Shift in sentiment: A case for Bitcoin’s failure to hit $100k in 2021.

This Tweet didn’t get much engagements, at least as expected…for obvious reasons. Oh well, if you don’t have enough time to read some boring article then that tweet will do.

Throwback to sometimes in the first quarter of 2021, 70% of twitter influencers and analysts tipped bitcoin to top $100,000 before the year runs out. However, that didn’t hold and the highest price level we saw bitcoin at was $68,700. I’d have loved to see how bitcoin looked at $69,000. Anyways, thanks to the infamous Coinmarketcap glitch, bitcoin actually smashed a million dollar price level…lol. Apart from that ‘miraculous’ glitch, we might have to wait for a while more before we can actually trade bitcoin for over $100,000.

A number of analyst and influencers were trolled for their failed $100k predictions; while I’m totally not a fan of people who speculate the price of bitcoin and cryptocurrencies, it’s fair to say that these predictions were not totally out of the line. It was meant to be…the $100k level.

But then there’s a huge shift in sentiments. A shift these analysts unfortunately didn’t consider or shoved aside…

Before we get to that; I’d like to ask two different questions:

What’s your favourite cryptocurrency project?

And

What percentage of your portfolio is in bitcoin?

Let me guess, bitcoin is not your favourite cryptocurrency and it makes up the least percentage of your portfolio. You probably have your reservations about the ‘old’ cryptocurrency but still hold a little of it; ‘just in case’. A good majority hold No bitcoin. If you fit into any of these classes, you’re not alone.

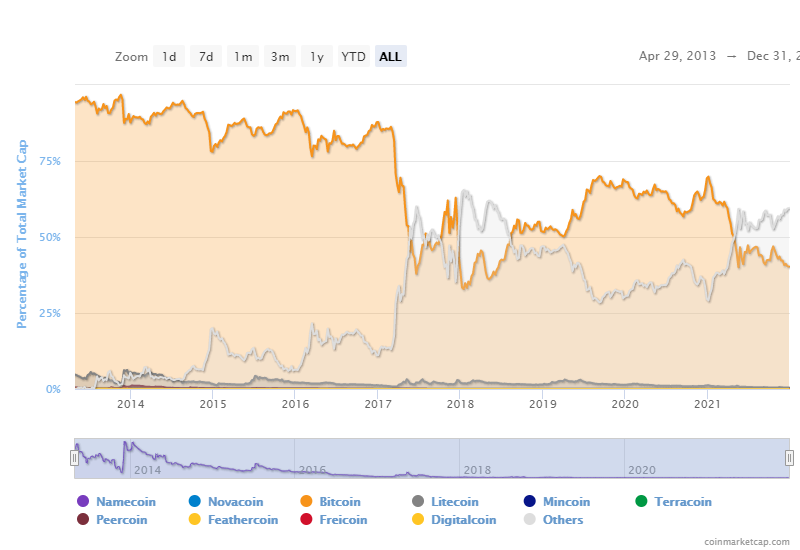

Bitcoin’s dominance is steady shrinking as it continues to lose investors to altcoins and other ‘fun’ cryptocurrency projects. A glance at the bitcoin dominance chart shows a continuous decline in the percentage of total cryptocurrency market valuation controlled by the alpha cryptocurrency.

Source: Coinmarketcap

Despite retaining its position at the top spot, the preference for other cryptocurrencies are growing but this is not necessarily due to investors considering other options as ‘more genuine’.

Shortly before the bull run of 2017, cryptocurrency investors had one common orientation – the superiority of bitcoin over other blockchain projects. ‘Bitcoin is king’; this statement goes both ways; financially and technologically. Bitcoin easily pulled off jaw-dropping performances while other projects only follow suit. Controlling the crypto space and its future, everyone’s dream was to ‘stack more bitcoin’

2017 saw bitcoin hit one of its most famous price levels, but in essence it was outperformed by most other ‘shitcoins’. On july 2017, bitcoin’s dominance stepped below 40% as it starts to slowly lose its grip on the market, this would slide close to 30% in early 2018. This phenomenon is partly due to the increasing number of alternative coins and mainly due to the ‘rush’ for these ‘new bitcoins’.

The rush for altcoins wasn’t only because most of them boast technological superiority over bitcoin, it was also because they have shown to be more volatile and more yielding than bitcoin…at their peaks. Projects like Nano would give four digits multiples in return.

The shift from bitcoin to other projects (altcoins) also represented a shift from belief in the technological viability of blockchain projects to a belief in their financial viability. Unlike the older investors, newer investors believe more in the ability of cryptocurrency investments to make them huge amount of money than in the potentials of the technology to change the world.

As the ‘Lambo’ dreams became more popular, preference for bitcoin dwindled. Instead of stacking bitcoin, investors would rather cash in on their gains to settle debts, pay bills and of course, buy a ‘Lambo’ or anything similar in structure.

Contrary to what you’d expect, majority of the profits from well performing projects such as doge coin and shiba inu were quickly converted to stable coins and further to fiat…not bitcoin. A breach in this normal flow of money slowed bitcoin’s growth and ultimately stopped it from hitting $100k.

The analysts weren’t wrong, they only failed to consider this major shift in human behavior. A shift which is becoming the new normal and bitcoin is poised to even lose more of its dominance as ‘shitcoins’ continue to climb investors’ scale of preference. Can’t say if or when bitcoin will trade above $100k but I’m sure it would have easily smashed that level this year if we didn’t spend more money on memecoins and hype projects.

Have our next publication delivered to your mailbox

Cryptocurrency Scripts is transforming into a community of enthusiastic cryptocurrency and blockchain believers! Join the Adventure!

Would you love to read similar articles?

Have our next publication delivered to your mailbox

Follow us on Twitter

Follow us on Medium

Follow us on Publish0x

Follow us on Facebook

Posted Using LeoFinance Beta

There will always be speculations in the space some of which are from a selfish point of view.

What do I mean?

Most of these price predictions by influencers is a tool to get people to FOMO so they can take profits.

Yes, BTC could hit $100k but the time and day no one can tell. Analysis can only make projections but the real catalyst to the fast rise in price of BTC will be community, adoption and use cases.

BTC to me has a very limited utility which is why its dominance continues to decline constantly. Attention and investments have been channeled to alts with laudable and appreciable use cases.

Bitcoin has progressed from a technology to a political and financial revolution. By this, the success of bitcoin isn't just measured by the technological development but also by how far it is penetrating the political and financial aspect of human life. That being said, it has done a lot and a lot has been done. $100k for BTC is well deserved but the sentiments aren't the same anymore. That's the main reason

Inasmuch as we appreciate the technological advancement and financial revolution BTC brought to birth, making profits will always be everyone's priority. So, I think this shift in sentiment shouldn't be a surprise. It is natural to yield to assets that give a better ROI and that doesn't really require a huge capital.

That notwithstanding, BTC still has the first-mover advantage plus it is still perceived by many to be the safest crypto asset in terms of price stability, $100k and above looks achievable.

True. Yeah, 100k is within reach, it's hard to say when that will happen anyways.

Till then we wait and watch