INTRO TO SPLINTERLANDS NEW LIQUIDITY POOLS!

I took a long break from content creation, but I'm BACK and working at it again! Don't worry though, even though I haven't been creating content, I've DEFINITELY been staying in tune with all the recent updates!

I've been playing ranked battles, using SPLEX's rental services, testing out the Archmage bot, and most importantly - enjoying the community of my guild - YGG - Yield Guild Games!

Now onto what everyone has been talking about. SPS Airdrop just ended, and new incentives for liquidity pools are here! From the recent Peak-D posts, we see that a lot of SPS and DEC has been allocated to the different liquidity pools involving Splinterlands assets to help keep the economy stable.

The burning question that was on MY mind, and likely on most people's minds is - "okay, I've got a million options to place my assets, JOSIE - which one is the best?"

Liquidity pools

First and foremost, if you do NOT know what a liquidity pool is, make sure you do a little bit of research to understand the basics of it. I don't plan on walking through the details in this specific post, BUT if there are enough questions, I may create a separate video on "Intro to Liquidity Pools"

At a high level, Splinterlands is giving out tokens to us for providing liquidity on different tokens. For example, if you wish to participate in the SPS and DEC liquidity pool, there is a bucket of SPS and DEC that the Splinterlands team will distribute among liquidity providers in order to incentivize people like us to provide liquidity! On top of that, you also receive a share of the transaction fees as people use the liquidity pools to swap their own assets.

Tools and Decisions

With all that being said, there are so many different options in terms of which liquidity pools to allocate your own assets, so how do you know where the best "bang for your buck" is? There are two CRITICAL variables to look at to make your decision - the FIRST is the current APR in each pool, and the SECOND is the risk of impermanent loss.

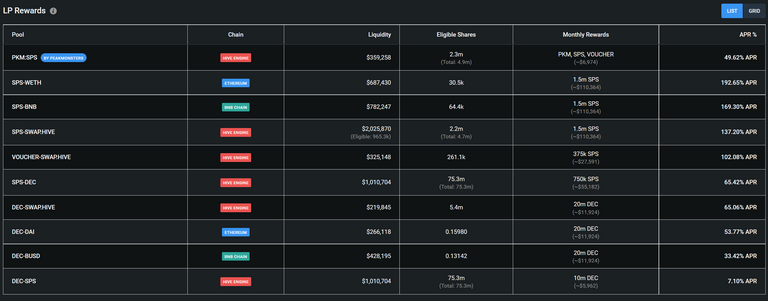

Let me explain the first, and most simple variable: each pool's APR. I LOVE the tool that @peak-monsters has put out to help us look at this. If y'all have never used Peakmonsters.com, the team has put together a very all-inclusive site to help you buy, sell, analyze, and view all the different assets in the game. I would highly recommend you check it out!

Once you've arrived at the Peakmonsters.com webpage, log in with your username and click on your profile at the top right. A couple buttons down, you will see a "SPS and DEC Rewards" page. Click on it to take a look at the different SPS staking and Liquidity provider rewards.

Under the "LP Rewards" section, these are all the liquidity pools available to players like you and me! For each liquidity pool, the Peakmonsters tool shows you the chain, the current liquidity, the eligible shares, the monthly rewards, and the APR. The APR is the most important part right now - the higher the APR, the more passive income you can potentially make!

You might be saying, well Josie - that's easy - use Peakmonster's tool and put money in the Liquidity pool with the highest APR. Yes, but also not really.

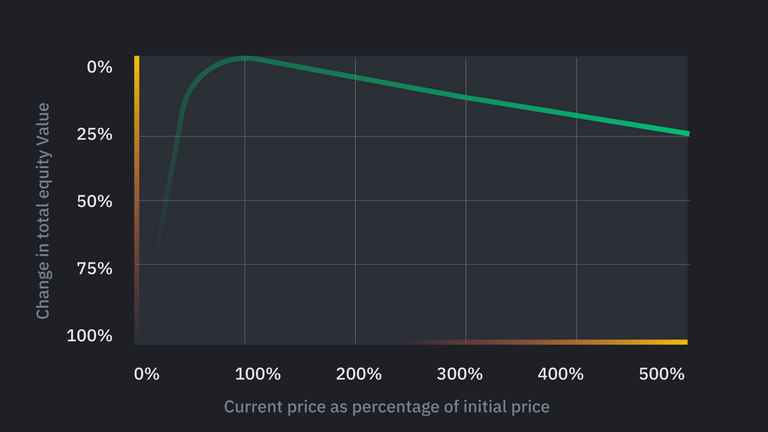

The second variable to look at is the potential for impermanent loss. If it's your first time participating in liquidity pools, you need to know that the algorithm in the liquidity pool tries to maintain a constant value balance between the two assets by increasing and lowering prices as tokens are traded.

