New Decentralized (?) Stablecoins - AAVE's GHO Approved

Decentralized stablecoins are having hard days to be trusted by people after the case of LUNA's UST. With the collapse of UST, we witnessed the domino effect on crypto lenders such as 3AC, Voyager, Celsius (saved itself, though), BlockFi and many others.

As we all are aware of the strengths and weaknesses of centralized stablecoins that are already leading the stablecoin market such as USDC and USDT, we need stablecoin solutions which are relatively secure and decentralized.

1 Stable for 1 Ecosystem Trend?

This furry is likely to end up having unique stablecoins in several ecosystems. Like our Hive-backed stablecoin (HBD), each decentralized exchange, crypto lender, and the crypto bank will be working on their stablecoins pegged to 1 USD in their reserves.

No company would dare to lose a potential liquidity that they can drive. Recently, USDC declared that it uses 80% of treasury for short-dated US Treasuries and holds 20% in cash! In "debt economy", anyone holding money can make money easily.

Though it is a huge hustle to be trusted (?) decentralized stablecoin in crypto, we see new guys joining the party. It means that there will be no rush into USDC or USDT for farms in DEXes IF they succeed.

AAVE's GHO

As it is speculated, AAve, Curve, Uniswap, and some popular crypto service providers are working on their stablecoins. Among the giants, AAVE is the one that has voted for a decentralized stablecoin and is approved by the community.

Though it can be easy to pass a proposal, it requires responsibilities of the governors to prevent the stablecoin from being manipulated as in the LUNA case.

According to the the governance report, there will be some dynamics that will make it decentralized, secure and stable.

The plan of GHO is to make it more on Ethereum Layer 1 so that security is provided in the broad sense (as it eliminates the risks of bridges etc) and sustain the stability via E-Mode.

Stablecoin holders can also access GHO with a rate close to 1:1 with zero slippage thanks to E-Mode.

