Retail Crypto Investments in Hong Kong & Interest in Asia

The bull run is a long waited market trend for the crypto ecosystem as we have been in a downtrend for several months. About 6 months ago, we tested the local bottom which was around $15K and the market bounced almost 2x from that level.

The price action in Bitcoin was a sign of a new trend for the crypto ecosystem after it was able to test and stay above the previous resistance levels. Since then, the volume and interest in crypto increased gradually. While things are looking good in a consolidating crypto ecosystem, it started to bother investors as the macro economic outlook do not let crypto go further.

As of June 1, Hong Kong will enable crypto investments for retail investors. There is a huge expectation from the side of Asia to bring some volume and hype to the ecosystem.

Will Asia be the catalyst?

Expectations from Asia

Coindesk shared the developments in the side of Hong Kong and the growing interest on Asian market actions. The influence of the FED and the ECB have been heavily effecting the sentiment of crypto ecosystem as the spokesperson of each central bank stated ambiguous opinions regarding the current situation of the inflation rates.

The announcement is consistent with long-held expectations that developments in Asia will catalyze the next crypto bull run and contrasts the lack of regularity in the West, particularly in the U.S.

While the U.S. is taking firm steps to investigate and limit crypto exchanges operating in the country, the crypto exchanges choose to move or restrict their operations for the U.S. citizens.

On the other side of the world, there are positive events coming Asia.

According to Coinjournal, Crypto segment was given a place in the state TV of China and this is seen as a very bullish sign by the CEO of Binance, CZ.

The last time it happened, it was pretty bullish, as he also mentioned. IMHO, it is understood that crypto is here to stay whether the central banks want it or not. The countries which are faster to integrate crypto into their operations and the lives of people will be leading and getting the biggest piece of the pie in the future.

Listings for Retail Investors in Hong Kong

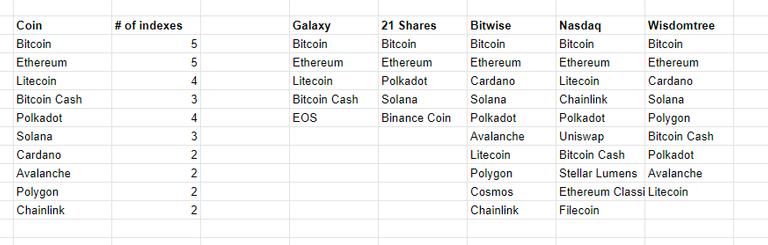

WuBlockchain on Twitter tweeted about the listing of OKX for their retail services on Hong Kong. According to the chart and speculations, the coins which are already indexed in 2 or more indexes are chosen to be served for the retail investors.

Basically, the current system does not include promising, over-hyped, or popular projects. Rather, it focuses on veterans and long-lasting ones in the initial stage. To be honest, I also prefer the current system in the beginning as there is no limit for the listing considering the fast growth of the crypto ecosystem.

Imagine they start with PEPE and investors lose 20% of their funds on the first day 🤡 This would not be a nice experience for both sides.

However, though the planned listings look a bit "old-fashion", it is good to go! Let's just grab some volume for these coins to pump all market with the new investors stepping in.

About 4 hours ago, WuBlockchain tweeted the new coins, 16 in total, to be listed on OKX.

BTC, ETH, ADA, MATIC, SOL, DOT, UNI, LINK, SAND, LTC, AVAX, AXS, ATOM, XLM, USDT and USDC. Hong Kong users can buy, sell and convert 16 major virtual assets through the app, including BTC, ETH and several others...

In the new format, we have 2 stablecoins and 1 GameFi token, too. Honestly, more tokens may bring more volume but I am on the side of having fewer but stronger projects. Not having XRP might be a sign of the same intention, too.

What do you think about this listing plan?

Posted Using LeoFinance Alpha

https://leofinance.io/threads/idiosyncratic1/re-idiosyncratic1-o6pgqd92

The rewards earned on this comment will go directly to the people ( idiosyncratic1 ) sharing the post on LeoThreads,LikeTu,dBuzz.