New Survey says roughly 16% of Corporations plan to hold Bitcoin

The institutionalization of Bitcoin will likely continue into the coming years

A new research survey put out by Gartner Inc, indicates that roughly 16% of corporations surveyed plan on adding bitcoin to their balance sheet in the next couple years, while roughly 5% indicated they planned on adding bitcoin this year.

While that may or may not sound like a large number, depending on your perspective, it does represent institutional demand that is likely not currently reflected in the price.

And that number may start to climb depending "on what others do".

The survey polled 77 executives from different companies with the majority of those surveyed being CFOs (50 of the 77).

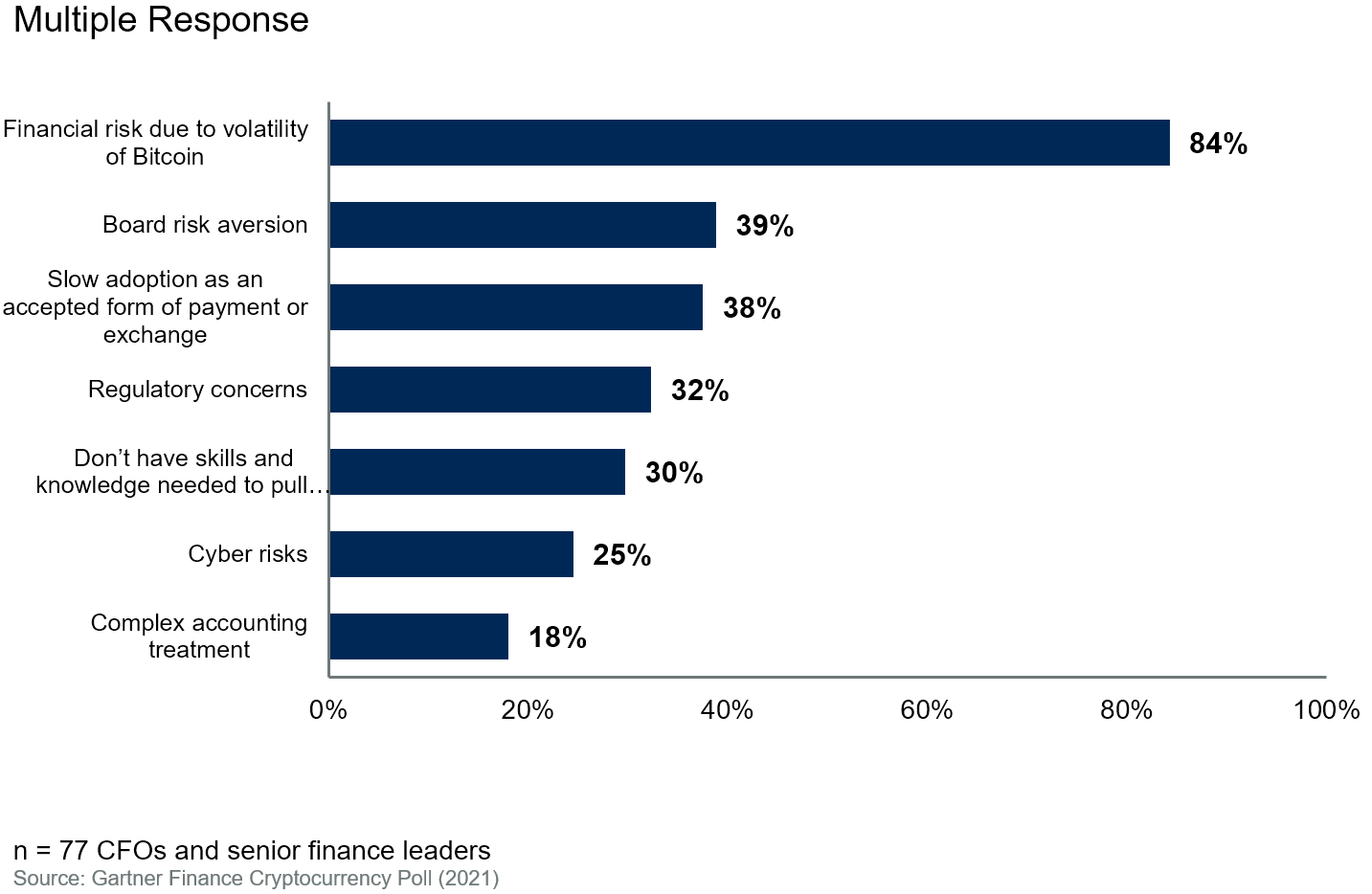

The concerns that the executives had towards holding bitcoin were as follows:

Not surprisingly, the volatility of bitcoin was the major issue among those not wanting to hold bitcoin on their balance sheet.

That was followed by board aversion, slow adoption, and regulatory concerns, respectively.

Herd mentality may change the results...

While only 5% said they were going to add it to their balance sheet this year, there was a larger percentage open to adding it in the future.

Roughly 16% of respondents said they willing to adopt the cryptocurrency as part of their organization’s financial strategy but appeared to be in no rush to do so.

Of that 16%, 5% of respondents indicated they would begin to hold bitcoin by 2021, 1% said they’d hold bitcoin at some point in 2022-2023, and the remaining 9% indicated they would begin holding bitcoin by 2024 or later.

The interesting thing about those numbers is that a number of respondents said they would be open to adding bitcoin if many other corporations did as well.

Meaning that if some start taking the leap of adding bitcoin, it may encourage others to do the same, which will likely encourage even more etc etc etc.

That's something I think we are already seeing with publicly traded companies.

As long as they keep being generously rewarded for the move to bitcoin, they are going to keep doing it and it's going to continue to pull others in.

MSTR doing another convertible debt offering is a perfect example of this:

https://hive.blog/hive-167922/@jrcornel/microstrategy-to-buy-another-usd600-million-in-bitcoin

The herd is coming, currently it's a low rumble in the distance but every day it gets just a little bit louder as they get just a little bit closer.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Yeah, I think that 5% feels really conservative given we are only in February and the gains we have already seen. As well as the investments that have already been put into it. It's probably just going to take a couple of the bigger players before we see that avalanche that Saylor was talking about.

Posted Using LeoFinance Beta

Yep, I would agree with that as well.

5% of 77 might seem small. But if you look at how many similar executives there are out there, then 5% of all of them is massive. I'm shocked it's that high!

Posted Using LeoFinance Beta

Yea, it was 5% saying they were going to buy this year. Roughly 16% said they planned on buying at some point.

it's only a matter of time

I think they should be a lot more worried about not knowing how, and a lot less about the volatility.

Sure, the volatility is an issue. Especially as you put more in. But many companies own a lot of stock. That's pretty volatile. You just have to get used to the asset.

What's worse is maintaining key security and access at the same time. Guarantee we're gonna have some article in the next year or two about one of them losing millions or even billions.

As I said earlier on another post, I can't wait to see the headline of some hedge fund losing 10 billion in Bitcoin because they lost their keys. Or they got hacked. That might be more likely...or not.

The number issue seems to be price volatility.

My basic understanding is the higher the price goes the less volatile it becomes. I think this is because the percentage of the swings to the dollar amount is smaller.

Or at least this is what I have been reading on why some of the larger financial companies are finally moving in.

Posted Using LeoFinance Beta

The Winklevoss twins said well, the crypto market is a market worth a few trillions of dollars