Balance Ecosystem Launched Algorithmic Stablecoin Designed to Preserve Peg

Introduction

The recent Terra/UST collapse has shook the cryptocurrency markets causing many to question the position algorithmic stablecoins hold within the industry. Furthermore, this shockwave effect has called into question whether or not stablecoins have a place in the DeFi universe or not.

So given this current negative backdrop, can algorithmic stablecoins survive and thrive? Well, a new project is tackling the underlying causes of sudden and violent stable asset failures such as Terra/UST so as to ensure algorithmic stablecoin usage is safer for the investing public.

The Balance Organization is offering USDB which it claims to be "a next generation algorithmic stable coin" [Balance. USDB

Where traditional finance meets DeFi. (Accessed June 7, 2022)].

The Mechanics Used to Preserve Peg

On March 31, 2022, startup Balance launched USDB on Fantom, "an algorithmic stablecoin designed to act as a bridge between traditional and decentralized finance (DeFi)" [Bold, D. USDB Algorithmic Stablecoin Launches on Fantom, New $490M FTM Incentive Program Kicks Off. (Accessed June 7, 2022)].

The Balance Ecosystem brings together a suite of products that aim to ensure algorithmic stablecoins can be used in a safer way. The supply of USDB is said to be heavily controlled in order to avoid a “depeg” from the U.S. dollar. If you recall, much of UST's woes began when the value of this digital asset fell below $1 — subsequently causing a bank run on LUNA, its sister token. Those behind the project say they are working slowly and carefully to ensure testing of USDB's resiliency takes place on a small scale. It's hoped these stress tests will iron out weaknesses in the system and enhance robustness by the time this algorithmic stablecoin is used more widely by consumers. Leaders also stress that USDB will not be paired with FHM, another cryptocurrency within the ecosystem — nor will this algorithmic stablecoin be built solely on a treasury of value-storing assets, a technique that's commonly used by rivals.

[Jones, C. Algorithmic stablecoin unveils new ways to preserve its peg to US dollar. (Accessed June 7, 2022)].

The Five Strategies USDB Employs to Preserve Peg

Quick Review of Pure Algorithmic Stablecoins

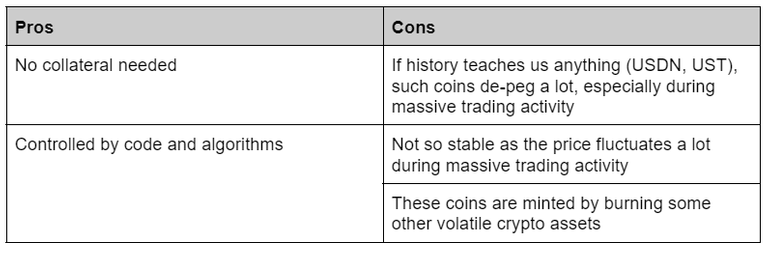

Algorithmic stablecoins, in their purest form, are entirely uncollateralized. Instead, an algorithm sells tokens if the price falls below the desired value and supplies tokens if the value goes beyond the desired amount. The number of these tokens in circulation changes regularly. A stablecoin’s performance and integrity are heavily dependent on how it behaves under stressful conditions, which include not just market volatility but also intentional attacks on its governing protocol. Whenever investors lose confidence in the algorithm, the peg falls, which causes a chain reaction.

[Xypher. USDB Stablecoin and How It Stands Apart. (Accessed June 7, 2022)].

USDB Currently Employs Three Strategies (Two Additional Strategies will be Introduced in the Future) to Preserve Peg

USDB currently employs three strategies to preserve it's peg which combine benefits derived from algorithmic, crypto & fiat-backed stablecoins. These strategies are:

- The USDB stablecoin has its own Treasury: "Having a treasury with a combination of decentralised assets allows for the stablecoin to have censorship resistant backing. These assets are liquid and can be sold if needed to restore the peg. This is exceptionally powerful, allowing for quick reactions to market instability" [Id].

- The USDB stablecoin uses 'Protocol Owned Liquidity (POL)': "The advantage and strength behind this concept is that liquidity providers, also known as rented liquidity, cannot manipulate or cause significant shifts in the price...By owning all our liquidity it insures that rented liquidity cannot manipulate or cause significant price shifts. This shift allows for the supply to be as elastic as possible to maintain the peg and ensures that every USDB in circulation can be returned for the $1 value if needed" [Id].

- The USDB stablecoin maintains an algorithmic relationship with the FHM token: "As a last resort with regards to the current crypto based backing the FHM token acts as a backing for USDB. The token can be sold or burnt to provide further backing for USDB if needed. This is a last resort measure if the above two backing systems cannot maintain the peg for some reason. These situations are highly unlikely as they would have to be due to systems not functioning as expected. However, having this third fail safe in place would give investors in USDB comfort in knowing that their stables are backed even further" [Id].

The Two Strategies being Developed by USDB to Preserve Peg

USDB will create Collateralized Debt Position (CDP) structures whereby investors will deposit a specified asset and receive USDB in return. In essence, this would cause the over-collateralization of the USDB stablecoin, but also introduces a degree of illiquidity into the system as a result of the backed assets. "However, having it in conjunction with other mechanisms adds significant value as the collateral provided is greater than the amount of USDB given out. Thus adding further stability to maintaining the peg and giving investors confidence" [Id].

And the fifth mechanism to be employed will be to have a portion of the USDB stablecoin backed by fiat.

With USDB moving into the e-commerce space there is a need to maintain a certain amount of off-chain collateral in order to further diversify risk and operate in the “real world”. Profits generated off-chain will be kept as a reserve towards on-chain USDB thus resulting in yet another method to add confidence to the USDB holder.

[Id].

Final Thoughts

In basic terms, this USDC stablecoin offers its investors:

- A safe haven for investors to put their capital during times of volatility

- Unprecedented interest earning opportunities (up to 32.5% APY low-risk)

- A seamless UI and bridge between the world of DeFi and TradFi

- A highly liquid, truly decentralized solution to the ‘stablecoin dilemma’ that is available on several chains including ETH, FTM, AVAX, BSC and many more

- A stable, low-risk asset backed by REAL assets (unlike the US dollar)

- A number of exciting use-cases to be announced, including HUGE yield farming opportunities, liquidity solutions for businesses and groundbreaking NFT compatibility (more on this soon).

[FanFest. USDB Mixes the Best Aspects of Algorithmic Stablecoins & Derives Value Through Defi. (Accessed June 7, 2022)].

In the wake of the Terra/UST collapse and recovery therefrom, projects in the nature of Balance Ecosystem have the opportunity to learn from the mistakes of its predecessors and provide a safe environment for investors utilizing stablecoins. In the words of a spokeperson from Balance: "The Balance Organization is succeeding where other algorithmic stablecoin makers have failed because they are dedicated to moving slowly, regardless of market interest or disinterest" [Jones. Supra].

Posted Using LeoFinance Beta