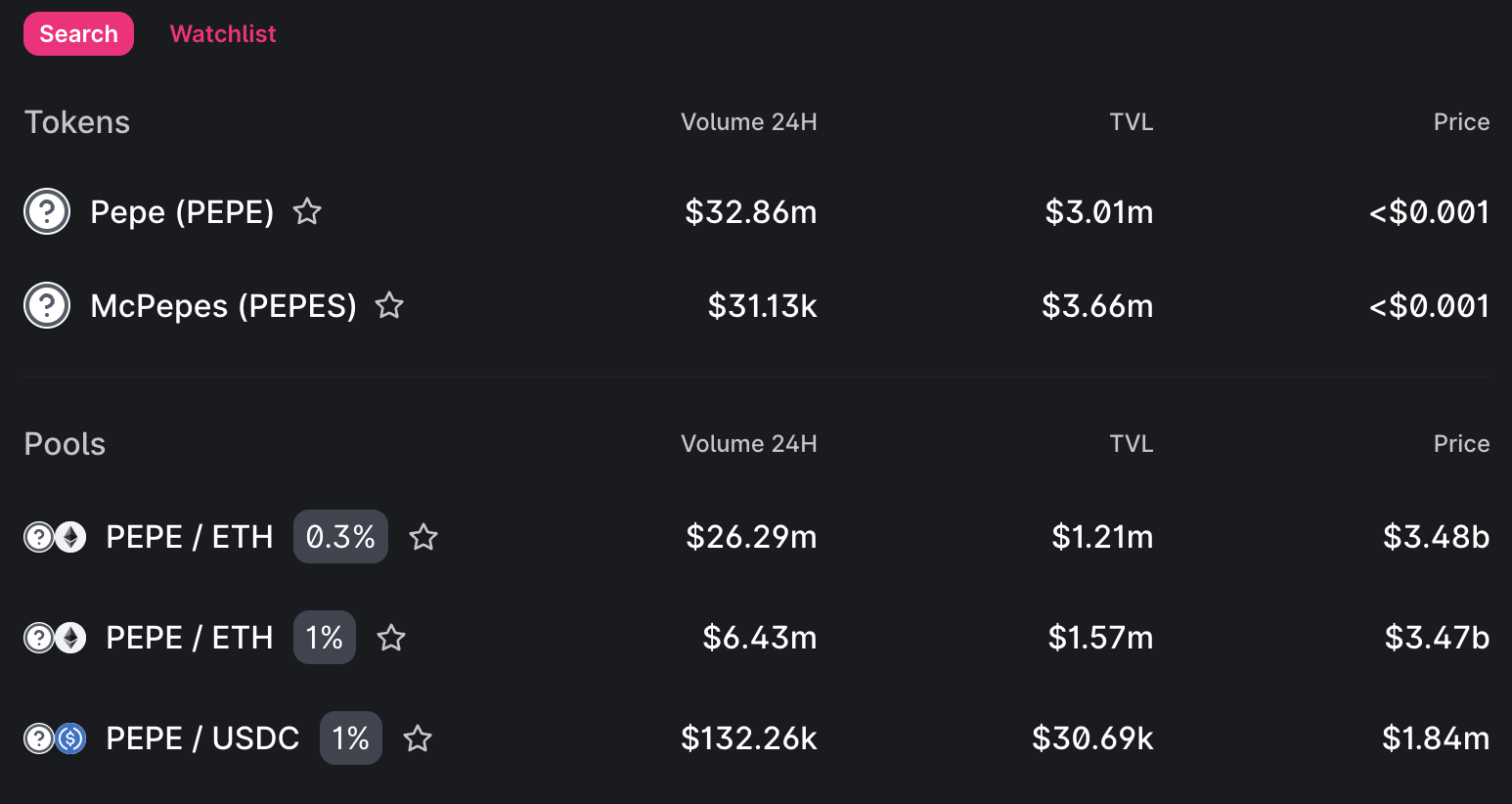

I usually check Info Uniswap to track the most popular coins traded on Ethereum, ETH Layer 2 and other EVM chains. There has been a coin called BOB skyrocketing on Arbitrum and I had intended to provide concentrated liquidity for farming. However, the "new" meme coin named PEPE attracted my attention when one of my friends mentioned on my timeline.

Farming Meme Coin Liquidity

All I wanted to test my new hobby by using the liquidity around the coin but all of a sudden things started to get worse 😅

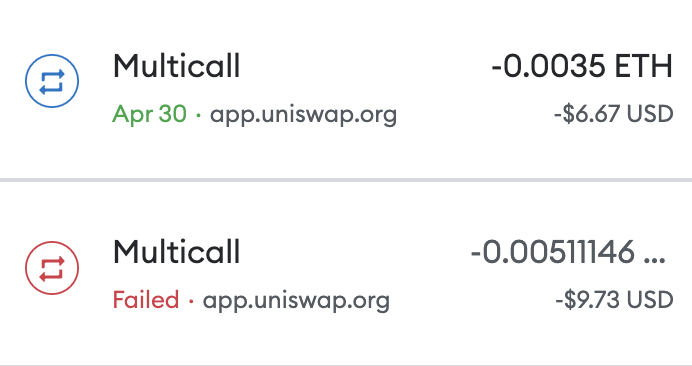

Ethereum's transaction fees skyrocketed as usual. Due to the limited funds that I had, I was not able to provide liquidity with the whole chunk of the meme tokens that I bought.

Moreover, the transaction failed.

