The Results of Aping into SPS

The launch of GLX airdrop has changed the whole sentiment in Splinterlands ecosystem. Since the beginning of trades on Hive-Engine, we saw thousands of dollars trading volume for GLX token. The major reason why GLX is one of the hottest tokens in Hive-Engine is directly about the APY that you can get by staking it on Genesis League official website.

I've been a long term investor of Splinterlands assets and I still have a list of items to have more before the bull-market or another hype starts on Splinterlands. One of my major goals is to have 2nd Validator License while it is still pretty cheap 🔥

The launch of GLX token made me change my short-term goals, as well. I started to turn my tradable tokens into Splinterlands governance token SPS because it is by far the most profitable option as of writing. Let me share my recent experience.

Before Turning into SPS

To be able to visualize the difference in my Splinterlands portfolio, I use SplinterCards as it provides lots of data about the game for free! Better if you check it out.

I had more than 300 Vouchers + 70k DEC in my wallet with no return daily. I hesitated to turn them all into SPS before because I know that these tokens are still undervalued.

Vouchers are pretty functional tokens and people need them for special events. $0.13 per Voucher is probably nothing for it. On the other hand, DEC is a stable token in its nature. I traded them for 1000 DEC = $0.65 though it is supposed to be $1 in reality.

While I had these tokens in the bag, I had around 11,500 SPS tokens staked.

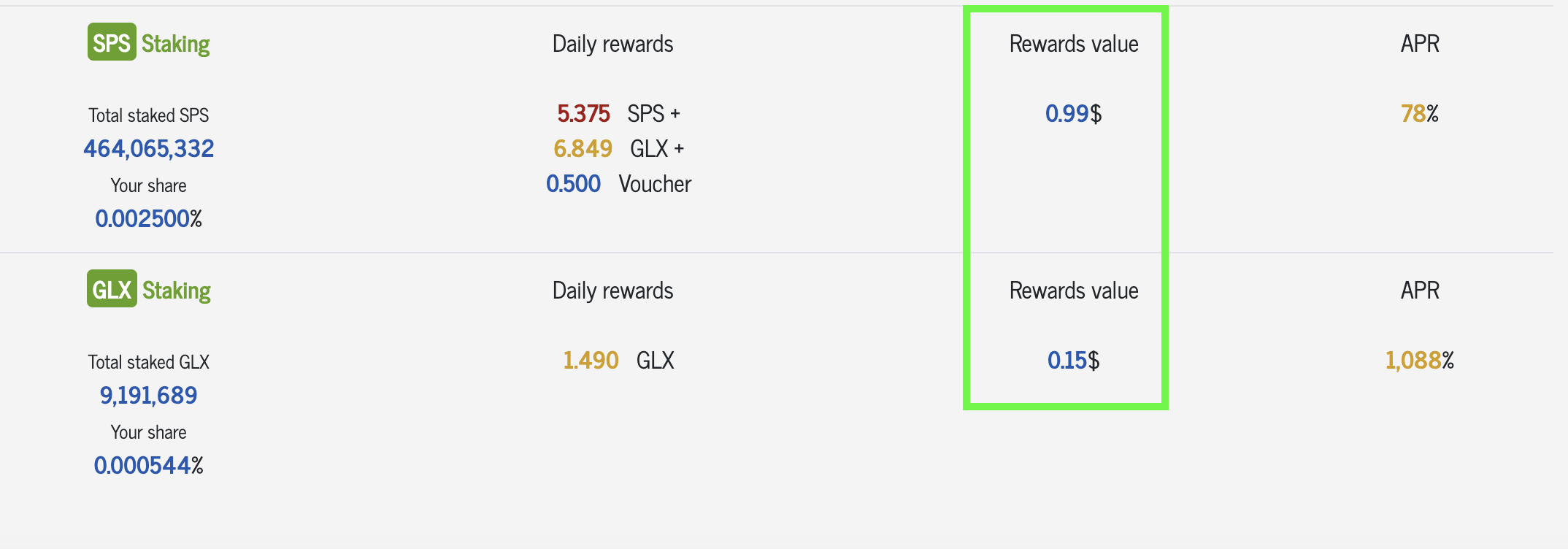

My staked SPS was bringing around $1 worth of SPS + GLX + Voucher tokens with 78% APR which is nice already.

However, the point that we should focus on may not be the initial part as we have a bigger slice of cake for GLX staking over there.

Aping into SPS

Eventually, I bought SPS tokens for $0.04 which is nearly All-Time-Low price of Splinterlands governance token. Besides, I keep the fact in my mind that this governance token is the core of Splinterlands ecosystem which makes it more valuable than the rest for me.

