Performance of XRP Verses LEO (Correlation Analysis June – October, 2022)

Performance of crypto assets is expected to be measured to support multiple investment decision plan.

In this article, I will be writing about the type of correlation that exist between LEO and XRP under the following sub heading.

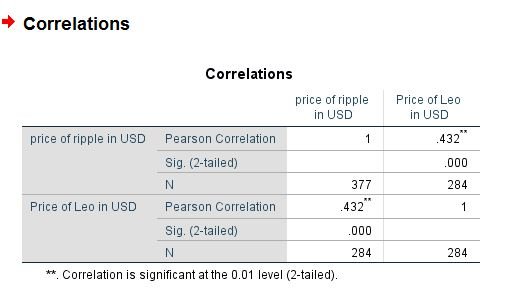

Correlation Between LEO and XRP

An analysis of correlation was carried out using SPSS software. It was found out that there is an average positive correlation between the price of LEO and that of XRP with value 0.432.

A positive correlation indicates that as the price of XRP is in a bull, the price of LEO will likewise experience same but at an average level. This indicates that if the price of XRP increases by 1% that of LEO will increase by 0.5% according to its price level. This also applies for the opposite of the relationship as regards bear market.

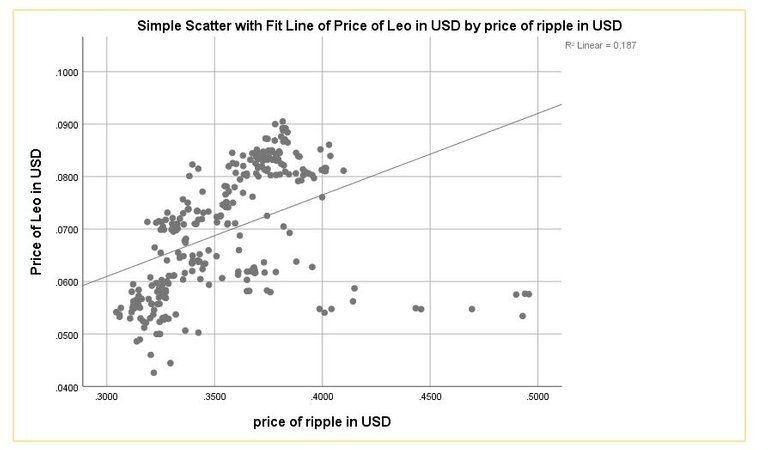

Details of correlation analysis can be seen using scatter dot

The scatter dot diagram explains better about the analysis. It can be seen from the XRP axis and LEO axis , a diagonal line used to determine the price of LEO when you trace the price of XRP.

It can be seen also that as the price of XRP is on the increase, that of LEO will also be on increase side.

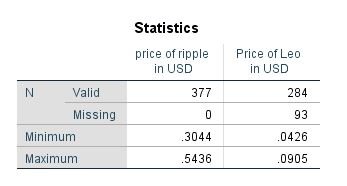

Maximum and minimum prices

The maximum and minimum prices of both assets can be seen below. However, it shows that over 93 entry data of leo price is missing because data was unable to be tracked by the crypto market.

Conclusion

The relationship between XRP and LEO is a good one which implies investors can make pairwise decision to invest in both assets.

Other images

Other images includes

Data view

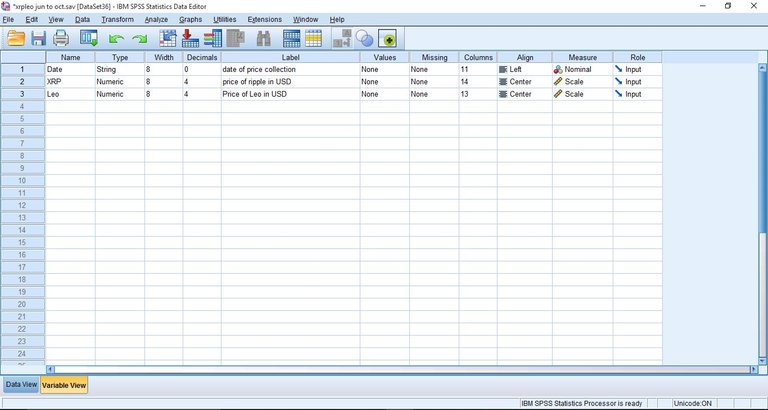

Variable view

Thanks for reading.

Posted Using LeoFinance Beta