Econometrics: Using Polycub To Predict The Price Of Leo

The usefulness of crypto prices in statistical analysis and interpretation cannot be overemphasized as it will enable crypto investors make decision as regards their investment.

This article will present prediction analysis model in SPSS. And shall be considered under the following objectives.

Model to test to be used

Condition for prediction analysis test

Analysis of prediction between polycub and leo and interpretation of result.

Conclusion

Other images

Model to test to be used

The model to be used in this analysis is linear regression. Linear regression combines two measureable variables with one used to predict the other.

Condition for prediction analysis test

It is necessary to checkout the following conditions before depending on the result of the analysis.

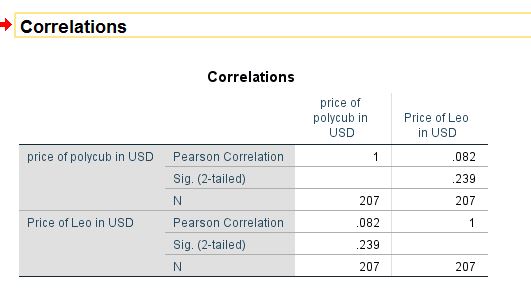

Correlation coefficient

Correlation coefficient determines the strength of linkage between two variables which in this case are the prices of polycub and leo token.

From the analysis of correlation, it can be found that there is a low form of correlation (r = 0.082)

With this, we can say the trend in price of polycub and leo are not related.

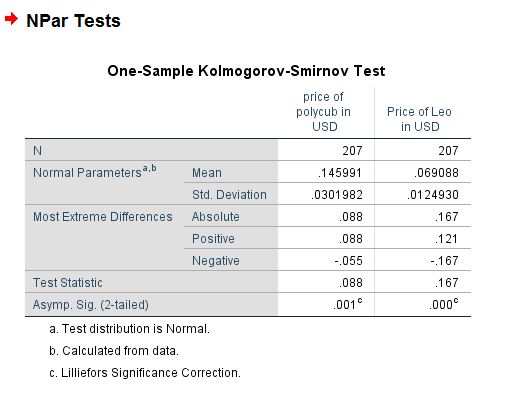

Normality test

Normality test in econometrics is to prove that the prices entered as data was gotten from a sample population and hence be trusted. The hypothesis for normality test states that variables are not normal but result of 1 sample Kolmogorov test shows a significant difference in our hypothesis of the price of polycub and that of leo.

They are normal.

Analysis of prediction between Polycub and leo Token

We can proceed to analyzing the price of Polycub and leo token using SPSS software.

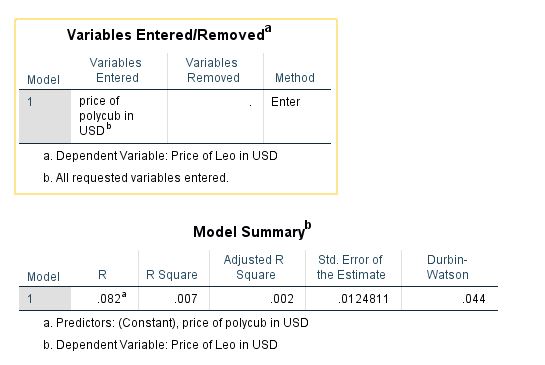

Model summary

The result of the analysis can be viewed using regression technique of linear regression. The result is displayed in the following categories.

First the image below shows the price of polycub is what needs to be entered as input and our dependent variable which is the price of leo is what we want to predict using the price of polycub token.

Can you take a look at the next table? The shows the summary of our model. Though it’s not actually used in prediction but explain that we can trust the model of our analysis to be few % correct.

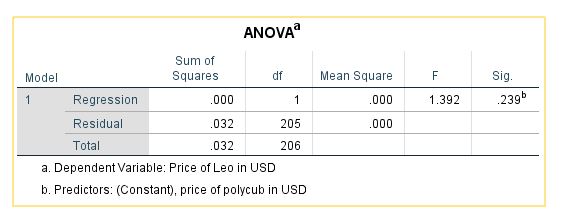

Anova table

The anova table has the hypothesis that there is no relationship between the variables.

But from the table there is a significant difference showing that our variables are related and there is a form of low relationship when using future values of polycub price to predict for leo price.

Coefficient table

The coefficient table present the model we shall be used in calculating for the price of leo token. It can be seen below in the B column that

Price of leo = 0.64 + 0.34 * price of polycub token.

Considering when the price of polycub is 0.1024

Price of Leo = 0.0988 which is the range of the last variable(0.0884)

Conclusion

This article has been able to present a predictive analysis model for the price of leo token when considering that of polycub. Due to the low correlation, the price will definitely fall in a close range.

Other images includes.