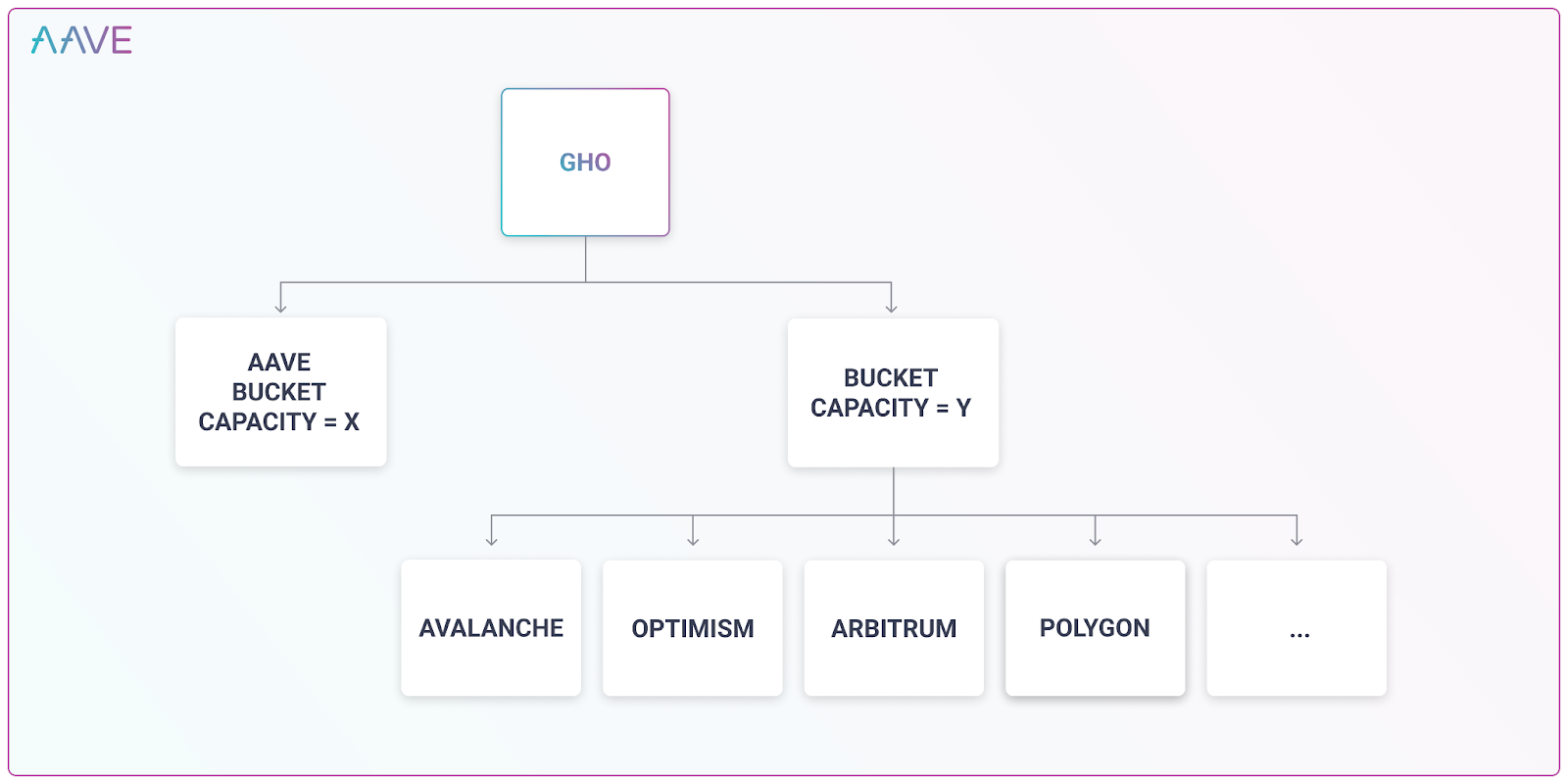

Portal will provide the ideal path forward to scale GHO in the heterogeneous multichain world. Using portals, GHO can be distributed trustlessly across networks whilst being minted on Ethereum,

E-Mode will be an internal portal that will be working between the layers and chains. Designing an internal gate is a safer idea IMO.

Minting is the most interesting part of GHO as some users will be able to mint the stablecoin.

Holders of stkAAVE can mint GHO at a discounted rate, meaning they will pay a lower interest rate on the GHO that they borrow. Therefore, there is an incentive to help secure the Aave Protocol as AAVE is staked (stkAAVE) into the protocol’s Safety Module.

The incentive for holders to stabilize it is quite logical. AAVE puts efforts to create something complicated but effective at the end of the day 😅

In the End, GHO is Pretty Functional

I, personally, liked it. Aave is one of the leading companies in terms of the TVL and, more importantly, development in cross-chain decentralized blockchain services.

Too much reliance on USDT and USDC has always been a risk on crypto. It will be stress-tested and, maybe, updated at the initial stages. However, the dynamics of the stablecoin sounds promising.

Read the governance report and share your ideas.

Will you hodl GHO in your farms?

When will PolyCUB create pCUB /GHO farm? (Soon 🦁 ?)

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1545148425183830016

The rewards earned on this comment will go directly to the people( @idiosyncratic1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

It is very interesting to watch what is happening in the stablecoin market. I do not believe [decentralized] stablecoins will be a part of the future.

In the end, we are likely to see maybe a dozen major stablecoin being utilized down the road. They will all likely have over at least 1 trillion tokens apiece.

There is plenty of room for all of them.

Posted Using LeoFinance Beta

I think there will be some “approved” pegs and other “virtual” stablecoins of metaverses in 3-4 years. No doubt that the decentralized stablecoins cannot be embraced by governments as printing/minting money is crucial for their survival. We will have hundreds of stablecoins but only a few of them will be classified as digital dollar’s pegswhile the others will only be utility tokens.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more