It might be worth looking into a separate video explaining impermanent loss, BUT the general gist is that if one asset rises significantly more than the other in the pool, then you have a risk of losing value in your tokens!

Just as an example, say we put $50 of SPS at $1 and $50 of HIVE at $1 into the SPS-HIVE pool. If both the value of SPS and HIVE go up the same amount, there is no loss to your asset values. If for some reason, SPS moons to $5, and HIVE stays at $1, you might expect that the value of your assets become $250 of SPS and $50 of HIVE, for a total of $300. BUT that is not the case for liquidity pools. What would happen is that there would be an arbitrage on your tokens, where some outsider would come in and swap a bunch of HIVE for SPS, and lower the total SPS tokens you own, and increase the total HIVE tokens you own, therefore taking away some of your value appreciation.

All that to say, to reduce impermanent loss, you want to look at whether tokens generally trend together in value. Let's just take a look at three popular ones - we can trend their values over the last three months and see where they trend together and diverge. The closer they trend together, the lower the risk of impermanent loss! The further they divert, the more chances of impermanent loss!

First - SPS and HIVE. I've pulled CoinMarketCap data for the last 7 days, 30 days, and 60 days. You can see that they trend relatively okay together. The most recent pump in HIVE prices though, would result in impermanent loss if you had put in tokens into the pool last week and want to take it out now.

Looking at SPS and DEC, this one seems to trend less together than SPS and hive. This means that there MAY be more risk of impermanent loss!

Now let's look at SPS and BNB. We can see here that they trend even closer together than SPS and HIVE. This, in general, gives less risk of impermanent loss.

It's hard to tell what the future impermanent loss will be, but as long as the APR makes up for any impermanent loss, you're in the green!

Conclusion

All that to say - unless you can predict the future, you really don't know what's going to happen! I've chosen to diversify my liquidity pool positions, and have put most of it into SPS-DEC even though the last 30 day trends have been off. This was mostly because I think in the short term, both DEC and SPS will move up. Once DEC is closer to its peg, I'll likely re-diversify it into HIVE and focus on the SPS and HIVE liquidity pool

Again - none of this is financial advice, but I think there is a LOT of opportunity here to earn some passive income in liquidity pools

If you've enjoyed this post and found value in the content, please help support me by liking the video and subscribing to my YouTube channel! If you're interacting from PEAK-D, make sure you follow me for more content like this!

That's it for this week FAM! See you all in the next post!

++Disclosure++: NONE OF THIS IS FINANCIAL ADVICE! I'm walking through my own thoughts and how I plan to participate in liquidity pools.

Congratulations @josieb! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Thank you!!!

Really Simple and To the point. I love that. Great Video.

Yay!! Thank you!

Nice intro, Josie

Thank you thank you!

Very well written Josie. Thanks for making a complicated subject so accessible.

So proud to get to game alongside you in the Brawlers!

Thank you!!! Y'all are so encouraging!

Great explanation. It makes me wish you were the first to explain this to me.

I look forward to learning more 😃

Thank you draygyn!!! AND FOR THE TIP :)

Thanks for sharing! - @alokkumar121

Post is good but you have not shared it in alternate social media which is the theme. This is a mandatory requirement.

Thank you for the upvote!! To clarify real quick - this is shared on my YouTube Channel (JosiePlaysCrypto)! I think that qualifies as an alternate social media?

Great discussion on liquidity pools! This is an awesome help for the Splinterlands community 😃

Thank you so much! Y'all have created a tool that's an integral part of Splinterlands!

!HBIT

!PIZZA

Thank you so much!

PIZZA Holders sent $PIZZA tips in this post's comments:

@waynechuasy(3/5) tipped @josieb (x1)

Join us in Discord!