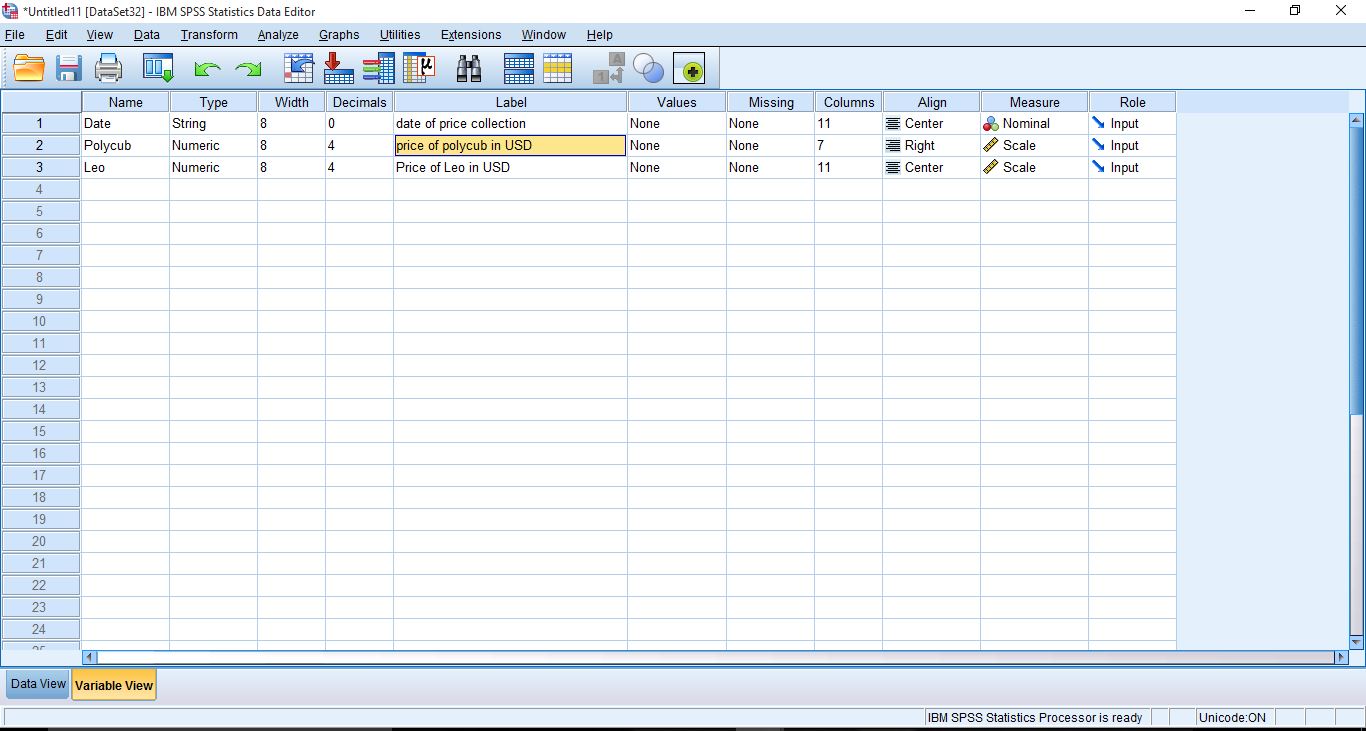

Variable view

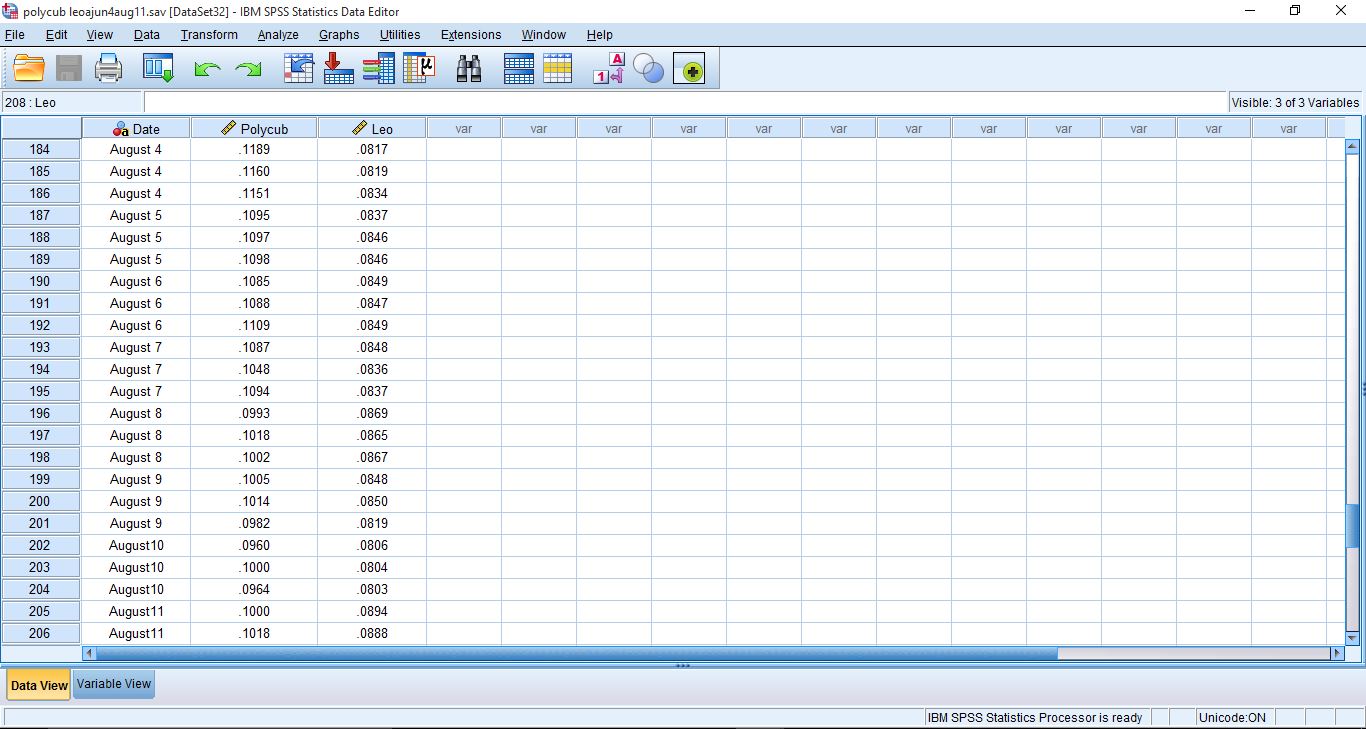

Data view

Congratulations @iniobong3emm! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 40000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

Thanks @hivebuzz