Even before providing liquidity, I lost 0.015 Ethereum due to a failed transaction 🙃

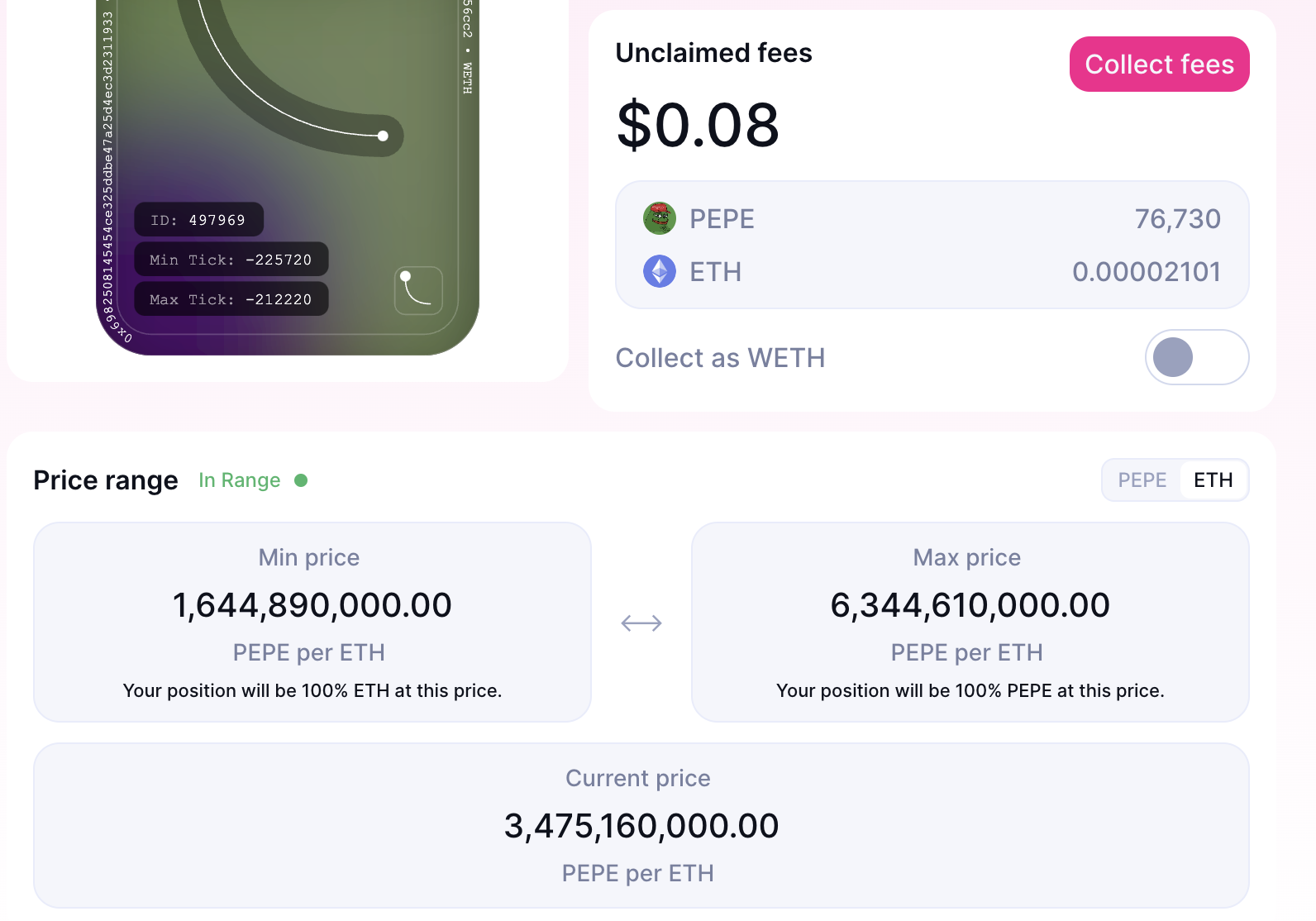

Sure thing it is frustrating but I still had some hope for the token. Then I provided liquidity but the earnings are not as high as I expected.

I started to farm around an hour ago and so far $0.08 liquidity fees are earned for $13 liquidity pool. The reason why I say the earnings are not high is that I was planning to hold a close range in which I would get more than $0.5 so far. However, as it is highly volatile, I opened up the spread.

If the token loses its 50% value, my position will be directly liquidated for ETH. Also, if it doubles its value, it will be 100% PEPE which I will trade and end up my farm.

Basically, It would be a better way to keep the concentration around 2,8b - 4,5b so that the liquidity brings more fees from them. In this case, this liquidity represents a long-term investor's pool 😂 Maybe it is time to be a clown.

To be honest, I still feel a bit regret taking such a position to utilize the hype, basically, I was hyped for the hype, as well. However, the trading volume / total value locked looks too juicy considering the PEPE hype on Twitter.

It was my first time in trying to farm meme coin liquidity. It is not going perfectly fine, unless the price doubles, but I have some notes for my next trials.

- Jumping on Meme Coin Farming on Ethereum is too expensive

- The liquidity range should be narrow for more efficacy in short term

- Rewards are great but risk should be considered beforehand

- Broad Range = 1% Fee, Narrow Range = 0.3% Fee in short term

Share your suggestions with us if you have any experience 👇

Hive On ✌🏼

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks for support dear team 🙏🏼

Why don't aim your focus on layer 2 instead of using the mainnet Ethereum? Better to stay far away of meme coins.

Unfortunately this coin is only on ETH mainnet. My next hunts will NEVER be on Ethereum. It is still rich chain 😅

Ethereum owners are the ones who benefit from the process. Eth trx cost is burned in any case.

Considering the daily tx volume thanks to meme coins, they help Ethereum a lot!