SAVING VS INVESTING

Saving: Saving simply means putting aside or separating away money for later use in a secure place with low or no respected increase, such as a bank, in the hand of a collector (Ajo) or savings box.

Investing: Investing means taking some level of risk to buying assets that will increase in value over a long term and provide more return or money than you put in it.

It's quiet unfortunately that many people get saving and investing wrong in life application, they take both to be the same or feel one of both is less important. I will put to you that both is very crucial and important part of human financial life. Some feel as a result of risk involve in investing they try to play safe and not invest. There is this saying life is a risk and it's even a risk to not take risk.

Saving and investing is quiet different though has similarities but will be focusing of the various difference which includes;

Risk

Saving involve no risk or less risk as the case maybe. While investing involve taking riskReturns

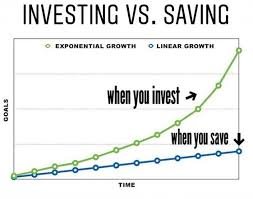

Saving has little or no return in term of increase, you can earn interest by putting money in a savings account, but savings accounts generally earn a lower return than investments. While this is not same with investing, when you invest in long term there is vivid increase in return.Goal

Saving is for a planned expenses or preparing for an unexpected spending i.e For emergency purpose. While is investing is for marketing financial returns over an initial investment.Mind

Saving require no boldness or confidence so therefore it's easy to learn, just require discipline. While investing require boldness and confidence, you can't do investment if you are fearful, fear to loss fund.

Saving is setting aside cash for future use. Investing means using cash to buy other assets that you expect to produce profits or generate more income.