Moving 401k to Short Term Cash

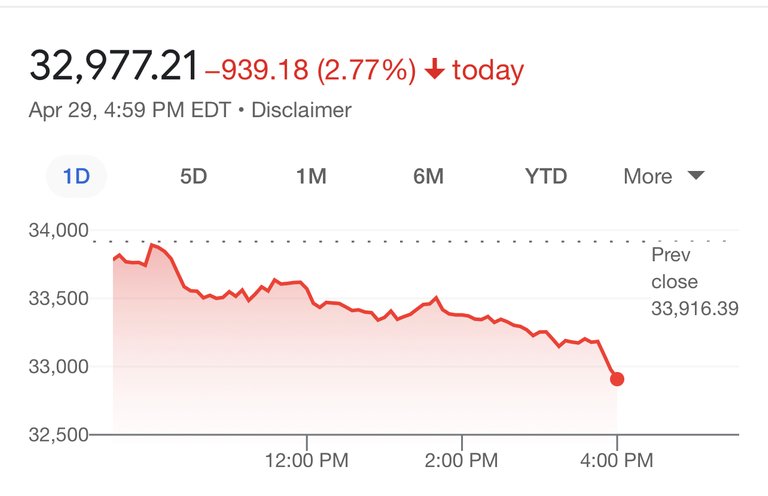

Lately, I was advised by family member to move all 401k to Short Term Cash. I finally decided to do it this Thursday night, allocated 100% funds to Short Term cash. I read the CNN business news as the tech-heavy Nasdaq fell 4.2% on Friday, dragged down by Amazon (AMZN), which dropped nearly 15% after it missed earnings expectations. The S&P 500 shed about 3.6% on Friday, while the Dow dropped about 940 points, or 2.8%.

My fund management company sold my funds on Friday, so my fund balance must drop a lot! I was not bothering to take a look of it. What was done is done, no matter what. My family member told me that I should listen to him early though.

I checked the statement for the March quarter, and I found out that I lost more than $7000. That means most of my last year contributions were gone. Stock market has been very volatile this year. The inflation is so high, and we have supplies chain problem. I even saw the recommendation from CNN today how to hold up our principal.

I am not an expert and not recommend you to move the fund to Short Term cash, and I just like to share with you what I read and what I know here. Hope everyone makes good decisions on the investment that suitable to you.

Posted Using LeoFinance Beta

should be no problem as the market might going to have correction for little bit longer, you can buy them back when it's lower in the next few weeks