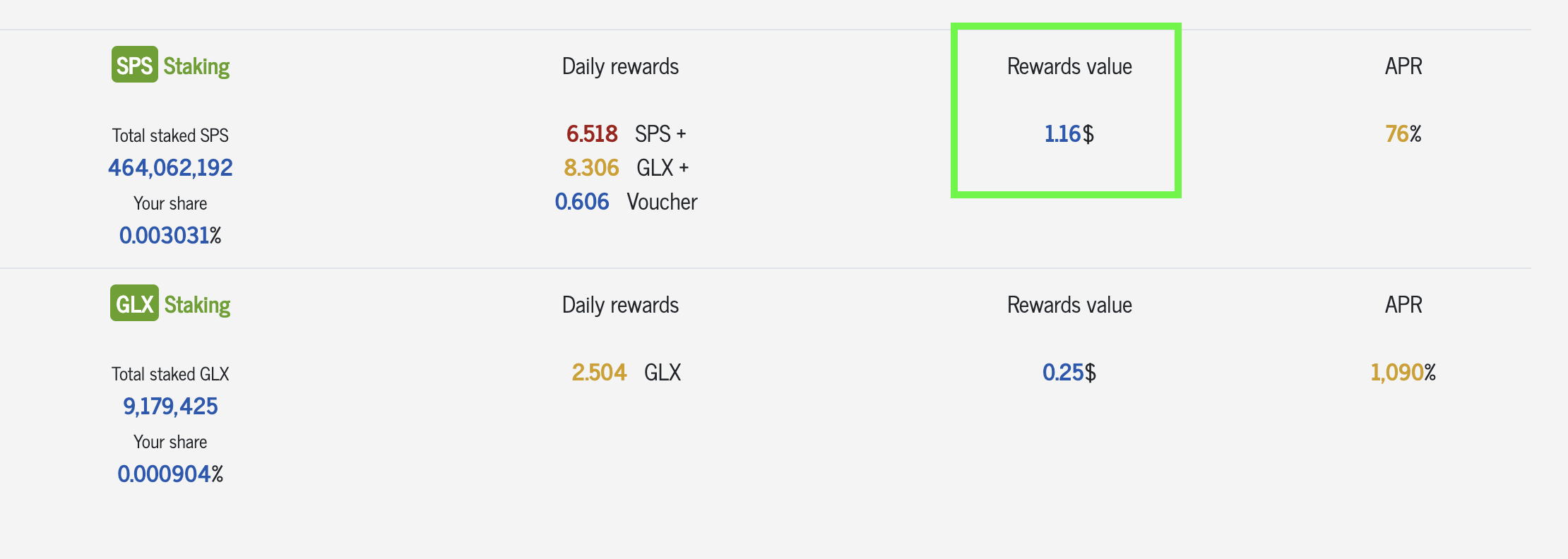

As a result of my purchases, there are some noticeable changes in both SPS staking and GLX staking sides of my portfolio.

Now, I'm getting 6.5 SPS + 8.3 GLX + 0.6 Voucher tokens that makes $1.16 in value. In this calculation, the increase in the daily GLX drip is pretty important as it is one of the major sources of better return for our investment.

For the GLX side, we start to get $0.25 with its current price and daily 8.3 (decreases gradually in time) GLX is going to be staked with 1090% for a long time.

IMHO, the strongest side of this investment is that it is for both the short term and the long term. In the near future, I'll be utilizing this crazy APR for GLX staking + airdrop and I'm glad to stake SPS regularly.

In the long run, I'm growing my share in SPS governance token which directly affects proposals, airdrops and Voucher distribution with Validator Licenses. It was a tough decision for my to trade my Voucher and DEC for low prices but I believe SPS is more likely to multiply its price way better than the stable token DEC and Voucher token.

What do you think about this strategy and do you follow any strategies?

Posted Using LeoFinance Beta

https://twitter.com/3305546045/status/1596444722914295808

https://twitter.com/1415155663131402240/status/1596641011270242304

The rewards earned on this comment will go directly to the people( @idiosyncratic1, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Post voted 100% for the hiro.guita project. Keep up the good work.

Stabilizer for CENT Token

New manual curation account for Leofinance and Cent

Hey there, great post! You just got a decentralized curation vote from the Leo Finance team, keep creating great content!

We invite you to check out latest initiative, talk about CUB's new variable staking and earn some curation from Leo Finance!

Posted Using LeoFinance Beta

That looks a smart move..

Interesting perspective on SPS. I need all the perspectives I can get to survive and thrive in this bear market and crypto in general.

Thanks

Posted Using LeoFinance Beta

Welcome mate. It was not easy to sell the other assets but I believe it’s worth ✌🏼

Thanks for sharing! - @alokkumar121