Ethereum Dominance In Defi Market, Can Solana, Avalanche, And Terra Take Over?

For the past three years, Ethereum had the highest total value locked in the DEFI market. The introduction of smart contracts gave Ethereum, the second crypto asset by market capitalization the glory it is enjoying today. However, Ethereum dominance In the Defi market which was above 95% as of January 2021 has reduced drastically to a figure below 70% as of December 2021.

The DEFI market has also grown tremendously in past years but the growth was more prominent in 2021. The likes of Solana, Avalanche, Binance Smart Chain, Polygon, Terra, etc have contributed greatly to the growth of the Defi market. Investors saw the same opportunities offered by Ethereum when it comes to DEFI in these new public blockchain projects, especially those of them that are built based on proof of stake (POS) Mechanism where scalability is not an issue.

With the delay in Ethereum 2.0 which is aimed at improving the scalability of Ethereum Blockchain, investors started moving to the likes of Solana, Avalanche, Binance Smart Chain, etc. It was the huge amount of money pumped into some of these projects like Solana and Avalanche that lead to their massive rise in price in 2021.

Can Ethereum be overtaken in Defi Market Dominance by the end of 2022?

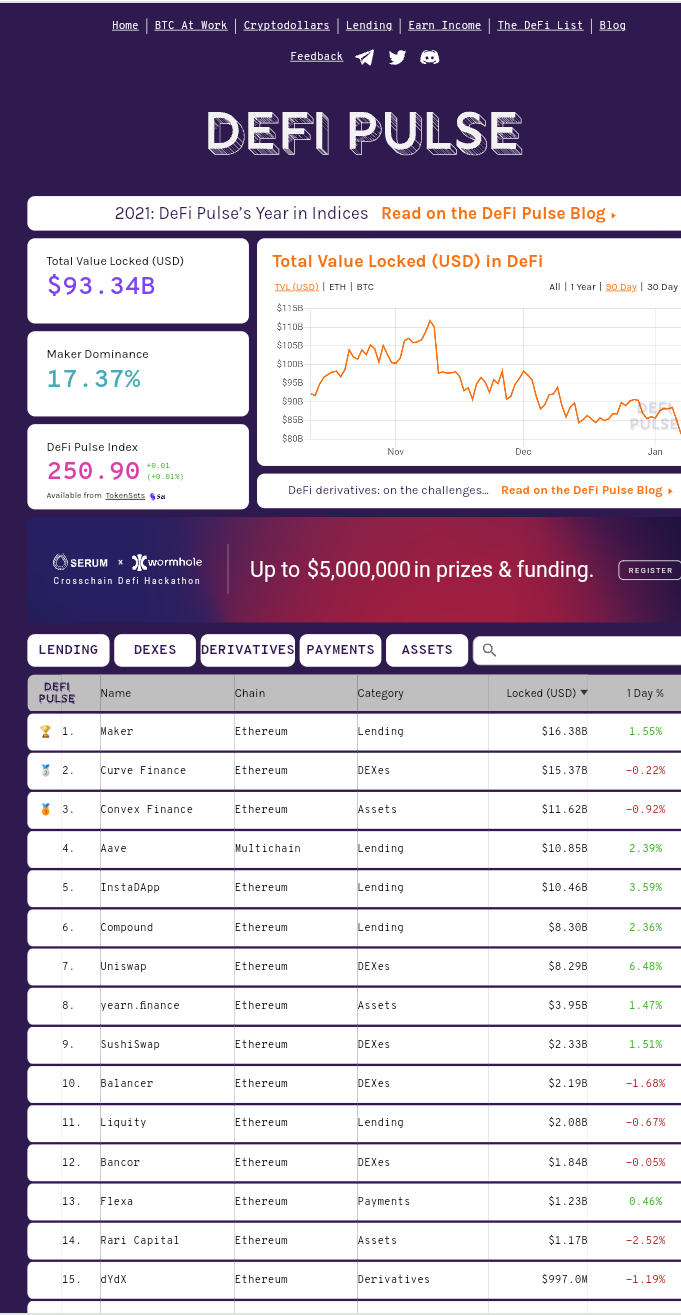

Statistics got from Defi Pulse as shown below, prove that Ethereum is still at the number one spot in the Total Value Locked (TVL) in Defi Market, while Terra sits at the second position.

The fact remains that people have started exploring other DEFI markets since they offer the same opportunities as Ethereum, but with higher scalability. For the past two years, I have tried as much as possible to avoid interacting with the Ethereum blockchains. I could remember paying a $50 fee on a particular transaction I did on the Ethereum network. Sometimes the gas fee is collected while the transaction is canceled at the end.

If Ethereum 2.0 is not completed by the third quarter of 2022, the probability of losing its position when it comes to TVL in the DEFI market to another blockchain is very high.

Investors are eager to leverage on the likes of Solana, Avalanche, and Terra not just because they are more scalable than Ethereum but also, they are more affordable than Ethereum. It will be profitable to invest in these coins now to benefit from them in the coming years.

Also, the lower gas fees offered by these blockchains is another advantage they have over Ethereum. Most Ethereum Defi farmers lose a greater percentage of their profits to gas fees.

In conclusion, if Ethereum 2.0 can be completed before the third quarter of 2022, Ethereum will retain its DEFI market dominance. The struggle may only be for the second place.

That was a nice and concise read... agree whole heartedly.