NFT-Fi Risks | Sudo Rare Rugged $820k

NFT-Fi is the most promising update on the NFT ecosystem for many people. You can provide your NFT into a liquidity pool, saw NFTs, or get loans for your digital assets. Though all these things sound futuristic, they are happening in today's crypto world.

NFT-Fi embraces traditional methods of NFT markets and combines them with the facilities of decentralized finance. For Top Tier NFT collection holders, it is a fantastic opportunity to grow their crypto portfolio. Yet, life is not that easy. Once again, high wins come with high risks.

Until Rug-Pull, Fundamental Problems

When the New Gen NFT Markets start to drain their liquidity or experience operational problems, then it turns into a chaos for both platform and the investors of it. Recently, BAYC holders' NFT's got liquidated due to the sharp decrease in the floor price.

In this case, BAYC holder lost its highly expensive NFT because of the low Health Factor and dropping floor prices. From the platform's side, you give loans for the valuable NFTs but the interest on these collections has already died out. It becomes a self-rug pull for the platform to get NFT with no buyer and give your ETH!

Rug-Pulls and Risky Smart Contracts

It is impossible for common crypto investors to understand whether the smart contract has any backdoor or not. When the hype on a project starts, people only care about the early investor gains which may bring fortune in crypto if you put your money in the right project at the initial stages.

Though it works in most cases, do not forget the risks you take in each transaction you sign!

the anonymous team behind the decentralized NFT exchange has pulled the rug. The theft has defrauded users of about $820,000 worth of ETH and other crypto tokens. - Cryptobriefing

The name of the project is SudoRare -> Combination of SudoSwap and LooksRare. Even its name is not authentic 🙄 The team behind the project collected Looks tokens from the investors via Liquidity pools and dried all liquidity pools. People lost more than $820k worth of cryptocurrencies as a consequence of this rug-pull.

Check the data on mainnet.

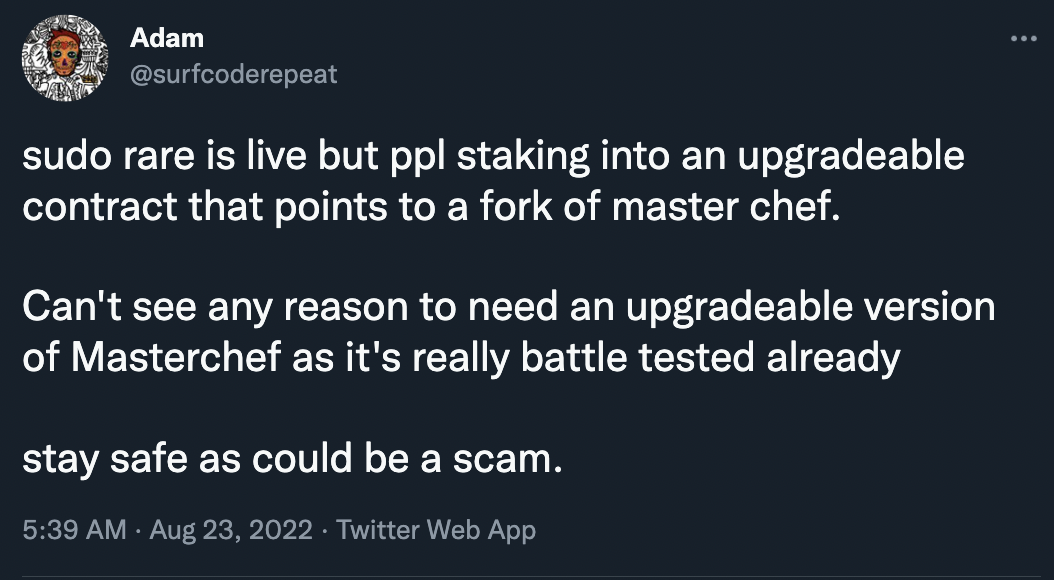

Tweet of Adam clearly says that there is something named "upgrdeable contract" and it can be manipulated by some parties. Too late.

Honestly, the newly growing NFT-Fi seems too risky for common investors like us. Untill a reliable platform with sustainable operations comes, I have no intention to be involved in this risky but fun stuff. Better be late by safer ✌🏼

Note: Any new project that uses the successful examples of its branches is 99% a rug-pull.

Sudo(Swap)+(Looks)Rare! They make fun of us!

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1562210141881212928

The rewards earned on this comment will go directly to the people( @idiosyncratic1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

NFTs had low liquidity to start with and it takes time to have a buyer so I am not really surprised that it doesn't go well with Defi.

Posted Using LeoFinance Beta

Maybe timing and attention on the projects are the other parameters that are neglected. I like the concept but my answer is “not now”