Does Bitcoin really offer a hedge against high inflation?

Over 1,600 economists are concerned about high inflation, while many believe that Bitcoin no longer works as a valuable refuge. Furthermore, Economists from all over the world believe that inflation will not be reduced until 2026.

Inflation is at record levels in many parts of the world and is not expected to end. And in the meantime, in the Bitcoin ecosystem (BTC), many wonder, does the cryptocurrency really offer a cover against high inflation?

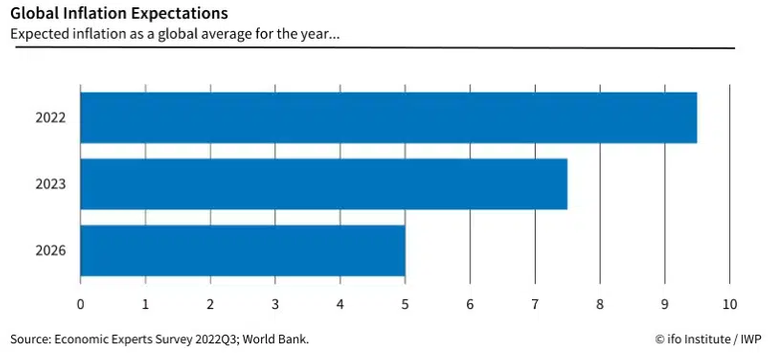

The Ifo Economic Research Institute in Germany asked over 1600 economists from 129 countries what their expectations were about future price developments? Their response was that they expect higher inflation rates in the world.

The economists consulted also expect high inflation rates worldwide over the next few years. Indeed, service and commodity prices are expected to remain high until 2026.

The inflation expectation of economists around the world is that the rate will progressively decrease each year, but will still remain high until 2026. Source: Info Institute.

Will Bitcoin protect us from high inflation?

With inflation rising every month and projected to continue unabated for years to come, some in the bitcoin ecosystem doubt that the pioneering cryptocurrency can function as a haven of value.

It is above all now that the price of the cryptocurrency has dropped by more than 67% below its record level.

However, there is every indication that this bitcoin time will not act in the same way as it did in the past. That's because the price of bitcoin is less related to inflation and more to monetary policy, as explained by BTC Andrés, a member of the Colombian Bitcoin community.

BTC Andres wrote on Twitter.

“Bitcoin is a hedge against inflation because it goes up against the dollar when it is printed, and it goes down when the vacuum cleaner is turned on”

From his perspective, bitcoin is a haven of value and he explains it as follows:

“If you have 2 million 100 thousand bitcoins, today, then you have 10% of bitcoin and in a hundred years, you will still have 10% of its total supply. ».

Consequently, for BTC Andrés, the secret is to save in bitcoin because now the American money supply has decreased in recent months, registering its largest decline in nearly two decades.

Yes, bitcoin is a hedge against inflation, says analyst

What is explained by BTC Andrés is detailed by the analyst Steven Lubka who points out in one of his articles that bitcoin is indeed a hedge against inflation, understanding the latter as monetary expansion.

He explains it this way: “When assets go up, they expand the money supply and bitcoin goes up. When assets fall sharply, contracting the money supply: Bitcoin goes down." He means that, like BTC Andrés, he expects the cryptocurrency to rise in value over time.

Bitcoin's objective is clearly something that opposes central banks and their political errors. We have to accept that bitcoin will not provide a hedge against CPI rises and that hedging against central bank actions is being in a directional relationship with those actions. - Said Steven Lubka

Posted Using LeoFinance Beta

Source of potential text plagiarism

Direct translation without giving credit to the original author is Plagiarism. Repeated plagiarism is considered fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

Please note that direct translations including attribution or source with no original content are considered spam.

If you believe this comment is in error, please contact us in #appeals in Discord.